How can business leaders stay up to date on local business risks

Manage the external business risks locally around your business better with BusinessRiskTV.

Subscribe to BusinessRiskTV

Nearby My Business Risks

Risk Less. Grow More. – BusinessRiskTV.com for Smarter Enterprise

BusinessRiskTV Business Report

Develop your local business intelligence and risk management knowledge

Crypto risk review with BusinessRiskTV

Get the latest Cryptocurrency news opinions and reviews. Breaking crypto News trends and events. Crypto risk analysis discussion and training. Read crypto news articles and watch videos live and on demand.

The Travel Rule (effective from 1st September 2023 in UK) is an international standard that requires financial institutions to collect and share information about cryptocurrency transfers. It was developed by the Financial Action Task Force (FATF), an intergovernmental organisation that sets standards for combating money laundering and terrorist financing.

The Travel Rule applies to all businesses that facilitate cryptocurrency transfers, including exchanges, wallets, and payment processors. In the UK, the Travel Rule will be enforced by the Financial Conduct Authority (FCA).

The Travel Rule requires businesses to collect the following information about each cryptocurrency transfer:

Businesses must also verify the identity of the sender and recipient before sharing this information.

The Travel Rule is designed to prevent the use of cryptocurrencies for money laundering and terrorist financing. By collecting and sharing information about cryptocurrency transfers, businesses can help to identify suspicious activity and track down criminals.

The Travel Rule will have a number of implications for businesses and investors in the UK.

For businesses

The Travel Rule will impose additional compliance requirements on businesses that facilitate cryptocurrency transfers. Businesses will need to implement systems and procedures to collect, verify, and share the required information. They will also need to train their staff on the Travel Rule and its requirements.

The Travel Rule is likely to increase the cost of doing business for cryptocurrency businesses. Businesses will need to invest in new technology and systems to comply with the rule. They may also need to hire additional staff to manage the compliance process.

The Travel Rule could also make it more difficult for businesses to onboard new customers. Businesses will need to collect more personal information from customers, which could deter some customers from using their services.

For investors

The Travel Rule could make it more difficult for investors to transfer cryptocurrencies between different wallets and exchanges. Businesses will need to verify the identity of both the sender and recipient of each cryptocurrency transfer, which could slow down the transfer process.

The Travel Rule could also make it more difficult for investors to remain anonymous. Businesses will be required to collect and share the name and address of each investor who makes a cryptocurrency transfer.

Overall, the Travel Rule is likely to have a significant impact on the cryptocurrency industry in the UK. Businesses will need to comply with the rule in order to avoid regulatory sanctions. Investors may also face some inconveniences as a result of the rule.

However, the Travel Rule is also seen as a necessary step to prevent the misuse of cryptocurrencies for criminal purposes. By collecting and sharing information about cryptocurrency transfers, businesses and law enforcement can work together to keep criminals out of the crypto ecosystem.

Conclusion

The Travel Rule is a complex and challenging new regulation for the cryptocurrency industry. However, it is a necessary step to protect the integrity of the market and prevent the misuse of cryptocurrencies for criminal purposes. Businesses and investors in the UK should be prepared for the impact of the Travel Rule and take steps to comply with its requirements.

In addition to the above, here are some other implications of the Travel Rule for businesses and investors in the UK:

Overall, the Travel Rule is a significant development for the cryptocurrency industry. It is important for businesses and investors to understand the implications of the rule and take steps to comply with its requirements.

Europe will see a spot bitcoin ETF traded before the U.S.. Europe’s First Spot Bitcoin ETF Lists in Amsterdam.

The Financial Stability Board (FSB) is an international body that monitors and makes recommendations on the global financial system. In July 2023, the FSB published a set of high-level recommendations for the regulation, supervision, and oversight of crypto-asset activities and markets. These recommendations are designed to address the financial stability risks posed by crypto-assets, while also supporting responsible innovation.

The FSB’s recommendations have a number of implications for current cryptocurrencies. First, they will require crypto-asset issuers and service providers to be subject to the same regulatory requirements as traditional financial institutions. This includes requirements for capital adequacy, liquidity, risk management, and customer protection. Second, the recommendations will require crypto-asset exchanges and other trading platforms to be licensed and regulated. This will help to ensure that these platforms are operating in a safe and transparent manner. Third, the recommendations will call for increased cooperation between regulators across jurisdictions. This will help to prevent crypto-asset activities from being used to evade regulation or finance illegal activities.

