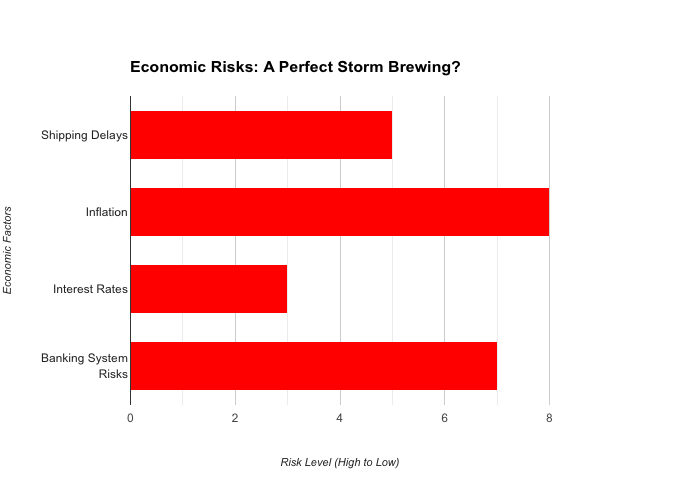

A Perfect Storm: China’s Treasury Retreat and Rising U.S. Rates

The intricate dance between the U.S. government, the Federal Reserve, and foreign investors, particularly China, is a critical factor in maintaining economic stability. Recently, whispers of a potential shift in this dynamic have raised concerns about rising inflation and interest rates in the U.S. This article explores nine key reasons why a scenario where China reduces its holdings of U.S. Treasuries, coupled with the Fed increasing its purchases, could push the U.S. economy towards higher inflation and interest rates.

1. Supply and Demand Imbalance:

U.S. Treasuries are essentially government-issued IOUs, representing debt. China, the largest foreign holder of U.S. Treasuries, acts as a major creditor. When China reduces its holdings, it decreases the overall demand for Treasuries. This, in turn, disrupts the supply-demand balance. With fewer buyers, the price of Treasuries falls, and yields (the return on investment) rise. Higher yields incentivise other investors to buy Treasuries, but it also makes it more expensive for the U.S. government to borrow money.

2. The Fed Steps In, But at a Cost:

To fill the gap created by China’s retreat, the Federal Reserve might be forced to increase its purchases of Treasuries. This quantitative easing (QE) injects money into the financial system, aiming to stimulate economic activity. However, this additional liquidity can also lead to inflation, as more money chasing the same amount of goods and services can drive prices up.

3. The Dollar Wobbles:

China’s decision to sell Treasuries could weaken the U.S. dollar. This is because a significant portion of the dollars China earns from its exports gets recycled back into the U.S. economy through Treasury purchases. With fewer purchases, the demand for dollars falls, potentially weakening its value. A weaker dollar makes imports more expensive, further fueling inflation.

4. A Vicious Cycle of Higher Borrowing Costs:

As mentioned earlier, a decrease in demand for Treasuries pushes yields higher. This translates to higher borrowing costs for the U.S. government. To meet its spending obligations, the government might need to borrow more, further pressuring interest rates upwards. This creates a vicious cycle, potentially hindering economic growth as businesses find borrowing for expansion more expensive.

5. The Domino Effect on Consumer Borrowing:

Rising interest rates don’t just affect the government. Consumers also face the brunt, as mortgages, auto loans, and credit card interest rates climb. This can lead to a decrease in consumer spending, which is the lifeblood of the U.S. economy. Reduced spending can lead to slower economic growth and potentially even deflationary pressures.

6. The Global Financial Tug-of-War:

The U.S. is not alone in its battle with inflation. Central banks worldwide are grappling with similar issues. If China’s Treasury selloff triggers a significant rise in U.S. interest rates, it could create a global tug-of-war. Other countries might be forced to raise their rates as well to maintain the relative attractiveness of their own currencies. This could stifle global economic growth.

7. Investor Confidence Takes a Hit:

A large-scale selloff by China could be interpreted as a lack of confidence in the U.S. economy. This could spook other investors, both domestic and foreign, leading to capital flight. Capital flight occurs when investors move their money out of the U.S. in search of safer havens. This can further weaken the dollar and exacerbate inflation.

8. The Geopolitical Angle:

The U.S.-China relationship has been strained in recent years. Some analysts believe China might use its Treasury holdings as a political weapon, strategically selling them to pressure the U.S. on trade or geopolitical issues. Such a move could be even more disruptive to the U.S. financial system, amplifying the aforementioned economic effects.

9. The Long-Term Uncertainty:

The long-term implications of a significant shift in China’s Treasury holdings are uncertain. The U.S. might find alternative buyers for its debt, but the process could be bumpy and lead to market volatility. Additionally, the effectiveness of the Fed’s response in such a scenario is debatable, with some economists questioning the efficacy of QE in the current economic climate.

Conclusion:

While the exact impact of China reducing its Treasury holdings is difficult to predict, the potential consequences for the U.S. economy are significant. Higher inflation and interest rates could dampen economic growth, strain consumer spending, and lead to market volatility. The Federal Reserve will have its hands full in navigating this potential storm, and the success of its response will be crucial in maintaining economic stability. It is important to note that this is a complex issue with various schools of thought.

It is important to note that this is a complex issue with various schools of thought. Some economists argue that China’s reduced demand for Treasuries might be offset by increased domestic demand from U.S. institutions like pension funds and insurance companies. Additionally, the U.S. government could take steps to reduce its budget deficit, thereby lessening its reliance on foreign borrowing.

Ultimately, the outcome hinges on several factors, including the magnitude of China’s selloff, the Fed’s response, and the overall health of the U.S. economy. Open communication and cooperation between the U.S. and China will be crucial in mitigating the potential negative consequences.

Looking Ahead:

The coming months will be critical in observing how this situation unfolds. The U.S. government’s debt issuance plans, China’s Treasury holdings data, and the Fed’s monetary policy pronouncements will be closely watched by financial markets.

Proactive measures by policymakers can help mitigate the risks. The U.S. government should strive for fiscal responsibility, while the Fed should calibrate its quantitative easing programs to ensure economic stability without stoking inflation excessively.

This potential shift in the U.S.-China economic relationship presents a challenge, but it also offers an opportunity for innovation and diversification. The U.S. can explore alternative funding sources and develop a broader investor base for its debt.

In conclusion, while the potential consequences of China reducing its Treasury holdings are concerning, proactive measures and a diversified approach can help the U.S. navigate this complex situation. Continuous vigilance and a commitment to economic stability by policymakers will be paramount in ensuring a smooth transition for the U.S. economy.

Get help to protect and grow your business

Subscribe for free business risk alerts and risk reviews

Read more business risk management articles