| Fast Links | |

|---|---|

| Risk Management Think Tank | Risk Management Club |

| Business Development Ideas | Advertorials |

| Business Risk Watch | Image Advertising |

| Business Risk Academy | Textlink Ads |

| Business Risk Jobs | UGCs |

Enterprise Risk Magazine Subscription Includes Free Alerts To New Articles and Videos And Paid Subscription Opportunities For Increased Business Protection and Growth

You will find related risk management articles and videos to develop your risk knowledge and business intelligence to improve your business decision making process

Our Enterprise Risk Management magazine will alert you to the best and worst of enterprise risk management on BusinessRiskTV via our Enterprise Risk Management magazine sponsors. Our Enterprise Risk Management magazine sponsors provide more information on their products or services in our Enterprise Risk Management magazine newsletter. Showcasing their business here online gives them a better chance of connecting with you online whether your in UK or the other side of the world.

Businesses in UK now realise more than ever the need to increase online presence. Find out what the best businesses are offering you on BusinessRiskTV today. Browse by scrolling down or sign up for free to our Enterprise Risk Management magazine.

Read articles and view videos on latest enterprise risk management news headlines opinions deals and reviews

Spend money more wisely on risk management. What are the latest must have tech and gadgets? Improve your business performance for less. Thinking about improving risk management in your business – what must you do or not do in managing business risks. Shop better online, boost your profit. Protect and grow your business faster with less uncertainty impacting on your business objectives.

Enjoy unlimited access to enterprise risk management news opinions and reviews

Explore the enterprise risk drivers within your business and external to your business impacting on your business. What is currently driving risk to your business and what can you do about it.

Become A Pro Risk Manager With BusinessRiskTV

Enterprise risk magazine supporting better decision-making in business risk management

Developing business management knowledge and business intelligence. Put your business on the map. Boost your online sales. Increase your online presence to grow your business faster with help from BusinessRiskTV.

BusinessRiskTV Protecting Businesses Better Grow Business Faster

Email editor@businessrisktv.com and enter code #ERMmag in the Subject Line of your email

Tweet @ERMuk @HolisticRiskMgt

Instagram BusinessRiskTV

Pinterest BusinessRiskTV

YouTube BusinessRiskTV and TikTok @BusinessRiskTV

Enterprise Risk Management Magazine Editorial Calendar (ERM) News Opinions Events Risk Analysis and Risk Reviews

Get help to improve your enterprise risk management with BusinessRiskTV.com

Make your enterprise risk management even better. Discover great deals discounts and special offers in enterprise risk management products and services. Connect live online with enterprise risk management experts. Get the best of risk management marketplace. Read our free online enterprise risk management magazine. Signup for alerts to the best of business with BusinessRiskTV.com.

Email editor@businessrisktv.com now and put #ERMmagazinelive in Subject line of your email.

Enterprise Risk Management Magazine Advertising Opportunities

Celebrate Your Online Business Growth With Pro Risk Manager

Enterprise Risk and Compliance Magazine For Governance Risk and Compliance Professionals and those charged with Corporate Governance Risk and Compliance Duties

Risk Management Corporate Governance and Regulatory Compliance GRC Insight

What Is Enterprise Risk Management

Understand The Benefits Of Enterprise Risk Management ERM Better With Risk Insight From Enterprise Risk Management Articles and Videos

Enterprise Risk Management Resources

Collaborate On Better Business Protection and Business Growth Initiatives To Sell More Online

