Do you want UK expert business and economy news, risk analysis, risk insight, risk management advice and tips on the biggest risks on the horizon or affecting your business right now.

Want all the latest UK business risk management news comment and reviews; and UK enterprise risk analysis? Sign up to our BusinessRiskTV newsletter, Business Risk Alerts and Business and Economic Risk Reports email editor@businessrisktv.com or follow us on your favourite social media account.

What do business leaders need to know in UK?

UK business leaders, entrepreneurs and business owners need one place to enhance their knowledge of business and economy developments to inform their critical daily and strategic business decision-making.

- Often UK news is biased towards a particular political persuasion, and this hides or alters the truth.

- Skewed business risk information leads to poor business decisions that are not the fault of the decision maker other than making poor choice on where to access best business risk information.

- We source, research and development independent UK business risk management information. Our network of business experts crunch risk facts to find better ways to protect and grow a business in the UK marketplace.

Inform your business decisions to be more successful in business in UK.

UK business leaders sign up for UK business intelligence to develop their risk knowledge

Sign up for free BusinessRiskTV risk alerts to help you make more informed business decisions.

UK business magazine news UK business leader forum and UK business directory online. Top business news today for UK business leaders. Stay up to date on the latest UK business news. Join in the discussion on UK business and economy. Improve your business making in the UK. Read and watch latest UK business and economy news opinions and reviews. Network with top business thought leaders in UK and overseas.

Promote and market your UK business with BusinessRiskTV

More Business Growth: Get your business name in front of our readers and viewers. Put your business in front of interested potential new customers in UK.

Read free summary of UK newspapers today

Live and ondemand TV for UK.

What do you need to know about today as a UK focused business leader? Read and watch UK news headlines, business risk analysis and improve your understanding of the risks facing your business activity in the UK.

UK Lenders Expecting More Defaults in 2024

As corporate and personal debts taken out during the pandemic by businesses and consumers fall due for repayment, UK lenders are expecting more defaults in 2024. This is because interest rates are expected to hit a new peak in 2023, making old debts unaffordable to refinance for many people and business leaders.

The Bank of England has raised interest rates 14 times since December 2021, when the cost of borrowing stood at a record low of 0.1%. The latest increase was on August 3, 2023, when the Bank raised rates by 25 basis points to 5.25%.

The Bank has been raising rates in an attempt to bring inflation under control. However, the Bank is facing a difficult balancing act. It needs to raise rates enough to bring inflation under control, but it also needs to avoid raising rates so high that it causes a recession.

The Bank’s Monetary Policy Committee (MPC) will meet again on September 21, 2023, to decide whether to raise rates again. The MPC is expected to raise rates by another 25 basis points, but it is possible that they could raise rates by 50 basis points.

The Bank’s decision on interest rates will have a significant impact on the UK economy. Higher interest rates will make it more expensive for businesses to borrow money, which could lead to job losses and a decline in economic growth. However, higher interest rates could also help to bring inflation under control, which would benefit consumers in the long run.

However, higher interest rates will also mean that people with variable-rate mortgages, car loans, and credit cards will have to pay more each month. This could put a strain on household budgets and lead to defaults.

In particular, businesses that took out loans to cover their losses during the pandemic are at risk of defaulting. This is because many of these businesses are still struggling to recover, and they may not be able to afford the higher interest payments.

It is estimated that the number of defaults in the UK could rise by as much as 50% in 2024. This could have a significant impact on the economy, as it could lead to job losses and a decline in consumer spending.

If more defaults do occur in 2024, it could have a significant impact on the UK economy. It is important to take steps now to mitigate these risks and protect people who are struggling with debt.

Here are some additional details about the impact of rising interest rates on different types of debt:

- Mortgages: People with variable-rate mortgages will see their monthly payments increase as interest rates rise. This could put a strain on household budgets, especially for people who are already struggling to make ends meet.

- Car loans: People with car loans will also see their monthly payments increase as interest rates rise. This could make it difficult for people to afford to keep their cars, and it could lead to an increase in repossessions.

- Credit cards: People with credit card debt will also see their interest rates increase as interest rates rise. This could make it more difficult for people to pay off their debt, and it could lead to more people defaulting on their credit cards.

If you are struggling with debt, there are a number of things you can do to get help. You can contact your lender to see if they can offer you a repayment plan or a reduction in your interest rate. You can also contact a debt charity for advice and support.

It is important to take action early if you are struggling with debt. The longer you wait, the worse the problem will become.

Do you have a strategy for building resilience for coming recession?

How to Build Resilience in a Recession

A recession is a period of economic decline characterised by falling output, employment, and income. It can be a difficult time for individuals and businesses, but it is possible to build resilience and weather the storm.

Here are some tips on how to build resilience in a recession:

- Have a financial plan. This includes knowing your income and expenses, having an emergency fund, and being prepared to make changes to your spending habits.

- Stay informed. Keep up with economic news and be aware of the latest trends. This will help you make informed decisions about your finances and your career.

- Network. Build relationships with people who can help you during a recession, such as friends, family, and colleagues.

- Be flexible. Be prepared to change your plans and adapt to new circumstances. This could mean finding a new job, starting your own business, or downsizing your lifestyle.

- Stay positive. It is important to stay positive during a recession, even though it may be difficult. This will help you stay motivated and focused on your goals.

Strategies for Overcoming a Recession

In addition to the tips above, here are some strategies for overcoming a recession:

- Focus on your strengths. What are you good at? What do you enjoy doing? Focusing on your strengths can help you find new opportunities during a recession.

- Be creative. Think outside the box and come up with new ways to make money or generate income. There are many opportunities out there, you just have to be willing to look for them.

- Don’t give up. It is important to stay motivated and persistent during a recession. If you keep trying, you will eventually find success.

How to Prepare for the Upcoming Recession

There is no way to know for sure if or when a recession will happen, but it is always a good idea to be prepared. Here are some tips on how to prepare for the upcoming recession:

- Start saving money. This will give you a financial cushion in case you lose your job or your income is reduced.