The FSB’s recommendations are likely to have a significant impact on the crypto-asset industry. Some cryptocurrencies may not be able to meet the new regulatory requirements and may be forced to shut down. Others may be able to adapt to the new regulations, but they may face higher costs of compliance. In the long run, the FSB’s recommendations could lead to a more regulated and mature crypto-asset industry.

Will cryptos survive and prosper under FSB recommended regulations?

It is too early to say for sure whether cryptos will survive and prosper under the FSB’s recommended regulations. However, there are a number of factors that suggest that they could.

First, the crypto-asset industry is growing rapidly. In 2022, the market capitalization of all cryptocurrencies reached over $3 trillion. This growth is being driven by a number of factors, including the increasing acceptance of cryptos by businesses and consumers, and the development of new crypto-based products and services.

Second, the crypto-asset industry is becoming more sophisticated. There are now a number of large and well-funded crypto companies that are developing innovative products and services. These companies are also investing heavily in compliance and risk management.

Third, the regulatory environment for cryptos is evolving. The FSB’s recommendations are a significant step forward, but they are not the only regulatory initiatives that are underway. Governments and regulators around the world are working to develop a comprehensive framework for regulating cryptos.

In conclusion, the FSB’s recommended regulations are likely to have a significant impact on the crypto-asset industry. However, there are a number of factors that suggest that cryptos could survive and prosper under these regulations. The industry is growing rapidly, becoming more sophisticated, and facing a more favorable regulatory environment. Only time will tell whether cryptos will ultimately become a mainstream asset class, but the FSB’s recommendations have made it more likely that they will.

Here are some additional thoughts on the implications of the FSB’s recommendations for the future of cryptos:

Overall, the FSB’s recommendations are a positive development for the crypto-asset industry. They will help to ensure that cryptos are used in a safe and responsible manner, and that they do not pose a risk to financial stability. However, the recommendations will also have some negative impacts on the industry, such as making it more difficult for new cryptos to enter the market. Only time will tell whether the positive impacts outweigh the negative impacts.

Keith Lewis 1 August 2023

Laser Digital, the digital assets subsidiary of Japanese bank Nomura has won an operating licence in Dubai, the latest in a number of mainstream financial institutions this year to enter the crypto sector.

Laser Digital received the licence from Dubai’s Virtual Asset Regulatory Authority, allowing it to offer crypto-related broker-dealer, management and investment services.

In a landmark ruling on July 13, 2023, U.S. District Judge Analisa Torres granted summary judgment in favour of Ripple Labs, Inc. in the SEC’s lawsuit alleging that XRP, the company’s native cryptocurrency, is a security. The ruling is a major victory for Ripple and the cryptocurrency industry, and it could have far-reaching implications for the future of regulation in the space.

The SEC’s lawsuit against Ripple was filed in December 2020. The agency alleged that Ripple had violated federal securities laws by selling XRP to investors without registering it as a security. Ripple argued that XRP was not a security, but rather a currency or commodity.

In her ruling, Judge Torres found that the SEC had failed to prove that XRP was a security. She noted that the SEC’s definition of a security is “vague and open-ended,” and that the agency had not provided clear guidance on how to determine whether a cryptocurrency is a security.

Judge Torres also found that the SEC had failed to establish that Ripple had engaged in any fraudulent or deceptive conduct. She noted that Ripple had made it clear to investors that XRP was a high-risk investment, and that they should not invest more than they could afford to lose.

The ruling is a major victory for Ripple and the cryptocurrency industry. It could have far-reaching implications for the future of regulation in the space. The ruling could make it more difficult for the SEC to bring similar lawsuits against other cryptocurrency companies. It could also lead to the SEC issuing new guidance on how to determine whether a cryptocurrency is a security.

What will happen to XRP in 2023?

The ruling in the SEC vs. Ripple case is a major positive development for XRP. The price of XRP surged by more than 70% in the hours following the ruling. It is likely that the price of XRP will continue to rise in the coming months and years.

The ruling could also lead to increased adoption of XRP by businesses and financial institutions. XRP is already used by a number of companies, including MoneyGram and Western Union. The ruling could make it more attractive for other companies to use XRP, as it would no longer be subject to the same regulatory uncertainty.

Overall, the ruling in the SEC vs. Ripple case is a major positive development for XRP and the cryptocurrency industry. It could lead to increased adoption of XRP by businesses and financial institutions, and it could make it more difficult for the SEC to bring similar lawsuits against other cryptocurrency companies.

