12 Reasons UK Business Leaders Should Be Worried About Begbies Traynor’s Latest “Red Flags” Report

A cause for serious concern has emerged for UK business leaders with the release of Begbies Traynor’s latest “Red Flags” report for 2024. The report paints a concerning picture of the financial health of UK companies, highlighting a significant rise in financial distress and critical financial distress. This article delves into 12 key reasons why UK business leaders should be deeply worried about the report’s findings and take immediate action to safeguard their businesses.

1. Soaring Rates of Financial Distress:

The report’s most alarming statistic is the sharp increase in the number of companies experiencing financial distress. Compared to the previous year, Begbies Traynor has identified a substantial rise in businesses struggling with cash flow, profitability, and mounting debts. This indicates a deteriorating financial landscape for UK businesses, posing a significant threat to their long-term viability.

2. Rise in Critical Financial Distress:

Even more concerning is the report’s revelation of a growing number of companies classified as being in critical financial distress. These businesses are on the brink of insolvency, facing imminent collapse if corrective measures are not implemented swiftly. This signals a potential wave of corporate failures in the near future, further disrupting the UK economy.

3. Industry-Specific Vulnerabilities:

The report identifies specific industries particularly susceptible to financial distress. Sectors heavily impacted by the pandemic, recent supply chain disruptions, or Brexit uncertainties might be facing a more significant burden. Business leaders in these vulnerable industries should be extra cautious and take proactive steps to mitigate risks.

4. Cash Flow Constraints:

One of the primary red flags highlighted in the report is the growing issue of cash flow constraints. Many businesses are struggling to generate sufficient cash to meet their operational expenses and debt obligations. This can lead to a vicious cycle of defaults, further hindering business operations and ultimately forcing closures.

5. Profitability Woes:

The report also emphasises the decline in profitability for many UK companies. This could be due to factors like rising input costs, stagnant consumer demand, or intense competition. Businesses struggling with profitability will find it increasingly difficult to service their debts and invest in growth, jeopardising their future prospects.

6. Mounting Debt Burden:

The report underscores the concerning trend of growing corporate debt levels. This could be attributed to factors like increased reliance on borrowing to finance operations or pandemic-related loans. High debt burdens can significantly limit a company’s financial flexibility and make it vulnerable to economic downturns.

7. Late Payment Risks:

The report reveals a rise in late payments between businesses, further straining cash flow and hindering economic activity. This domino effect can disrupt entire supply chains, causing financial stress throughout the business ecosystem. Companies need to implement stricter credit control measures to mitigate late payment risks.

8. Insolvency Surge Risk:

With the increasing number of companies in financial distress, the report warns of a potential surge in insolvencies. This could lead to job losses, business closures, and a decline in economic activity. Business leaders should be prepared for this possibility and take steps to safeguard their employees and stakeholders.

9. Access to Finance Challenges:

The report suggests that access to finance might become more challenging for businesses in distress. Lenders may become more cautious in extending credit, further limiting the options available to struggling companies. This could create a vicious cycle, making it even harder for businesses to recover.

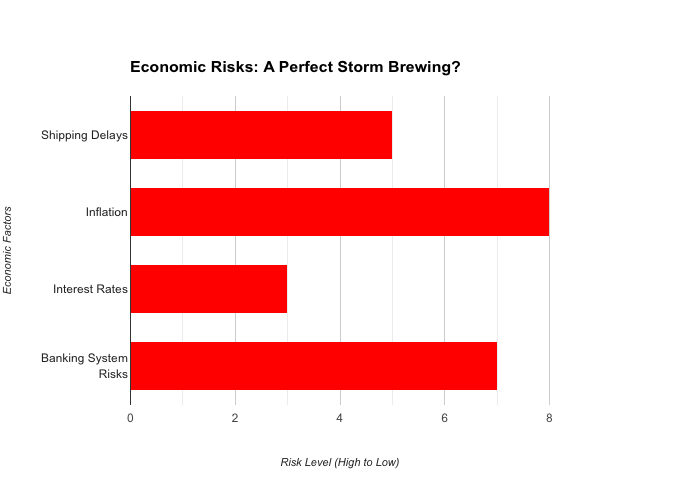

10. Geopolitical and Economic Uncertainties:

The report acknowledges the ongoing geopolitical tensions and global economic uncertainties that can exacerbate financial distress for UK businesses. The ongoing war in Ukraine, potential recessions in major economies, and ongoing supply chain disruptions can significantly impact UK businesses, requiring them to be adaptable and resilient.

11. Importance of Early Warning Signs:

The report emphasises the importance of recognising early warning signs of financial distress. These can include declining sales, rising costs, difficulty meeting debt obligations, and negative cash flow. Business leaders should be vigilant in monitoring these indicators and take corrective action as soon as possible.

12. Proactive Restructuring and Recovery:

The report underscores the importance of proactive restructuring and recovery strategies for businesses facing financial distress. This might involve renegotiating debt agreements, implementing cost-cutting measures, or exploring new revenue streams. Seeking professional help from insolvency practitioners can be crucial in navigating challenging financial situations.

In Conclusion:

Begbies Traynor’s “Red Flags” report serves as a stark warning to UK business leaders. The alarming rise in financial distress and critical financial distress demands immediate attention and proactive measures. By acknowledging the red flags, understanding industry vulnerabilities, and implementing robust financial management practices, businesses can increase their resilience and navigate these challenging times. Early intervention and a willingness to adapt can be the difference between survival and succumbing to financial pressures. Business leaders who heed the report’s warnings and take decisive action will be better positioned to weather the storm and emerge stronger.

Recommendations for UK Business Leaders:

- Conduct a thorough financial health check: Regularly assess your company’s financial health, identifying any areas of concern. Monitor key metrics like cash flow, profitability, and debt levels.

- Develop a contingency plan: Be prepared for potential economic downturns or unforeseen circumstances. Create a contingency plan outlining cost-cutting measures, alternative financing options, and potential restructuring strategies.

- Strengthen your cash flow management: Implement stricter credit control measures to minimize late payments from customers. Explore options to improve operational efficiency and reduce unnecessary expenses.

- Open communication with stakeholders: Maintain open communication with lenders, investors, and creditors. Proactively address any concerns and keep them informed of your financial situation and recovery plans.

- Seek professional advice: Don’t hesitate to seek professional guidance from insolvency practitioners or financial advisors. They can provide valuable insights and tailor solutions to your specific circumstances.

By taking proactive measures and remaining vigilant, UK business leaders can navigate the current economic climate and ensure the long-term sustainability of their businesses. The challenges highlighted in Begbies Traynor’s report can be overcome with a combination of sound financial management, strategic planning, and a willingness to adapt. Remember, early intervention is key. By addressing financial distress early on, businesses can increase their chances of recovery and emerge stronger from these challenging times.