- Pay down debt. This will free up more money in your budget and make it easier to weather a financial storm.

- Update your CV. Make sure your CV is up-to-date and highlights your skills and experience.

- Network. Build relationships with people who can help you find a job or start your own business.

- Stay positive. A positive attitude will help you stay motivated and focused during a recession.

5 Ways to Develop Resilience

Resilience is the ability to bounce back from adversity. It is a valuable asset, especially during a recession. Here are 5 ways to develop resilience:

- Accept that change is inevitable. Things will not always go your way, but that is okay. The sooner you accept this, the easier it will be to deal with change.

- Be flexible. Be willing to adapt to new circumstances. This could mean changing your job, your lifestyle, or your plans for the future.

- Be positive. A positive attitude can help you stay motivated and focused during difficult times.

- Have a support system. Having people who care about you and can offer support can make a big difference during a tough time.

- Take care of yourself. This means eating healthy, exercising, and getting enough sleep. Taking care of your physical and mental health will help you cope with stress and adversity.

Building resilience is not always easy, but it is worth it. By following these tips, you can develop the ability to weather any storm.

A recession can be a difficult time, but it is possible to build resilience and overcome it. By following the tips in this article, you can increase your chances of success.

Get the latest business and economy news opinions and analysis from BusinessRiskTV

August 2023 – British manufacturing output dropped over the three months to August by the most in almost three years, according to CBI.

UK manufacturing output volumes contracted at their fastest pace since the COVID-19 pandemic and order books deteriorating.

June 2023 – What was the debt interest payment for UK in May 2023 for month of May only – £9.4 billion!

The £9.4 billion debt interest payment for the UK in May 2023 was the highest monthly figure since records began in 1993. This was driven by a number of factors, including:

- The rising cost of living, which has pushed up inflation. This has increased the interest payable on index-linked gilts, which are government bonds that pay interest linked to inflation.

- The increase in the UK’s national debt. The debt has risen to over £2.6 trillion, and this means that the government is paying more interest on it each year.

- The Bank of England’s decision to raise interest rates. This has also increased the interest payable on government bonds.

The high level of debt interest payments is a concern for the UK government. It means that less money is available for other spending, such as public services. The government is under pressure to reduce the debt, but this will be difficult to do in the current economic climate.

Here are some additional details about the debt interest payment in May 2023:

- The figure was £0.7 billion higher than the Office for Budget Responsibility (OBR) had forecast.

- The interest payable on index-linked gilts was £4.7 billion, up from £3.2 billion in May 2022.

- The interest payable on conventional gilts was £4.7 billion, up from £4.5 billion in May 2022.

The high level of debt interest payments is a sign of the UK’s economic challenges. The government will need to find ways to reduce the debt in order to free up more money for other spending. However, this will be difficult to do in the current economic climate.

17 June 2023 – The Delayed Effects of Rising Interest Rates

The Bank of England (BoE) has been raising interest rates in an effort to bring down inflation. However, the effects of these rate hikes are not felt immediately. There is a lag between when the BoE raises rates and when the effects of those rate hikes are felt in the economy.

This lag is due to a number of factors. First, it takes time for businesses to adjust their pricing and investment decisions in response to higher interest rates. Second, it takes time for consumers to adjust their spending habits in response to higher interest rates.

As a result, the full effects of the BoE’s rate hikes will not be felt until several months after the hikes have been implemented. This means that the UK is likely to experience elevated levels of inflation for some time to come.

UK Inflation is Proving Very Sticky

UK inflation has been rising steadily in recent months. In May 2022, it reached a 40-year high of 9%. This is due to a number of factors, including the war in Ukraine, which has pushed up the price of energy and food.

The BoE has been raising interest rates in an effort to bring down inflation. However, so far, these rate hikes have had little effect. This is because inflation is proving to be very sticky.

Sticky inflation is inflation that is slow to respond to changes in interest rates. This can be due to a number of factors, including:

- Wage inflation: When wages rise, it can lead to higher prices, as businesses pass on the higher costs to consumers.

- Inflation expectations: When people expect inflation to rise, they may start to demand higher wages, which can lead to a self-fulfilling prophecy.

- Supply chain disruptions: Supply chain disruptions can lead to higher prices, as businesses struggle to get the goods and services they need.

The Price of Energy

The price of energy is a major factor driving inflation in the UK. The war in Ukraine has pushed up the price of oil and gas, which has had a knock-on effect on the price of electricity and other goods and services.

If the price of energy continues to rise, it could make it more difficult for the BoE to bring down inflation. This is because higher energy prices will put upward pressure on prices across the economy.

The Risk of a Recession

The BoE is walking a tightrope. On the one hand, it needs to raise interest rates in order to bring down inflation. On the other hand, it does not want to raise rates so high that it causes a recession.

If the BoE raises rates too high, it could lead to a recession. This is because higher interest rates can make it more difficult for businesses to borrow money, which can lead to job losses and economic hardship.

The BoE is trying to find a balance between bringing down inflation and avoiding a recession. However, it is a difficult task, and there is no guarantee that the BoE will be successful.

The delayed effects of rising interest rates are only just starting to be seen. UK inflation is proving very sticky, and it may not fall at the rate markets are currently discounting. The price of energy is a major factor driving inflation, and if it continues to rise, it could make it more difficult for the BoE to bring down inflation. The BoE is walking a tightrope, and there is no guarantee that it will be successful in bringing down inflation without causing a recession.

Additional Thoughts

In addition to the factors mentioned above, there are a number of other factors that could affect the path of inflation in the UK. These include:

- The strength of the global economy: If the global economy weakens, it could lead to lower demand for goods and services, which could help to bring down inflation.

- The pace of wage growth: If wage growth slows, it could help to moderate inflation.