Key Takeaways

What are the next steps for Ripple?

Ripple has said that it plans to continue to develop XRP and its other products and services. The company also plans to continue to work with regulators around the world to ensure that XRP is used in a compliant manner.

The ruling in the SEC vs. Ripple case is a major step forward for Ripple. However, there are still challenges ahead. The company will need to continue to work with regulators and to build trust with the broader cryptocurrency community. If Ripple can successfully navigate these challenges, it is well-positioned to play a leading role in the future of the cryptocurrency industry.

In June 2023, the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Coinbase, the largest cryptocurrency exchange in the United States. The SEC alleged that Coinbase had violated securities laws by offering and selling unregistered securities.

The SEC’s complaint specifically named 12 digital assets that it claimed Coinbase had offered and sold as unregistered securities. These assets included Bitcoin, Ethereum, Litecoin, and several other major cryptocurrencies.

The SEC argued that these assets were securities because they met the definition of an investment contract under the Howey Test. The Howey Test is a legal standard that defines an investment contract as an investment of money in a common enterprise with profits to come solely from the efforts of others.

The SEC alleged that Coinbase’s customers were investing money in a common enterprise by buying and selling cryptocurrencies on the platform. The SEC also alleged that Coinbase’s profits came solely from the efforts of others, namely the miners who process transactions and secure the blockchain networks on which cryptocurrencies are based.

Coinbase denied the SEC’s allegations and filed a motion to dismiss the lawsuit. The company argued that the digital assets it offered and sold were not securities because they were not investments in common enterprises. Coinbase also argued that the SEC had not given it fair notice that its activities were illegal.

The case is still pending in federal court. A trial date has not yet been set.

Is Coinbase in Trouble?

The SEC’s lawsuit against Coinbase is a significant development in the regulation of cryptocurrency exchanges. If the SEC is successful, it could set a precedent that would require other cryptocurrency exchanges to register with the SEC and comply with securities laws.

However, it is important to note that the case is still pending and Coinbase has denied the SEC’s allegations. It is possible that Coinbase will be able to win the case or reach a settlement with the SEC.

It is also worth noting that the SEC has not brought similar lawsuits against other major cryptocurrency exchanges. This suggests that the SEC may be targeting Coinbase specifically, perhaps because of its size or its high profile.

Only time will tell how the SEC’s lawsuit against Coinbase will be resolved. However, the case is a reminder that cryptocurrency exchanges are not immune from regulation and that they could face legal challenges in the future.

What are the Other Lawsuits Against Binance and Coinbase?

In addition to the SEC’s lawsuit against Coinbase, the company has also been sued by several private investors. These investors allege that they lost money by investing in cryptocurrencies on Coinbase’s platform.

The investors’ lawsuits allege that Coinbase failed to adequately disclose the risks associated with cryptocurrency investing. They also allege that Coinbase engaged in market manipulation and that it allowed fraudulent activity to take place on its platform.

Coinbase has denied the investors’ allegations and has filed motions to dismiss the lawsuits. The cases are still pending in federal court.

Binance, another major cryptocurrency exchange, has also been sued by the SEC and by private investors. The SEC’s lawsuit against Binance alleges that the company operated an unregistered securities exchange. The private investors’ lawsuits allege that Binance engaged in market manipulation and that it allowed fraudulent activity to take place on its platform.

Binance has denied the SEC’s allegations and has filed motions to dismiss the private investors’ lawsuits. The cases are still pending in federal court.

Is Coinbase Winning the Lawsuits?

It is too early to say whether Coinbase will win the lawsuits against it. The cases are still pending and it is possible that they could be resolved through settlement.

However, Coinbase has a strong legal team and it has denied all of the allegations against it. The company has also filed motions to dismiss the lawsuits, which suggests that it is confident in its chances of winning.

Only time will tell how the lawsuits against Coinbase will be resolved. However, the company has a good chance of prevailing in court.

Update 29 June 2023

Coinbase has filed papers asking a New York federal court to dismiss the SECs lawsuit that accuses the company of offering a dozen unregistered securities. Coinbase claimed the case should be thrown out in part because the digital assets it lists for trading are not “investment contracts”. Coinbase says the tokens it sells can’t be investment contracts because buyers and sellers are simply assets that are not tied to any contractual obligation.