Enterprise Risk Management Training

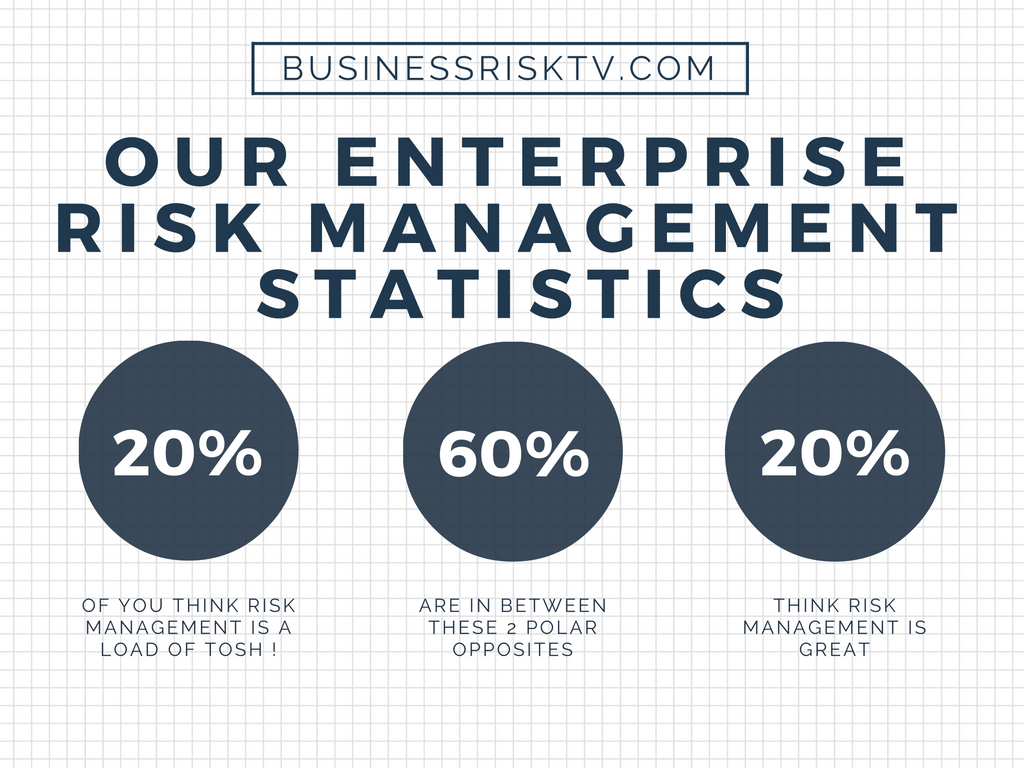

Enterprise Risk Management Training Is For The 60% Of Leader Majority Who Seek To Understand How Enterprise Risk Management Can Help Them Manage Risks Better

Enterprise Risk Management Webinars

Join Online Educational Workshops Webinars and Discussions To Get Help To Grow Faster

Looking To Grow Your Business Faster?

Business Coaching Services

Our risk assessment training course online with your online business coach will help you understand the risk profile of your business. You will then be able to make decisions to protect your business better and grow business faster with less uncertainty impacting on your business objectives. Understand why you need to be aware of risk in your organisation.

Enterprise Risk Management Monitor Discussion Debate and Risk Analysis

How to reduce uncertainty in business with BusinessRiskTV

Learn how to manage risk or uncertainty better.

Better Business Performance With BusinessRiskTV

BusinessRiskTV Virtual Market Place

Put your products or services into our online virtual marketplaces to reach more new customers.

Use Advertorial Advertising to explain the problems your products or services control and why you are better than your competitors.

Save money and time buying selling online

Keep up with business risk management news headlines and understand potential problems or new business opportunities through regular business and economy news updates.

Business growth strategies with BusinessRiskTV.com

Plan new business growth strategy with support from our online resources including social media accounts.

Fill job vacancies faster with BusinessRiskTV.com

Make sure a shortage of skilled labour does not hold your business back. Fill skills gaps faster and more cost-effectively.

Discover better ways to manage your business risks with BusinessRiskTV.com

Tackle current and future business risks with more knowledge and confidence.

Looking for marketing and advertising consultants?

BusinessRiskTV innovative business solutions will work with you to grow your business faster.

The BusinessRiskTV Marketplace

We have the best marketplace to fit your business needs.

Exploring Industry Risk Factors Including Emerging and Developing Risk Analysis and Risk Management

Whichever industry you work in, we have the risk management experts to help you overcome hurdles to faster business growth.

Managing Risks To Business Better To Improve Business Results

Join our business club to access full benefits that will help you protect and grow your business faster with less uncertainty.

Find and Apply For Jobs Online

People with your skills and experience are often in short supply. We help job seekers intent on developing their career, advance more quickly.

Find out about growing your business before your competitors do with BusinessRiskTV

Thinking More Creatively With BusinessRiskTV

Global Risk Report Discussion Analysis and Review On BusinessRiskTV

Ask risk experts from around the world how to solve your business problems.

Are you a risk adviser or risk consultant who needs more help information and support to grow your consultancy business faster?

Enterprise Risk Adviser Magazine. Are you an enterprise risk management adviser? Need to keep up to date with latest business management developments? Want to connect with other enterprise risk management experts? Need to attract more risk management clients? Looking for a new job in risk management?