- The outcome of the war in Ukraine: The war in Ukraine is a major source of uncertainty, and its outcome could have a significant impact on the global economy and inflation.

It is difficult to predict what will happen to inflation in the UK in the coming months and years. However, it is clear that the BoE faces a difficult challenge in bringing down inflation without causing a recession.

25 May 2023 – UK: Impact of Money Reduction

USA has just experienced its fastest contraction of M2 Money Supply since 1993. If America catches a cold the UK gets the flu! An incredible reduction of money supply in the UK has already begun. Borrowing money is either not an option cause banks do not want to lend to you, or its so expensive to borrow as to be prohibitive – and will continue to increase has inflation in UK will be around for long time. Prepare for the credit crunch! Lets look at M2 Money Supply a bit more.

If the money supply M2 in the UK reduces, it can have several effects on businesses and consumers. Here are some potential consequences:

- Reduced liquidity: A decrease in the money supply means there is less money available in the economy. This can lead to reduced liquidity, making it harder for businesses to obtain loans or credit. It may also limit consumers’ access to credit, affecting their ability to make purchases or invest.

- Higher interest rates: With a decrease in the money supply, the demand for loans may exceed the available funds. To balance this demand, lenders may raise interest rates to discourage borrowing. Higher interest rates can make it more expensive for businesses to invest and expand, and for consumers to finance purchases such as homes or cars.

- Economic slowdown: A decrease in the money supply can contribute to an economic slowdown or recession. When there is less money circulating in the economy, consumer spending tends to decrease, and businesses may scale back their investment and hiring. This can lead to reduced economic activity and potentially higher unemployment rates.

- Decreased inflationary pressures: A reduction in the money supply can help reduce inflationary pressures. With less money available, there is less demand for goods and services, which can lead to a decrease in prices. While this may benefit consumers by making goods and services more affordable, it can also impact businesses’ profitability, especially if they have fixed costs or contracts that were negotiated based on higher inflation expectations.

- Exchange rate effects: Changes in the money supply can influence the value of a currency. If the money supply in the UK decreases relative to other currencies, the value of the British pound may strengthen. A stronger currency can make UK exports more expensive, potentially affecting businesses reliant on international trade. Conversely, it can make imports more affordable for consumers.

It’s important to note that the impact of a reduction in the money supply will depend on various factors, including the magnitude of the decrease, the overall state of the economy, and the actions of the central bank and government to mitigate or address the situation.

A reduction in the money supply can have negative consequences for businesses and consumers in the UK. Here’s why it can be considered bad and what they can do to protect themselves:

- Economic downturn: A decrease in the money supply can contribute to an economic slowdown or recession. This can result in reduced business activity, job losses, and decreased consumer spending. Businesses may face lower demand for their products or services, while consumers may experience reduced purchasing power. To protect themselves, businesses can focus on cost-cutting measures, diversify their customer base, and explore new markets or product offerings. Consumers can prioritize essential purchases, save more, and look for cost-saving opportunities.

- Limited access to credit: With a decrease in the money supply, it may become more difficult for businesses and consumers to access credit. This can hinder business expansion plans, investment projects, and consumer spending. To protect themselves, businesses can maintain healthy financial records, build strong relationships with lenders, and explore alternative financing options such as venture capital or crowdfunding. Consumers can work on improving their credit scores, reducing debt, and exploring other sources of financing like personal loans or credit unions.

- Increased borrowing costs: A decrease in the money supply can lead to higher interest rates as lenders try to manage the limited available funds. This can increase the cost of borrowing for businesses and consumers, affecting investment decisions, expansion plans, and major purchases. To protect themselves, businesses can explore renegotiating existing loans or debts to secure lower interest rates, focus on improving cash flow, and consider alternative financing options. Consumers can consider delaying non-essential purchases, comparing loan offers to find the best rates, and seeking financial advice to manage their debt.

- Exchange rate fluctuations: Changes in the money supply can impact the value of the currency, leading to exchange rate fluctuations. A stronger currency can make exports more expensive and imports more affordable. This can affect businesses engaged in international trade and consumers relying on imported goods. To protect themselves, businesses can diversify their customer base by exploring new export markets, hedge against currency risks, and optimize their supply chain. Consumers can consider local alternatives for certain products, compare prices, and be mindful of currency exchange rates when making international purchases.

- Increased uncertainty: A reduction in the money supply can create economic uncertainty, making it challenging for businesses and consumers to plan for the future. Uncertainty can lead to reduced investment, delayed decision-making, and a cautious approach to spending. To protect themselves, businesses can focus on building resilience, diversifying their revenue streams, and closely monitoring market trends. Consumers can prioritize building an emergency fund, diversify their investments, and seek professional financial advice.

Overall, it’s crucial for businesses and consumers in the UK to stay informed about economic developments, adapt to changing conditions, and take proactive measures to safeguard their financial well-being during a period of reduced money supply.

A reduction in the money supply can have adverse effects on businesses and consumers in the UK, including economic downturn, limited access to credit, increased borrowing costs, exchange rate fluctuations, and increased uncertainty. However, there are steps that businesses and consumers can take to protect themselves during such circumstances. These include implementing cost-cutting measures, diversifying revenue streams, exploring alternative financing options, maintaining healthy financial records, improving creditworthiness, comparing loan offers, hedging against currency risks, seeking professional advice, and staying informed about economic developments. By being proactive and adaptable, businesses and consumers can mitigate the potential negative impacts of a decrease in the money supply and navigate challenging economic conditions more effectively.

14 September 2022 – UK house prices leapt in July by 15.5 percent in annual terms, the biggest increase since May 2003 according to the Office for National Statistics ONS.

July’s increase represented a sharp jump from June’s 7.8% rise in prices which was a sharp slowdown from May.

UK inflation has fallen slightly to 9.9 percent. However, the Bank of England target is 2 percent. Interest rates in the UK must be increased by at least 3/4 of percentage point next week and at least one more 3/4 percent point next time.