Coinbase also claims that tokens that were once securities can cease to have that status as the blockchains that host them become increasingly decentralised.

Coinbase’s argument that its listed tokens are simply assets and not investment tokens has not been seriously tested in U.S. courts. The court case is unlikely to conclude until 2024.

Coinbase is also relying heavily on a so-called “fair notice defense” that is based around the constitutional principle the governments cannot initiate prosecutions if they have failed to let people know about the relevant law at issue.

The future of Bitcoin is a hotly debated topic. Some believe that the cryptocurrency is a bubble that is destined to burst, while others believe that it is the future of money.

There are a number of factors that could lead to Bitcoin going to zero. One is if there is a widespread loss of confidence in the cryptocurrency. This could happen if there were a major security breach or if governments cracked down on Bitcoin.

Another possibility is that Bitcoin could be replaced by a newer, more efficient cryptocurrency. There are already a number of competing cryptocurrencies, and it is possible that one of these could eventually supplant Bitcoin.

However, there are also a number of factors that could lead to Bitcoin reaching a million dollars or more. One is if Bitcoin becomes more widely adopted as a form of payment. This is already starting to happen, as more and more businesses are beginning to accept Bitcoin.

Another possibility is that Bitcoin could become a store of value. This is because Bitcoin is limited in supply, and it is not subject to government interference. As a result, Bitcoin could become an attractive investment for people who are looking for a safe way to store their wealth.

So, which way will Bitcoin go? It is impossible to say for sure. However, the evidence suggests that Bitcoin is here to stay. The cryptocurrency has a number of unique properties that make it valuable, and it is likely to continue to grow in popularity in the years to come.

Arguments for Bitcoin Reaching a Million Dollars

There are a number of arguments that suggest that Bitcoin could reach a million dollars or more in the future. These arguments include:

Arguments Against Bitcoin Reaching a Million Dollars

There are also a number of arguments that suggest that Bitcoin is unlikely to reach a million dollars. These arguments include:

The future of Bitcoin is uncertain. However, the evidence suggests that Bitcoin is here to stay. The cryptocurrency has a number of unique properties that make it valuable, and it is likely to continue to grow in popularity in the years to come. Whether Bitcoin will reach a million dollars or more is anyone’s guess. However, the potential for significant gains is there, and this could make Bitcoin an attractive investment for some people.

What Do You Think?

What do you think the future holds for Bitcoin? Do you think it will reach a million dollars or more? Or do you think it is more likely to go to zero? Share your thoughts in the comments below.

More articles:

Will Bitcoin ever be worth $1 million?

How low will Bitcoin go in 2023?

What will Bitcoin be worth in 2025?

Is it possible for Bitcoin to go to zero?

Central bank digital currencies (CBDCs) are digital versions of fiat currencies that are issued and regulated by central banks. They are designed to offer the same benefits as traditional cash, such as anonymity and ease of use, while also providing some of the advantages of digital payments, such as speed and efficiency.

Cryptocurrencies, on the other hand, are decentralised digital currencies that are not issued or regulated by any central authority. They are based on blockchain technology, which is a secure and transparent distributed ledger system.

There is a growing debate about whether central banks need to kill crypto in order to successfully adopt CBDCs. Some argue that cryptocurrencies pose a threat to the financial system and that central banks need to take steps to ensure that they do not gain widespread adoption. Others argue that cryptocurrencies can actually complement CBDCs and that the two can coexist in the future.

Arguments for killing crypto

There are a number of arguments in favor of central banks killing crypto. One argument is that cryptocurrencies are a threat to financial stability. Cryptocurrencies are often volatile and can be used for illegal activities, such as money laundering and terrorist financing. This could lead to a loss of confidence in the financial system and could make it more difficult for central banks to manage monetary policy.

Another argument is that cryptocurrencies are a threat to consumer protection. Cryptocurrencies are often complex and difficult to understand. This could lead to consumers being scammed or losing money. Central banks have a responsibility to protect consumers and could do this by banning cryptocurrencies.

Arguments for coexisting with crypto

There are also a number of arguments in favour of central banks coexisting with crypto. One argument is that cryptocurrencies can actually complement CBDCs. For example, cryptocurrencies can be used for international payments, while CBDCs can be used for domestic payments. This could make it easier and cheaper for people to make payments across borders.

Another argument is that cryptocurrencies can promote innovation. The development of cryptocurrencies has led to the development of new technologies, such as blockchain. These technologies could be used to improve the efficiency and security of the financial system.