Find the best risk management course for your needs

Risk management training companies use our services to help fill unused capacity on their risk management training courses to make the risk management course more profitable. You maybe able to find the best risk management course near you or online at a discount.

Enterprise Risk Management Magazine UK

We explore the latest thinking and services connected with ethical socially responsible well governed businesses in the UK and overseas

BusinessRiskTV UK News Opinions Reviews

Our UK business and economy features and risk analysis help to inform UK business leaders and business leaders seeking to do more business in or with the UK.

Issues connected with smooth business delivery are often the subject of research development and risk analysis

The global changes to recruitment and staff retention including the shift in expectations arising from increased home working are tackled in full

Country city and industry needs are separated to allow us and you to focus on your needs, problems and solutions.

Top Business Thought Leaders On Business Growth For London Marketplace

Managing Business Uncertainty

Work with BusinessRiskTV to develop new strategies to adopt to navigate uncertainty in business

UK Business and Economy Update

Find out more about enterprise wide risk assessment tools to help your business expand faster with more confidence

Business and Economy Horizon Scanning

What Will Threaten Your Business This Year

Enterprise risk management implementation to help you anticipate and manage business risks better

Improving Risk Management

Risk Management Experts

Put yourself forward as business risk expert at future risk management workshops

Failure to manage business risks does not always mean failure of risk managers

Supplier Risk Management Review

Supply Chain Risk Management Forum

Loan Guarantees To Promote UK Exports

Growing Business Faster

Look at your business risks through the eyes of other business risk management experts

London Business Leaders Forum

Technology Risk Management

Improving eCommerce

Environmental Risk Management Review

Environmental Threats and Opportunities

Financial Services The EU New York and the UK

Which door will you pick to enter a new era of business post-pandemic?

International Trade Barriers –Business and economy magazine analysing and reviewing key risk drivers in the local and global marketplace.

Join our online meeting place for international trade questions. CLICK HERE or email editor@businessrisktv.com entering code #InternationalTradeCentre

International Trade Hub – International trade support for businesses that trade internationally

Balancing Risk and Reward

Subscribe for free to enterprise risk management magazine alerts bulletins and reviews to your inbox

Get enterprise risk management magazine report to your inbox. We aim to be accessible without dumbing down. We will cut through the financial and economic jargon and tell you everything you need to know in clear accessible language and we will not pull any punches in doing so.

What business threats and opportunities are you most interested in? What do you want to do to expand or better protect your business? Share your business risk management our experiences by emailing editor@businessrisktv.com.

Please include a contact number if you are willing to speak to a journalist.

- Tweet @HolisticRiskMgt and @ERMuk

- Send pictures video or Press Releases to editor@businessrisktv.com

- Instagram BusinessRiskTV

- Pinterest BusinessRiskTV.com

- YouTube BusinessRiskTV and TikTok @BusinessRiskTV

Enterprise Risk Management Articles Including Global Business Recovery From Pandemic

Survival strategies in business

Enterprise risk management explained. Discover enterprise risk management best practices. Understand the enterprise risk management benefits for your business. Enterprise risk management integrating with strategy and performance imporvement.

Business leaders must chart their own business risk management survival and prosperity strategy. However risk management tips advice and support can help inform the business decision making process. Our ambition must be to create and develop the most resilient growing businesses to reward the owners its workers and wider society.

Is your company fit for the future?

Read articles and view videos from risk professionals and those involved with enterprise risk management.

Want to know more about enterprise risk management ERM? Identify and react quickly to potential business threats and opportunities. Improve collaboration with top risk management experts and business leaders.

Develop your risk knowledge and improve business intelligence to help inform your business decision making.

- Manage business risks better

- Understand your risk exposure

- Research evolving corporate risks.

Develop an holistic enterprise risk management approach to business decision making. Network with your peers around the world. Keep up to date with our Enterprise Risk Management Magazine. Understand monitor and control corporate enterprise risks with more informed position.

Read enterprise risk management news articles and view videos on enterprise risk management opinions debates and business reviews

Business Risk Management Magazine Free Subscription – Keep up to date with enterprise risk management research and development. What are enterprise risk management experts saying today? What business threats and opportunities should you be aware of today.

BusinessRiskTV Enterprise Risk Management Magazine ERM Magazine

Read your copy of Enterprise Risk magazine and sister magazine ERM Magazine online from anywhere at anytime. We make over 27000 plus Risk Management Online members aware of the magazines so you can distribute your business message globally quickly and cheaply.