The value of the pound against dollar has fallen to decades lows and the Federal Reserve will pressure the pound even lower this month if the Bank of England does not at least match the interest rate increases in America. Failure to match USA interest rate increases will make UK inflation worse and mean the Bank of England will need to increase UK interest rates even higher in future, for longer to control UK inflation.

13 September 2022 – Britain’s jobless rate hit its lowest since 1974.

UK unemployment rate dropped to 3.6 percent in the three months to July, the Office for National Statistics said.

UK inflation is expected to hit 10.2 percent in the 12 months to August when figures are published tomorrow. on the 22nd of September the Bank of England is anticipated to increase UK interest rate by 3/4 of a percent to try to tame UK inflation. if the Bank of England does push up UK interest-rate in such a jump it will be the biggest increase since 1989 (excluding an attempt to shore up the pound in 1992 which was quickly reversed).

The number of UK job vacancies in the June-to-August period is 1.266 million. A shortage of workers is pushing UK wages higher.

BusinessRiskTV

UK wages excluding bonuses rose by 5.2 percent, the highest rate since the three months to August 2021. As UK inflation is at least double that, UK standard of living is collapsing in real terms.

The UK government’s newly announced pledge to cap corporate energy bills as well as households’ should help avoid a sharp rise in unemployment this winter and inhibit but not prevent a UK recessionary business environment.

9 September 2022 – UK energy support package will result in higher faster interest rate rises UK

The Bank of England used to bang on about how inflation is not controlled by higher interest rates due to the war in Ukraine pushing up energy costs and thus inflation. Bank of England suggested it could not control events in the Ukraine or control the impact on UK economy with interest-rate increases.

Now that the UK government has decided to support consumers and businesses with £150 billion package of free money flooding the marketplace over the next couple of years, inflation rate will temporarily fall but will highlight the true level of UK inflation the Bank of England can control.

Many analysts now say that the real UK inflation rate, taking energy out of the equation, is 11%. The Bank of England target rate is 2%. Therefore the Bank of England has nowhere to hide and must now rapidly increase UK interest rates to control the controllables level of inflation. If the Bank of England does not rapidly increase UK interest rates then we should ask why?

17 August 2022 – Consumer Prices Index (CPI) inflation hit 10 .1 percent in the 12 months to July – up from 9 .4 percent in June.

Average wage rises are running at 4 percent. On average, the standard of living in the UK continues to fall as cost of living far outstrips income increases.

The official figures – released by the Office for National Statistics (ONS) this morning – are the highest since February 1982 when inflation hit 10 .2 percent.

The economy is predicted to enter recession – defined as two quarters, or six months, of economic decline – in the last three months of this year and into 2023 .

British house prices rose in June by 7.8 percent in annual terms, the weakest increase since July last year, which was immediately after the scaling back of a COVID-19 emergency tax break for house-buyers.

ONS

UK house prices continue to rise but at a slower pace. June’s increase represented a sharp slowdown from May’s 12.8 percent annual jump in prices.

25 July 2022 – Asda Income Tracker showed 20 percent of UK households had negative disposable income in June – an average shortfall of 60 pounds.

An increasing number of people in the UK are suffering from a shortfall between what they earned and what they needed to spend on essentials according to UK supermarket group Asda today.

Inflation in UK rose to a 40 year high of 9.4 percent in June but will blast through double figures in coming months.

In response to the crisis, Britons are trading down in both stores and products, switching from mainstream supermarkets to discounters and from branded to lower priced private label products.

They are also cutting back on fuel purchases as they reduce the number of car journeys they make, buying fewer takeaways, cancelling streaming services and cancelling repair warranties on domestic appliances.

14 July 2022 – Reduction in supply of mortgages and unsecured borrowing in UK in the third quarter of 2022

British lenders expect the availability of mortgages and unsecured consumer lending to fall. They also expect borrowers to default more as the year progresses.

The cost of borrowing in UK will rise further and perhaps faster than in previous Bank of England interest rate increases. Today in the USA, the financial markets are now anticipating a 1% increase in USA interest-rate in August following a big jump in inflation in June to 9.1 percent. Similar faster interest-rate increases in the UK can be expected as UK heads towards and passes 11 percent.

30 June 2022 – Ease of doing business UK rank 2022

22 June 2022 – UK inflation hits fresh 40-year high of 9.1 percent.

The rate of inflation in the UK has risen to a fresh 40-year high of 9.1 percent in May, according to the latest official figures from the UK Office for National Statistics (ONS).

Inflationary expectations are increasing wage rise expectations and will result in increasing social unrest including more strikes for higher pay.

Inflation in the UK has accelerated slightly in May from April. The Bank of England says UK inflation is going above 11 percent soon as if inflation as nothing to do with it! Its inflation target for UK is 2 percent and if UK inflation goes above this the Bank of England is supposed to act to control inflation.

UK inflationary pressures are increasing not easing as the producer price index, which measures inflation before it reaches consumers, jumped to a 45-year high of 15.7pc. The retail price index, which is used to determine train ticket prices and to which some index-linked bonds are pegged, rose to 11.7pc.

20 June 2022 – The Bank of England (BoE) must raise interest rates more aggressively to avoid a sterling depreciation against the dollar that would drive inflation higher, according to policy maker Catherine Mann.

Mann, an external member of the Monetary Policy Committee (MPC), was part of the defeated minority of three, who voted to increase the Bank rate by 50 basis points at last week’s meeting.

20 June 2022 – Bank of England withdraws mortgage affordability test.

The Bank of England Financial Policy Committee will withdraw its mortgage affordability test recommendation in August 2022 following a review of the mortgage market.

The central bank introduced the test in 2014 to ensure that borrowers do not become a threat to financial stability by taking on debt they could not afford to repay.

The BoE said its loan-to-income “flow limit” would not be withdrawn and, alongside other affordability assessments, would help to protect the financial system in a simpler, more predictable and more proportionate way, it thinks. Could it also be the case that mortgages will increasingly become unaffordable as 2022 progresses and we turn into 2024.