The debate about whether central banks need to kill crypto is likely to continue for some time. There are valid arguments on both sides of the issue. Ultimately, the decision of whether or not to kill crypto will be up to individual central banks. There are direct and indirect ways central banks and governments can try to kill crypto. However, the global marketplace suggests that central banks would need to do it globally and it is not clear how they would coordinate such action when it is difficult to get global agreement on anything. Furthermore, there is an argument that cryptos like Bitcoin provide a way to hold and retain value that is outside the reach and control of central banks and national governments.

However, it is important to note that the adoption of CBDCs is not a zero-sum game. It is possible for both CBDCs and cryptocurrencies to coexist. In fact, it is possible that the two could complement each other and help to improve the efficiency and security of the financial system. Attempts to kill crypto by central banks and national governments may raise questions as to the motivations of centres of power.

Cryptocurrencies are digital or virtual tokens that use cryptography for security. A cryptocurrency is difficult to counterfeit because of this security feature. A defining feature of a cryptocurrency, and arguably its most endearing allure, is its organic nature. It is not issued by any central authority, rendering it theoretically immune to government interference or manipulation.

Cryptocurrencies use decentralised control as opposed to centralised digital currency and central banking systems. The decentralised control of each cryptocurrency works through a blockchain, which is a public transaction database, functioning as a distributed ledger. Bitcoin, first released as open-source software in 2009, is generally considered the first decentralised cryptocurrency. Since the release of bitcoin, over 4,000 altcoins (alternative variants of bitcoin, or other cryptocurrencies) have been created.

There are many potential benefits for businesses that adopt cryptocurrencies. Some of these benefits include:

What is tangible about cryptocurrency?

The tangible benefits of cryptocurrency to businesses are the reduced transaction fees, faster transactions, global reach, increased security, and reduced risk of fraud. These benefits can help businesses save money, improve customer satisfaction, expand into new markets, and reduce the risk of fraud.

Is cryptocurrency tangible or intangible?

Cryptocurrency is a digital asset, which means that it is not a physical object. However, it does have tangible value. This value is derived from the fact that cryptocurrency can be used to purchase goods and services. It can also be used to store value and to invest.

Does cryptocurrency have any tangible value?

Yes, cryptocurrency has tangible value. This value is derived from the fact that cryptocurrency can be used to purchase goods and services. It can also be used to store value and to invest.

The value of cryptocurrency is determined by supply and demand. The supply of cryptocurrency is limited, as there is a finite number of bitcoins that will ever be created. The demand for cryptocurrency is growing, as more and more businesses and individuals are beginning to accept it as a form of payment.

As the demand for cryptocurrency continues to grow, its value is likely to increase. This makes cryptocurrency a good investment for those who are looking to protect their wealth from inflation and other economic risks.

The adoption of cryptocurrency by businesses can offer a number of tangible benefits, including reduced transaction fees, faster transactions, global reach, increased security, and reduced risk of fraud. These benefits can help businesses save money, improve customer satisfaction, expand into new markets, and reduce the risk of fraud.

As the use of cryptocurrency continues to grow, businesses that adopt it early may be able to gain a competitive advantage.

Some people with high powers and responsibilities in USA are increasing their attack on crypto-sphere. What will it mean for the America and global economy?

As the rest of the world is opening its mind to the place of cryptocurrency in modern world America is doubling down on its suppression of cryptocurrency.

Opinion: Keith Lewis 8 June 2023

It is still too early to say whether the SEC’s attacks on cryptocurrency exchanges like Coinbase and Binance will impede or protect the US economy. However, there are a few potential outcomes that could occur.

One possibility is that the SEC’s actions will stifle innovation in the cryptocurrency industry. The SEC has been criticised for its heavy-handed approach to regulating cryptocurrency, and some fear that this could lead to businesses leaving the US or choosing not to launch their products here in the first place. This could have a negative impact on the US economy, as it could prevent the development of new technologies and businesses that could create jobs and boost economic growth.

Another possibility is that the SEC’s actions will protect investors from fraud and abuse. The cryptocurrency industry has been plagued by scams and other forms of fraud, and the SEC’s actions could help to protect investors from these risks. This could lead to increased investment in the cryptocurrency industry, which could have a positive impact on the US economy.

It is also possible that the SEC’s actions will have a mixed impact on the US economy. It is possible that the SEC’s actions will stifle innovation while also protecting investors. This could lead to a slower pace of economic growth, but it could also lead to a more stable and secure cryptocurrency industry.

