The Stubborn Fire: Why Inflation Persists and Interest Rates Remain Elevated (April 2024)

As a Western world economic expert, I’m here to address the concerning reality: inflation isn’t fading as quickly as hoped, and central banks are likely to maintain higher interest rates for an extended period. Let’s delve into the twelve key reasons behind this situation, illustrated with specific examples and data:

1. Lingering Supply Chain Disruptions: The pandemic’s scars haven’t fully healed. A 2023 study by the McKinsey Global Institute found that global container freight rates remain 300% higher than pre-pandemic levels. In the United States, port congestion in Los Angeles and Long Beach persists, with an average of over 100 container ships waiting to unload as of April 2024. These bottlenecks continue to disrupt the flow of goods, keeping prices elevated.

2. The Ukraine War’s Ripple Effect: The ongoing conflict in Ukraine is a significant disruptor. Global oil prices reached a record high of $135 per barrel, a direct consequence of sanctions on Russia, a major oil exporter. This has a domino effect, pushing up transportation costs and impacting the prices of a wide range of goods. Additionally, Ukraine, known as the “breadbasket of Europe,” is struggling to export its vital wheat crop, leading to concerns about global food security and rising food prices.

3. Labour Market Tightness: The post-pandemic job market is remarkably tight in many Western economies. In the US, for example, the unemployment rate hovered around 3.5% in early 2024, near a 50-year low. Businesses across sectors are struggling to fill vacancies, with a record number of open positions reported in March 2024. This strong demand for labor translates to wage pressures. While a March 2024 report by the Federal Reserve Bank of Atlanta showed average hourly earnings increasing by 5.2% year-over-year, some sectors like leisure and hospitality are experiencing even steeper wage growth. While wage increases are positive for workers, they can also fuel inflation if businesses pass on these costs to consumers.

4. De-globalisation Trends: Geopolitical tensions and a growing emphasis on national security are prompting some countries to re-evaluate their reliance on globalised supply chains. The US government, for instance, is investing in domestic semiconductor production to reduce dependence on Asian manufacturers. This trend, while in its early stages, could lead to inefficiencies and higher production costs in the long run, potentially feeding into inflation.

5. Persistent Shelter Costs: Housing costs, a significant component of inflation calculations (typically around one-third in the US Consumer Price Index), remain stubbornly high. The median existing-home sale price in the United States reached a record $407,600 in March 2024, a 17% increase year-over-year. This is due to a confluence of factors – low inventory (driven by factors like pandemic-related construction delays), rising construction costs due to material shortages, and strong investor demand for rental properties. Experts predict a slow correction in housing prices, meaning shelter costs will likely continue to exert upward pressure on inflation.

6. Climate Change’s Impact: The increasing frequency and intensity of extreme weather events due to climate change are disrupting agricultural production and straining supply chains. Hurricane Fiona’s devastation in the Caribbean in late 2023 is a stark example. Additionally, the transition to a low-carbon economy requires investments in clean energy infrastructure, which can put upward pressure on prices in the short term. For instance, the cost of solar panels and wind turbines has risen due to supply chain disruptions and increased demand for raw materials.

7. Anchored Inflation Expectations: If consumers and businesses become accustomed to consistently rising prices, they might adjust their expectations accordingly. This can lead to a self-fulfilling prophecy, where wage-price spirals become entrenched. For instance, a University of Michigan survey in March 2024 showed that consumers’ long-term inflation expectations remained elevated at around 4.5%, significantly higher than the central bank’s target of 2%. This highlights the importance of central banks managing inflation expectations through clear communication.

8. Fiscal Policy Challenges: Government spending increased significantly during the pandemic to support economies and businesses. While necessary at the time, ongoing fiscal deficits can contribute to inflationary pressures by pumping more money into the system. The US federal budget deficit, for instance, reached a record $2.8 trillion in fiscal year 2023. America is borrowing an extra £1 trillion dollars every 100 days at present. Balancing growth concerns with fiscal consolidation presents a delicate challenge for policymakers. Implementing targeted measures that support specific sectors or vulnerable populations, while avoiding broad-based stimulus, is crucial to managing inflation.