The ratio of average mortgages to incomes has hit 3.4, the highest level since records began in 1992.

BusinessRiskTV

In 2021, a fifth of mortgages were on variable rates, down from 70 percent a decade earlier. This means that many mortgage holders will be insulated from need to remortgage for some time. However, when fixed mortgage period comes to an end over the next few months it will be a huge shock to people and the UK economic system. Monthly mortgage payments will jump even assuming people can remortgage to better mortgage and not be stuck on existing mortgage providers much higher standard variable rate.

Only about 30 percent of people in the UK have a mortgage. The rest either rent, or have outright ownership of their home. However, they cost of renting in the UK is rising, partly to reflect the rising costs of landlords and partly due to shortage of homes in the UK.

The impending UK recession will push up unemployment, slowly in 2022 but faster in 2023. Rising unemployment at a time of increasing interest rates will make mortgages less affordable. Could the changes of the Bank of England be in preparation for the impending financial crisis?

16 June 2022 – Bank of England BoE increases interest rate by just 0.25 percent to 1.25 percent.

With runaway inflation in the UK arrives employee wage increase expectation that fully embeds inflationary pressures in the UK economy. Whether the cause of inflation is supply chain problems or the war in the Ukraine or the failure or the Bank of England to do its main job or the governments of the UK is almost irrelevant now. People will have less money to spend in next couple of years and this will cool inflation a little but it needs to be smothered at this time and then the BoE can slow pace of quantitative tightening QT. Instead the BoE reduces the coal insignificantly on the inflation engine fire. The BoE should have followed the lead of the central bank of USA, the Federal Reserve, and start hitting the brakes hard now so it can ease off the brakes later.

If you want to bring inflation down you need to massively boost supply or drastically reduce demand. There are 9000 ships stuck at Shanghai unable to either load or unload. The situation is actually worse at Los Angeles. Supply chain problems are a factor with inflation that interest rate setting will not change. If people have less money they will not be able to buy more. Not being able to buy more restricts demand. If you want to control inflation quickly, you need to push up interest rate fast. The Bank of England does not want to control inflation quickly. The BoE is aiming for what’s called a smooth landing. Time will tell if they set the right course.

In the meantime the UK will face a summer autumn winter and spring of social discontent. People want their pay to rise at least at the rate of inflation. As the Bank of England has not acted fast enough, they will want higher wages than if the BoE had acted quicker. The UK economy will face greater hardship for longer as a result of BoE monetary policy not because of supply chain issues or war in Ukraine.

9 percent inflation will quickly rise to 11 percent by the BoE own analysis of the UK economy. With the BoE inaction we have not seen the start of the end of runaway inflation in the UK with this weeks interest rate increase.

14 June 2922 – UK unemployment rate rose slightly in the first three months to April 2022.

UK official unemployment rate is 3.8 percent, according to the Office for National Statistics ONS. Many market experts had expected on unemployment rate fall.

The ONS reported that real wages – a measure of regular wage growth when inflation is factored in – had now dropped by 2.2 percent on the year from 1.2 percent during the three months to March. When the Bank of England had the cost of living under control and inflation was below its 2 percent target the standard of living in UK was rising. Peoples expectations on wages increases has now fully embedded inflation in the UK marketplace as is, and will be increasingly, evidenced by strikes over pay offered by employers to employees.

13 June 2022 – The UK economy contracted by 0.3 percent in April, according to official figures released by UK Office for National Statistics (ONS).

The ONS said each main area of the economy contributed to April’s decline.

7 June 2022 – British shoppers cut their spending in May by the most since the country was in a coronavirus lockdown in January 2021, according to a survey published by British Retail Consortium (BRC).

UK total retail spending fell by largest amount year-on-year since January 2021. The reduction in UK retail spending is also accelerating as the year progresses and inflation increases.

There is also a red flag from credit card spending which is increasing. Part of the spending can be explained by increased spending on holidays but there are fears that UK consumers are being forced to put more day-to-day spending on plastic. This could result in reduced spending in future and increased bad debt for individuals and businesses in UK.

20 May 2022 – Former Bank of England BoE Governor Mervyn King said today that central banks including the BoE are to blame for the current surge in inflation to its highest in 40 years, after doing too much quantitative easing during the pandemic.

While central banks point to supply-chain difficulties and a surge in energy prices, worsened by Russia’s invasion of Ukraine in February, critics say inflation is also evidence of too much monetary and fiscal stimulus during the COVID-19 pandemic.

King, who is now an independent member of Britain’s upper house of parliament, and sits on its economic affairs committee, said there had been “a failure of the economics profession”.

18 May 2022 – UK inflation hits 40-year high of 9 percent in the 12 months to March, according to the Office For National Statistics ONS in UK.

Perhaps even more worryingly, this record high inflation level in UK is highly likely to be already higher and set to go higher still as the year wears on. When it was indicated by Bank of England that inflation in UK would be above 10 percent by the end of the year, they didn’t mean inflation would be 10 percent headline figure you first think of!

Latest UK inflation announcement from the ONS covers price changes from April 2021 until April 2022

BusinessRiskTV

The Bank of England Governor this week in response to MPs questions, almost happily, said food prices could rise apocalyptically! Some things he couldn’t control with increases in interest rates, like oil and food prices, but if he and Bank of England had set out to stop stimulating the UK economy in 2021 we would be less in the proverbial now on this costs that would have been more under control. The delay in increasing interest rates now means the Bank of England will have to be more aggressive in raising interest rates than was needed to mitigate rising UK inflation. UK interest rate is currently 1 percent and expected to rise again in June to at least 1.25 percent.

One thing in the Bank of England’s defence is that increasing National Insurance costs to workers and businesses in UK in April will contribute to reducing demand for the rest of 2022 and into 2023. This will mitigate inflation rate in UK.