Only time will tell what the ultimate impact of the SEC’s actions will be. However, it is clear that the SEC’s actions have the potential to have a significant impact on the US economy.

Here are some additional thoughts on the matter:

Overall, the SEC’s actions on cryptocurrency exchanges are a complex issue with the potential to have both positive and negative impacts on the US economy. It is important to monitor the situation closely and to assess the impact of the SEC’s actions as they unfold.

The Securities and Futures Commission (SFC) of Hong Kong has finalised rules to allow retail trading of cryptocurrencies from June 1, 2023. The new rules are designed to protect investors and promote the development of the virtual assets industry in Hong Kong.

Under the new rules, only licensed cryptocurrency exchanges will be allowed to offer retail trading services. Licensed exchanges will be subject to a number of requirements, including:

The SFC has also issued a number of guidance notes to help licensed exchanges comply with the new rules.

The new rules are expected to have a number of benefits for the virtual assets industry in Hong Kong. First, they will provide investors with greater confidence in the safety and security of their investments. Second, they will help to attract new investors to the industry. Third, they will help to promote the development of the industry in Hong Kong.

The new rules have been welcomed by the industry. The Hong Kong Blockchain Association said that the rules “will help to create a more stable and transparent environment for the development of the virtual assets industry in Hong Kong.”

The new rules are a significant step forward for the development of the virtual assets industry in Hong Kong. They will help to protect investors, promote the development of the industry, and attract new investors to Hong Kong.

What are the new rules?

The new rules are set out in the Securities and Futures Ordinance (SFO) and the Securities and Futures Commission (SFC) Handbook. The SFO provides the legal framework for the regulation of securities and futures in Hong Kong. The SFC Handbook provides guidance on how the SFO is to be interpreted and applied.

The key provisions of the new rules are as follows:

What are the benefits of the new rules?

The new rules are expected to have a number of benefits for the virtual assets industry in Hong Kong. First, they will provide investors with greater confidence in the safety and security of their investments. Second, they will help to attract new investors to the industry. Third, they will help to promote the development of the industry in Hong Kong.

What are the challenges of the new rules?

The new rules will present a number of challenges for the virtual assets industry in Hong Kong. First, it will be a challenge for licensed exchanges to meet the requirements of the new rules. Second, it will be a challenge for the SFC to effectively regulate the industry.

What is the future of the virtual assets industry in Hong Kong?

The new rules are a significant step forward for the development of the virtual assets industry in Hong Kong. They will help to protect investors, promote the development of the industry, and attract new investors to Hong Kong. The industry is expected to continue to grow in the coming years.

What are the risks of investing in cryptocurrencies?

Cryptocurrencies are a new and volatile asset class. As such, there are a number of risks associated with investing in them. These risks include:

How can I protect myself from the risks of investing in cryptocurrencies?

There are a number of things you can do to protect yourself from the risks of investing in cryptocurrencies. These include:

Could these new rules open drive Bitcoin value up particularly as Hong Kong May give easier access to millions of Chinese investors?

It is possible that the new rules could drive Bitcoin value up, particularly as Hong Kong may give easier access to millions of Chinese investors.

The new rules will provide investors with greater confidence in the safety and security of their investments, which could lead to increased demand for Bitcoin. Additionally, the new rules will make it easier for Chinese investors to access Bitcoin, which could also lead to increased demand.

However, it is important to note that there are a number of factors that could affect the price of Bitcoin, including the overall economic climate, the performance of other cryptocurrencies, and regulatory changes. As such, it is impossible to say for sure whether the new rules will drive Bitcoin value up.

Here are some of the reasons why the new rules could drive Bitcoin value up:

However, there are also some reasons why the new rules could not drive Bitcoin value up:

Overall, it is too early to say whether the new rules will drive Bitcoin value up. There are a number of factors that could affect the price of Bitcoin, and it is impossible to say for sure how these factors will play out.

Cryptocurrency Risks and Opportunities

Cryptocurrencies, such as Bitcoin and Ethereum, have been gaining popularity in recent years, and businesses in the UK are starting to take notice. While these digital currencies offer a number of benefits, they also come with a number of risks and challenges. In this article, we will explore the threats and opportunities that cryptocurrencies present for businesses in the UK.