Subscribe to BusinessRiskTV.com Enterprise Risk Management Magazine for free entering code #ERMmagazine

Helping connect enterprise risk managers locally and globally

Keeping up to date with latest enterprise risk management news opinion and analysis is free. Come back often to find the latest enterprise risk management debate comment and risk analysis. Pick up the latest enterprise risk management tips solutions and business reviews.

- Want to list your business in our online business risk management directory?

- Are you running any deals discounts or special offers for risk management products or services you want more people to know about?

- Could you write an advertorial to advertise your business risk management related business and inform our readers?

Reach more new customers with BusinessRiskTV.

Click on Register Now or email editor@businessrisktv.com and enter code #ERMmagazinedirectory in Subject Line of email

Is your business online presence maximising your sales into the online marketplace?

Online Marketplace Consultants

Do not let your competition access your next sale

People with limited budget will still buy from your business if they find your business products or services at the right time. We help potential new buyers find your products and services online.

Promoting marketing and advertising your business on Enterprise Risk Management Magazine for 12 months

Learn how to promote deals discounts offers to attract new customers with BusinessRiskTV

Reach influencers key decision makers and the business leaders who will buy from your business

Find out how to promote your business locally and globally. CLICK HERE or email editor@businessrisktv.com entering code #ERMmagazinemarketing.

Business leaders do not always have the marketing budget to promote their business locally and globally. We provide a range of online marketing options for businesses to fit most budgets so you can promote your business products or services for longer.

Link into your existing online sales process direct from BusinessRiskTV or use our eCommerce solutions to increase your sales cash flow and profit.

Increase the sources of your revenue streams more sustainably. Grow your business faster with BusinessRiskTV.

Alternatively click on subscribe button below to find other ways of promoting your business more cost effectively.

Click on subscribe button below to find other ways of promoting your business more cost effectively or email editor@businessrisktv.com and enter code #ERMmagazine

Developing confidence in corporate decision making process in uncertain business world. Pick up business enterprise protection and growth news

Our business enterprise risk magazines could be the best resource for you to reach out more cost effectively to buyers of your type of products or services.

We aim to keep key decision makers informed about enterprise risks and provide a leading thought leadership tool for enterprise risk management discussions and debate.

BusinessRiskTV Enterprise Risk Magazine covers all private sector and public sector services. Industry leaders and risk professionals accessing risk management tips advice and risk management guidance to improve business performance.

Risk management focus groups forums and enterprise risk management workshops to look at enterprise risk on a country by country industry and specific risk basis

Entrepreneurs c-suite business leaders business owners and risk professionals meeting up to explore mutual business growth with BusinessRiskTV

Enterprise Risk Magazine covers all commercial and not for profit risk issues and aims to facilitate solutions to enterprise risk related problems.

Subscribe Risk Management Magazines

Editorial will call upon risk experts from around the world to help provide news opinion and analysis for your business or enterprise.

Country industry and specific risk experts produce business enterprise news reports opinion and risk analysis to help inform your decision making process to reduce the effect of uncertainty on your goals and objectives.

Free enterprise risk magazine subscription in country industry and specific risk magazines:

- Africa Magazine

- Argentina Magazine

- Asia Pacific Magazine

- Australia Magazine

- Brazil Magazine

- Canada Magazine

- European Union Magazine

- France Magazine

- Germany Magazine

- India Magazine

- Indonesia Magazine

- Italy Magazine

- Japan Magazine

- Mexico Magazine

- Russia Magazine

- Saudi Arabia Magazine

- South Korea Magazine

- Spain Magazine

- Turkey Magazine

- United Kingdom Magazine

- Unite States of America Magazine

- China Magazine

- South Africa Magazine

Stay in touch with the biggest economies in the world and assess how developments in these countries impacts on your business.

BusinessRiskTV risk management magazines provide risk management news opinions and reviews for free. A risk management magazine online can be read at any time anywhere with WiFi or mobile connection. Our risk management articles are designed to inform key business decision makers. How would it feel to have a little more confidence in your business decision making process? Email editor@businessrisktv,com to subscribe for free to a governance risk and compliance magazines for your industry or country.

Enterprise Risk Management Magazine Feature Articles and Video News

BusinessRiskTV enterprise risk management magazine feature articles look at the latest developments in business the global economy and financial markets.