Another, bigger brake, will be another massive energy cost hike in October 2022 as the UK energy price cap will be shuffled upwards. The bump in energy prices in April will not be fully felt by UK consumers as the weather heats up. However, come the UK winter and Spring 2023, UK consumers spending power will be slashed by massive increased cost of energy.

The UK economy has already made a handbrake turn to face its impeding recession. It could have made a slower, less painful, less frightening, shallower, shorter recession if the Bank of England had fulfilled its duty earlier in 2021. As it is, the UK is now facing a horror ride! Destination recession or depression will not hit until 2023.

17 May 2022 – UK unemployment falls to lowest since 1974

Good news! It is good news, but the calm before the impending storm to end of year and into probably all of 2023 if not 2024.

UK unemployment fell to 3.7 percent in the first three months of this year

BusinessRiskTV

Average earnings, excluding bonuses, were 4.2 percent higher than a year earlier in the three months to March. As inflation in the UK is so much higher than wage increases, the average standard of living in the UK is falling.

6 May 2022 – Restructuring firm Begbies Traynor has reported a 19 percent year-on-year increase in British firms in critical financial distress in the first quarter of 2022.

5 May 2022 – The Bank of England has raised UK interest rate from 0 .75 percent to 1 percent today to try to control out of control inflation robbing UK consumers’ spending power.

UK interest rate is now at highest level for 13 years. However they will have to increase much further to control inflation now. The Bank of England should have begun the interest rate increases last year when it was clear that a shortage of skills was going to start to push up UK inflation.

If you delay the pain of higher interest rates, as the Bank of England has done, you have to increase interest rate higher for longer to eradicate the mindset of increasing prices in business and increasing wages to keep up with inflation. That’s how runaway inflation starts and goes out of control. Putting inflation back in its box will now be more painful than it needed to be.

Forecast for UK economic growth this year remains at 3.75 percent. UK economic growth 2023, forecast cut to 1 percent. Cut its growth projection for 2024 to 0.25 percent.

Bank Of England

If the BoE projections on economic growth for UK are right, and they often are not, then UK inflation will be well above 2 percent target. Which means everybody, but particularly poor to middle earners, will be suffering a continued fall in their standard of living. The UK, like all other countries fighting inflation, cannot bring inflation under control without suffering a recession. The recession will be longer and deeper if the BoE does not increase interest rate faster or longer. Yes that will induce a recession but the BoE should have realised that last year and begun interest rate increases then. Then we may have benefited from soft landing of economy. Too late now!

UK inflation climbing above 10 percent in October 2022, due to another increase of about 40% in the U.K.’s energy price cap

Bank Of England

We either bite the bullet now or get our heads blown off!

UK households are facing a 1.75 percent drop in real disposable income this year, the second-biggest fall since 1964. That’s even after government support measures to ease the cost of living crisis

Bank Of England

The Bank of England is considering actively selling bonds it purchased under quantitative easing QE. No major central bank has yet conducted active sales of government bonds. Some have committed to not issuing more sovereign bonds when old bonds mature – printing money -which is not as tight form of Quantitative Tightening QT – the opposite of QE.

Pay growth rising to 5.75 percent in 2022. As UK inflation be around 10 percent, UK living standards will be falling even though UK wages rising.

Bank Of England figures

1st May 2022 – According to figures in Big 4 accountant’s EY the UKs biggest companies issued 44 percent more profift warnings for the first 3 months of this year compared to start of of year last year.

Profit warnings can be issued issued for a variety of reasons, but the most common reason at the moment is the rising cost of inflation in UK.

Companies reporting lower profits give less dividends, or stop paying dividends, and this will also impact of the value of the share pushing share prices down. Lower valuations and dividends reduces income of pensioners present and future pensioners. They have less money or confidence to spend.

In addition, UKs biggest companies will be less inclined to invest in the future of their amidst growing uncertainties in their marketplace and the certain knowledge that borrowing to invest in their business is going to be more expensive over next year with rising interest rates in UK.

The UK has entered a negative economic spiral out of control that can only end with a recession. The real question is how long the recession be. Many market watchers say the world is entering the mother of all stock market collapses. It could of been avoided if central banks and national governments had not continued to pump trillions of pounds into their economy’s quicker and more aggressively.

30 April 2022 – According to the latest UK economic outlook report from PwC, British households are set to be £900 worse off this year in a “historic fall” in living standards. The lowest earners face a £1,300 blow to finances. The report found that inflation will hit 8.4% later this year, which will mean a 2% drop in household incomes, marking the biggest fall in real wages since the 1970s and the largest decline in living standards since records began. Russia’s invasion of Ukraine and belt-tightening among households and businesses means the economy will grow at a slower-than-expected rate of 3.8% in 2022, down from the 4.5% previously pencilled in and last year’s record 7.4% expansion, the report suggests.

29 April 2022 – 58 percent of British companies plan to raise prices in the coming year due to rising cost pressures, a monthly survey by Lloyds Bank.

Business confidence remains above long

term average but business leaders are

having to pass on their rising costs to

consumers and other businesses buying

their end product or service. UK inflation

is around 4 times healthy inflation target

of 2 percent set by Bank of England. Economists expect the central bank to raise interest rates to 1.0% from 0.75% on May 5, taking borrowing costs to their highest since 2009.

The desire to recruit in UK is ebbing

slightly as costs of recruiting increase due

shortage in marketplace and the ability to

find recruits the need is unfulfilled.

27 April 2022 – UK Retail Sales Dropped Like Stone in April CBI

The slump partly is reflected by a switch away from stuff to buy to stuff to experience like leisure services. It is also an indicator of the effect of the rising cost of living in UK. Increased food and fuel costs mean people have less money to buy stuff or services in UK.