9. The Global Energy Transition: The shift towards renewable energy sources is crucial for long-term sustainability. However, the transition requires significant investments in new infrastructure, which can be inflationary in the short term. For instance, the cost of building new solar and wind farms, as well as battery storage facilities, has increased due to supply chain constraints and rising material costs. Additionally, the intermittent nature of renewables might necessitate backup sources like natural gas, keeping energy prices volatile. A balanced approach that prioritises clean energy development while ensuring grid stability and affordability is essential.

10. The “Whiplash” Effect: The rapid tightening of monetary policy by central banks could have unintended consequences. Businesses facing higher borrowing costs might cut back on investments, potentially leading to slower economic growth. This “whiplash” effect, where aggressive interest rate hikes trigger a recession, needs careful management. Central banks need to clearly communicate their policy trajectory and be data-dependent, adjusting the pace of tightening as economic conditions evolve.

11. The “Behind the Curve” Narrative: Central banks were initially hesitant to raise interest rates, fearing a premature dampening of economic recovery. This delay in policy response might require a more aggressive tightening now to achieve desired inflation targets. The Federal Reserve, for example, waited to begin raising rates, after inflation had already reached a 40-year high. This underscores the importance of central banks acting pre-emptively to prevent inflation from becoming entrenched.

12. The Asymmetry of Monetary Policy: Unlike raising rates, lowering them is a quicker and more potent tool. This asymmetry makes it challenging for central banks to fine-tune their approach. They might need to keep rates higher for longer to ensure inflation doesn’t resurge once initial progress is made. Additionally, central banks need to be mindful of financial stability risks as they tighten monetary policy.

The Road Ahead and the Importance of Clear Communication

The current situation demands a multi-pronged approach. Central banks will likely maintain their focus on raising interest rates until inflation shows sustained signs of retreat. Governments need to implement targeted fiscal measures that support growth without adding fuel to the inflationary fire. Businesses need to invest in ways to improve supply chain resilience and productivity. Finally, continued international cooperation is essential to address the global challenges like the war in Ukraine and climate change that are contributing to inflationary pressures.

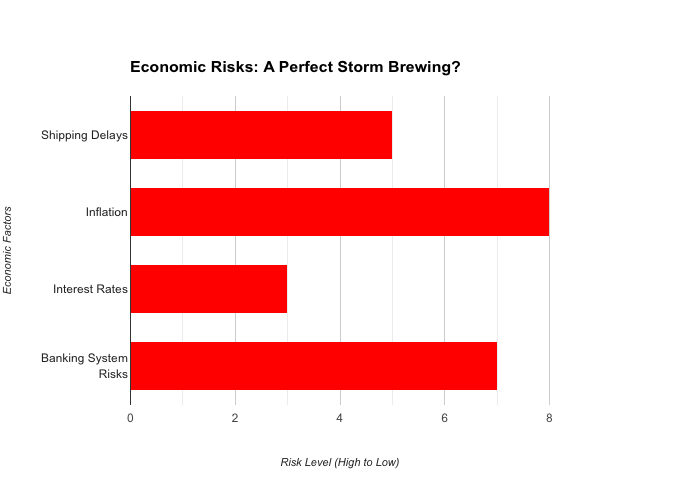

Western countries interest rates are more likely to be higher for longer. This risks systemic collapse of the banking and shadow banking systems and may drive world into deep economic depression it will take 5 plus years to recover from.

While the path ahead is challenging, it’s crucial to remember that central banks have successfully tamed high inflation in the past. By taking decisive action and working together with governments and businesses, we can overcome this hurdle and achieve a more stable and sustainable economic future.

Crucially, clear communication from central banks is paramount in managing public expectations and fostering confidence in their ability to control inflation. Regular press conferences, detailed economic forecasts, and transparent explanations of policy decisions are essential. This builds trust and helps to prevent financial market panic in the face of rising interest rates. By working together and communicating effectively, policymakers, businesses, and individuals can navigate this complex economic environment and achieve a return to price stability.

Get help to protect and grow your business

Subscribe for free business risk alerts and risk reviews

Read more business risk management articles