The Cloudy Crystal Ball: Why Economic Models Can’t Predict the Future (and What We Can Do About It)

As business leaders and consumers in the UK navigate the ever-turbulent waters of the global economy, one question looms large: can we trust the forecasts? Economic models, once hailed as oracles of the future, have stumbled badly in recent years, failing to anticipate major events like the 2008 financial crisis and the COVID-19 pandemic. This has left many wondering: are we all just flying blind?

The Limits of the Model Machine:

Economic models are not, and never will be, crystal balls. While these complex mathematical constructs can provide valuable insights into economic trends, they are inherently limited by a number of factors:

- Incomplete Data: Economic models rely on historical data to identify patterns and relationships. However,the economy is a dynamic system,constantly evolving in unpredictable ways. New technologies, political upheavals, and natural disasters can all throw sand in the gears of even the most sophisticated model.

- Human Factor Flaw: The economy is ultimately driven by human behaviour,which is notoriously difficult to predict. Models often struggle to account for factors like consumer confidence, investor sentiment, and political decision-making, leading to inaccuracies.

- The Black Swan Problem: As Nassim Nicholas Taleb famously argued,unforeseen events – “black swans” – can have a profound impact on the economy. Models excel at predicting the familiar, but struggle to handle the truly unexpected.

The Governor’s Voice:

This point has been echoed by no less than Andrew Bailey, the Governor of the Bank of England, who, in a speech earlier this year, stated:

“Economic models are powerful tools, but they are not infallible. They are based on historical data and assumptions, and they can be blindsided by unexpected events. It is important to remember that models are not reality, they are just a simplified representation of it.”

Beyond the Model Maze:

So, if economic models cannot be relied upon for perfect foresight, are we doomed to make decisions in the dark? Absolutely not. While models may not provide infallible predictions, they can still be valuable tools for understanding the underlying dynamics of the economy. Here are some ways we can move beyond the limitations of models and make informed decisions in a world of uncertainty:

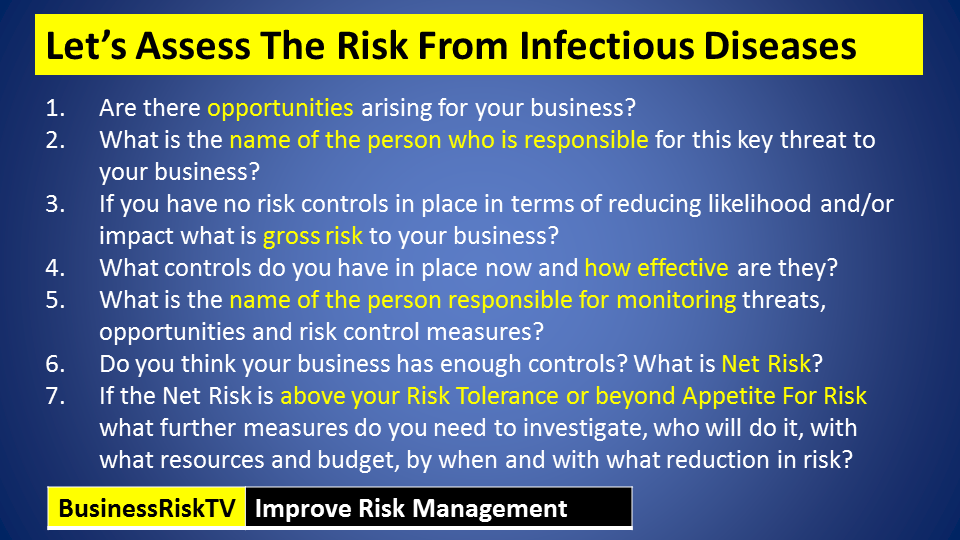

- Embrace Scenario Planning: Instead of relying on a single “most likely” forecast, consider multiple scenarios, ranging from optimistic to pessimistic. This allows for a more nuanced understanding of potential risks and opportunities.

- Focus on Leading Indicators: While lagging indicators, like GDP growth, tell us what has happened, leading indicators, like consumer confidence surveys, can provide clues about what might happen. By monitoring these signals, we can be better prepared for potential shifts in the economy.

- Listen to the Ground: Don’t get lost in the data blizzard. Talk to businesses, consumers, and workers on the ground to get a sense of their lived experiences and concerns. This qualitative data can complement the quantitative insights from models and provide a more holistic understanding of the economic landscape.

- Prioritise Adaptability: In a world of constant change, the ability to adapt is key. Businesses and consumers should focus on building resilience and flexibility into their plans, allowing them to adjust to unforeseen circumstances.

Conclusion:

Economic models are imperfect tools, but they are not useless. By understanding their limitations and employing additional strategies, we can move beyond the model maze and make informed decisions in an uncertain world. As Bank of England Governor Bailey reminded us, “The future is always uncertain, but by being prepared and adaptable, we can navigate the challenges ahead and build a more resilient economy.”

Get help to protect and grow your business

Subscribe for free risk alerts and risk reviews

Read more business risk management articles for free