UK wages are not keeping up with prices and so the standard of living in UK is falling. UK inflation is running at 30 year high of 7 percent and forecast by government via OBR to go above 9 percent by end of 2022. Wages are rising around half as fast at 4 percent on average. The Bank of England is expected by markets to increase UK interest rates to 1 percent on 5th May 2022, to try to control inflation. Making more more expensive to borrow normally reduces demand and thereby prices. However, UK interest rates will need to go much higher to control inflation running at 5 times healthy inflation target of 2 percent.

22nd April 2022 – UK Consumer Confidence Close To All Time Record Low

An influential survey of UK consumers (GfK index survey covering April 2022) sentiment on the strength (or lack of it) revealed UK consumers are at or near their least confident in the prospects for UK economy.

UK inflation has hit 30 year high of 7 percent but the Office for Budget Responsibility OBR says UK inflation will rise to at least 9 percent by the end of the year.

BusinessRiskTV

A further huge rise in energy costs for consumers is expected after the Price Cap is adjusted (upwards!) in October 2022. Double digit inflation by 2023 is realistic possibility.

In the face of UK inflation being potentially more than 5 times the level the Bank of England considers healthy inflation, it must push up interest rates in May and repeatedly in 2022, even though it will slow economic growth in the UK. The Bank of England has left flushing the economy with cheap money for too long and now an inflation inferno is set to hit poorer and mid income families particularly hard. More of their spending power is hit by rising inflation as a proportion of overall household income. Businesses profit will be reduced throughout 2022 and 2023 as business leaders scrap for less and less consumer and other business spending but with their own rising costs.

14th April 2022 – Five insurers Aviva, Lloyds Banking Group, Ageas, NFU Mutual and LV= General Insurance and a unit of Allianz have joined a programme set up by Britain’s FloodRe to give homeowners extra funds to build up future resilience to floods in UK.

The insurers will offer customers access to reimbursement costs of up to 10,000 pounds over and above the cost of flood repairs and losses.

The extra money can be used for protective measures such as raising electrical sockets and white goods above floor level and replacing flooring with waterproof tiles.

12 April 2022 – It seems bad just now but inflation is going to jump from 6.7 percent now (estimate) to nearly 9 percent by end 2022 according to UK government budget forecasts. Interest rates need to jump massively to bring inflation down so mortgages will jump if you’re not on Fix. Borrowing money will become much more expensive before year end and probably rise into 2023. #BusinessRiskTV #ProRiskManager #UKnews #UKreporter2022 #UKreview #RiskManagement

UK unemployment has fallen to its joint lowest in almost 50 years. The UK jobless rate fell to 3.8 percent in the three months to February from 3.9 percent, which matches the lowest rate in 2019 pre-pandemic. Prior to the 2019 low mark it was 1974 before unemployment rate was so low. However this is probably a low mark as UK economic growth has slowed to standstill. By 2023, at latest UK will be in a recession. Unemployment will rise.

How bad is the UK economy March 2022

23rd March 2022 – UK inflation reached a 30 year high last month increasing to 6.2 percent more than 3 times Bank Of England healthy inflation target of just 2 percent.

The Bank Of England could easily double current interest rate of 0.75 percent to 1.5 percent at least within 12 months to try to control inflation before it destroys value, jobs and leads to an economic depression. 1.5 percent would not even be historically high but the UK has become greedy for cheap money in government and for personal finance.

People working in the investment industry don’t want higher interest rates as it tends to lower corporate share prices, but the low to middle earners need to see and feel inflation under control to maintain quality of lifestyle. Low interest rates tends to see money go from the poor and middle earners to the super rich making them richer but everyone poorer.

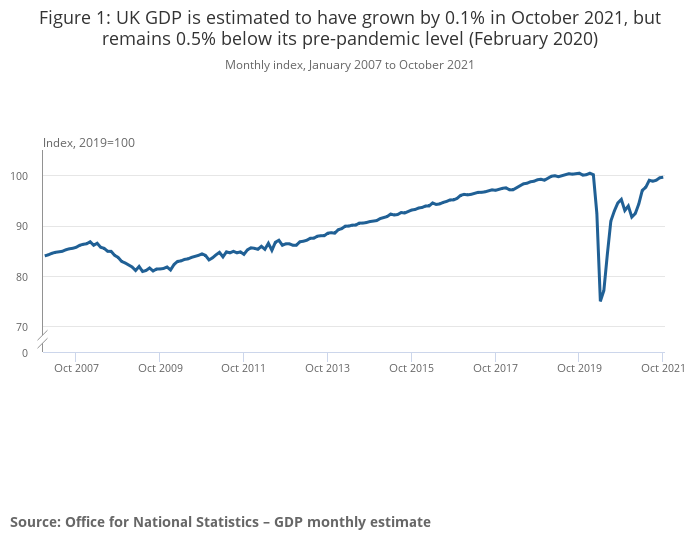

15th January 2022 – UK economy recovers to prepandemic levels in November for first time according to Office for National Statistics ONS

November was pre Omicron infection levels in UK but the signs of a post pandemic revival are strong. Business leaders need to prepare for post pandemic risk management to mitigate new threats and seize new business opportunities.

10 December 2021 – UK economy almost recovered to pre-pandemic levels by end of October 2021

Although October economic growth was weaker than many expected, the UK economy has nearly recovered to pre-pandemic levels, and is likely to have done so by end of November, for which official figures are not ready yet.

Slighter weaker economic growth in October than anticipated has given Bank of England increased opportunity to keep interest rate on hold at 0.1 percent until February 2022. This could save the UK government tens of billions of pounds in interest payments on UK government borrowings but will leave high inflation unchecked.

24 November 2021 – British manufacturing factories order books grew at fastest pace since at least April 1977.

The latest Confederation Of British Industry CBI November 2021 survey found that British industrial orders jumped by largest amount on record in November.

23 November 2021 – Bank of England Governor, Andrew Bailey, told House of Lords Economic Affairs Committee he might reduce early forward guidance on central bank policy. The UK central bank could return to stating Bank of England decisions on monetary policy to official pre planned meeting days.