Features of Membership and registration with BusinessRiskTV

Get more involved with us to use a number of features including

- Receive email or text alerts about what you may need to know today about enterprise risks in your country or industry

- Watch and even participate in online broadcasts about business risks to develop your skills and knowledge

- Remain independent from but collaborate with other members to seize new business opportunities and business growth

- Contribute articles to inform other business leaders and raise your business profile.

- Provide business enterprise risk insight for your country or industry peers to help manage risk better and raise your business profile.

Become a member of BusinessRiskTV for free.

Join BusinessRiskTV for free today entering code #ERMmagazine.

Best Business Magazine Subscription

If you are not sure which is the best business magazine subscription for you and your business subscribe to BusinessRiskTV for free and tell us a bit about yourself and your business. We will advise which we think is the best business magazine subscription for you.

Subscribe to BusinessRiskTV.com for free

#ERMtv for live and OnDemand video streaming enterprise risk management training

Business Economy Live Digital Programming enter code #ERMtv – Enterprise risk management theory and enterprise risk management tools to protect and grow your business with less uncertainty. Discover enterprise risk management best practices during our enterprise risk management online course. Make enterprise risk management roles and responsibilities clear accepted and embedded in business decision-making.

Receive alerts to upcoming enterprise risk management workshop sessions

Watch enterprise risk management webinar wherever you have wifi connection. Get answers to your enterprise risk management questions.

Latest Enterprise Risk Management Solutions (ERM Solutions)

CLICK HERE or email editor@businessrisktv.com entering code #ERMreviews. Find out more about latest enterprise risk management solutions. We work with enterprise risk management partners across the world to find the best solutions for your country and industry.

Best Enterprise Risk Management Companies For Your Country Industry Or General Business Needs

Managing Business Risks Better with C&C Associates

Industry and risk updates. Thought leadership forum to protect and grow your business. Manage critical risks impacting on your business objectives better. Understand your key risks to inform your business decision making process. Use enterprise risk management (ERM) for a holistic approach to improved business performance. Join online virtual meetings to explore enterprise-wide risk assessment of your business. Construct the best enterprise risk management framework for your enterprise. Sign up for an enterprise risk management online course. Read the latest enterprise risk management news.

Read more risk management articles and watch videostreams for free

Topical risk management features on current and future enterprise risks. Our readership and viewers extends beyond 50000 people interested in risks management worldwide.

Editorial includes controversial opinions and non-typical attitudes to societal and enterprise risks. Editorial includes project risks, supply chain risks, risk assessment process, asbestos risks, safety risks, legionella risks, motor fleet risks, iso 31000, iso 31010, environemental risks, fire risks, cyber risks, horizon scanning, enterprise risk management, corporate risk management, public sector risk management, not-for-profit organisation risk management, risk management toolbox and much more. We have a local and global reach online.

Enterprise Risk Management Magazine, BusinessRiskTV, Risk Management Online and other social media accounts create Breakfast Lunch and Random Online Meeting opportunities for groups of like-minded individuals and one-to-one meetings. Such risk management events create editorial and advertising opportunities.

Risk Management Online Events

BusinessRiskTV hosts live online sponsored events, training workshops and discussions on specific industry country or specific enterprise risk topics.

Risk Partners Directory and BusinessRiskTV Marketplace

Benefit from 12 months branding on BusinessRiskTV.com by being listed in our risk management directory.

- Your company logo

- Your company contact details

- Up to 100 words about your risk management company offering and the products or services you offer locally and globally

- Link to your risk management related website

- Advertise your job vacancies for free

To discuss these and other business development opportunities please contact us.

Enterprise Risk Management Magazine BusinessRiskTV

Enterprise Risk Management Magazine BusinessRiskTV Videos Live and OnDemand

Enterprise Risk Management Protect and Grow Your Business Faster With Less Uncertainty With BusinessRiskTV Enterprise Risk Management Magazine

#BusinessRiskTV #EnterpriseRiskMagazine #EnterpriseRiskManagement #RiskManagement #ERMtv #RiskNews #RiskMagazine #EnterpriseMagazine #ERMjournalist #CorporateMagazine #BusinessMagazine #ERMmagazinedirectory #ERMmagazinemarketing #RiskManagementNews #RiskManagementArticles #RiskManagementNewsletters #EnterpriseRiskManagementNews #CorporateGovernance #RiskAssessment #ERMmagazine

Business Risk Management Club