The change of approach follows the most recent débâcle of the Bank of England, clearly leading the markets analysts media business leaders and general public down the path of an interest rate rise in November, only to not increase interest rates on the official meeting day. Bailey said he was not a fan of ‘forward guidance’ used by the Bank of Englands previous governor, Mark Carney, also labelled an “unreliable boyfriend”. He may just keep quiet until official meeting dates and given his failed communication strategy this month that might be better for everyone!

11 November 2021 – UK economy is still on track to recover all economic growth lost during pandemic by end of December.

It took 5 years for the UK economy to recover from the 2008 global financial crisis caused by poor financial sector risks management. It has taken the UK economy less than 2 years to recover from a bigger financial and health crisis. Now we just need to pay for it!

Crucially UK unemployment is comparatively very low and falling, compared to unemployment rate post global financial crisis of 2008. House prices are at an all time high, business confidence is high and the cost of borrowing in UK remains at a record all time low, though set to rise in December 2021 or February 2022 at latest. Paying back the record high level of debt will be easier if borrowing costs from higher interest rates can be minimised through low borrowing rates, high employment and increased government revenue from taxes.

The UK recovery is accelerating. We have only had a month, October, where furlough has not been in existence. In the run in to the end of the calendar year the UK consumer can cement the recovery by spending especially as many have saved thousands of pounds during the pandemic. It is highly likely that the last quarter of 2021 could be a stronger growth period than the previous quarter especially as it contains Christmas spending. UK GDP will be 7 percent for 2021 which is supersonic fast growth by UK recent history where 2 percent would be regarded as ok.

UK GDP could be around 5 percent in 2022 – slower than 2021 but still supersonic fast. We can expect several interest rate increases in 2022 in an attempt by Bank of England to temper UK inflation.

Another Unreliable Boyfriend At Helm Of Bank Of England

Sky News 4 November 2021 Report On Effect Of Bank Of England Decision On Interest Rate For UK

Andrew Bailey Governor of Bank of England presided over an interest rate risk communication strategy on run up to Bank of England announcement that indicated an interest rate increase now in November that did not happen. Previous Bank of England Governor Mark Carney told us that when UK unemployment rate fell to 7 percent interest rate would rise – it didn’t!

UK Business News Magazine and UK Business Directory

Read and watch UK news. Keep up to date with UK business and economy developments which may impact on your business decision-making. Receive alerts newsletters and reviews to protect and grow your business in the UK and overseas.

Put your business on the UK map

Boost your online sales. Increase your presence online. Grow your business faster with BusinessRiskTV UK Business News Magazine and UK Business Directory.

BusinessRiskTV.com Protecting and Growing Businesses Faster

Email editor@businessrisktv.com

Subscribe to BusinessRiskTV for free UK business and economy alerts bulletins and reviews to your email inbox

Latest UK Business Magazine News Opinions and Reviews

Plan your UK and overseas trips and holidays

Promote and market your business on BusinessRiskTV UK Online for 12 months

Find out how to promote your business in UK locally and globally. CLICK HERE or email editor@businessrisktv.com entering code #UKmarketing.

Put your products and services in front of new people already interested in your type of business offering before your competitors do.

Link into your existing online sales process direct from BusinessRiskTV or use our eCommerce solutions to increase your sales cash flow and profit.

Increase the sources of your revenue streams more sustainably. Grow your business in UK faster with BusinessRiskTV.

Grow your business faster in our UK exhibition area

Build business resilience via diversification of income streams. Promote market and advertise your business online

- Work with UK business enterprise risk management solution providers.

- Access business expert advice business tips and executive mentoring for better business protection in UK and growing a business faster in UK

- Get the right people to support your team’s ambitions and protect against their fears

Partner with your peers and business experts who can help you overcome barriers to a better future for your business.

Subscribe to BusinessRiskTV.com UK Business Magazine enter code #UKbusinessmagazine

UK Marketplace Exhibitions Conferences Expos Trade Shows Fairs Magazine

Access latest UK Exhibitions business and economy news opinion and analysis. Get ready to disrupt the UK business market place and grow your business faster in UK with BusinessRiskTV UK Exhibitions area. Find out how to manage risk more profitably and build corporate resilience in rapidly changing UK marketplace.

- Want to list your business in our online UK business directory?

- Are you running deals discounts or special offers in UK online you want more people to know about?

- Could you write an advertorial to advertise your business in the UK and inform our readers?

Sell more into UK from our UK exhibitions area. Export your products or services from your UK base.

Click on Register Now or email editor@businessrisktv.com entering code #UKdirectory.

Read and write articles to help business leaders in UK manage risks better. Our UK exhibitions areas help you to find the best business solutions for your business.

Benefit from new visits to the UK exhibitions area who are looking for other products or services but you instead! UK Exhibitions business magazine, for better ways to be in business in UK. UK Exhibitions business news and events, economy commentary business advice and much more.

Tune in to leading speakers to help inform your business decision making to manage enterprise risks more cost effectively. Connect with other business leaders in UK. Meet face to face online with UK business thought leaders and business management experts in LIVE and OnDemand workshops discussions and business development opportunities.

- Learn how to increase your profit Free Business Management Workshop

- UK Executives Business Forum Business Mentoring Tips Advice Business Support

- UK Business Lifestyle Magazine Articles Business Innovation for UK Businesses

Sign up for our UK Virtual Trade Show enter code #UKexhibitions

Read more free business risk management articles and watch risk management videostreaming

#BusinessRiskTV #UKbusinessnews #UKbusinessmagazine #UK # UKbusinesses #UKmarketing #UKdirectory #UKJournalist #BankofEngland #UKbusinessmag #UKonline #UKbusiness #UKeconomy #UKmagazine #BusinessMagazine #UKbusinessmagazine #UKreview #UKreports #UKNews #UKmarketplace #UKbusinessmag #UKbusinessmagazine

UK Business Magazine BusinessRiskTV Business Leader Magazine