Threats

One of the biggest threats that businesses in the UK face when it comes to cryptocurrencies is their volatility. Cryptocurrencies are known for their fluctuations in value, which can be significant and happen quickly. This volatility makes it difficult for businesses to predict and plan for the future, as they may not know how much a particular cryptocurrency will be worth at any given time.

Another threat is the risk of hacking. Cryptocurrency exchanges and wallets are vulnerable to cyber attacks, and if a business stores large amounts of cryptocurrency, it could be at risk of losing it all in the event of a successful hack.

Regulatory risks are also present for businesses that deal with cryptocurrencies. The UK government has not yet created a comprehensive framework for the regulation of cryptocurrencies, which means that businesses may not be sure of their legal obligations or of how to comply with them. This could result in fines or other penalties if a business is found to be in violation of any laws or regulations.

Opportunities

Despite these threats, there are also a number of opportunities that cryptocurrencies present for businesses in the UK. One of the biggest opportunities is the ability to reach a global market. Cryptocurrencies are decentralised, meaning that they are not controlled by any government or institution. This makes them accessible to anyone with an internet connection, regardless of where they are located.

Another opportunity is the ability to reduce transaction costs. Traditional payment methods, such as credit cards, can be costly for businesses, as they often have to pay fees to the banks and other financial institutions that process the transactions. Cryptocurrencies, on the other hand, can be sent and received directly between parties, without the need for intermediaries, which can reduce costs significantly.

Innovation is another opportunity for businesses in the UK. Cryptocurrencies and blockchain technology have the potential to change the way that businesses operate and interact with their customers. For example, blockchain technology can be used to create secure and transparent supply chain management systems, which can improve efficiency and reduce costs.

Cryptocurrencies present a number of threats and opportunities for businesses in the UK. While the volatility and risk of hacking are significant concerns, the ability to reach a global market and reduce transaction costs are among the key opportunities that these digital currencies offer. Businesses that are considering incorporating cryptocurrencies into their operations should weigh the risks and benefits carefully, and should be prepared to adapt as the regulatory environment evolves.

Are more USA crypto regulatory measures on their way? Could they be part of coordinated global clampdown on crypto?

There are bad actors using crypto to launder money. However, the biggest banks in the world have been regularly been fined for repeated widespread mismanagement that resulted in money being laundered by the traditional finance establishment. Is money laundering risk being used by the traditional finance establishment and national governments as an excuse to regulate crypto? Maybe even eliminate current crypto in favour of national CBDC or one international CBDC?

P

In recent months, there has been growing concern that UK banks are clamping down on cryptocurrency. In particular, Natwest has come under fire for its new terms and conditions, which state that the bank will no longer allow customers to make payments to cryptocurrency exchanges.

This has led to speculation that Natwest is trying to prevent its customers from investing in cryptocurrency. However, the bank has denied this, saying that the new terms and conditions are simply a way of protecting customers from fraud and other risks.

So, what is the truth about UK banks and cryptocurrency? Are they really clamping down on it? And if so, why?

The Controversy Surrounding Cashless Society

One of the main reasons why banks are concerned about cryptocurrency is because it could pose a threat to the cashless society. In recent years, there has been a growing trend towards a cashless society, with more and more people using cards and online payments instead of cash.

Banks are keen to promote this trend, as it makes it easier for them to track customer spending and to collect fees. However, cryptocurrency could undermine the cashless society by providing an alternative way to make payments.

This is why some banks have been accused of trying to stifle the growth of cryptocurrency. For example, in 2017, Barclays banned its customers from buying cryptocurrency. And in 2018, HSBC said that it would not allow its customers to use its credit cards to buy cryptocurrency.

The Real Threat to Cryptocurrency

However, the real threat to cryptocurrency is not from banks. It is from governments.

Governments around the world are increasingly concerned about the potential risks posed by cryptocurrency. These risks include the use of cryptocurrency for money laundering and terrorist financing. Governments also risk losing control of the money – control the money control the people.

As a result, governments are starting to regulate cryptocurrency. In the UK, the Financial Conduct Authority (FCA) has issued guidance on cryptocurrency.

NatWest’s New Terms and Conditions

Natwest is introducing new terms and conditions that will have the effect of potentially restricting customer payments to cryptocurrency exchanges and payments into back accounts from cryptocurrency. These terms and conditions are designed to protect customers from fraud and other risks, but are also potentially worrying controls over people and businesses human rights.

They send a clear message to customers that Natwest does not approve of cryptocurrency. And this message is likely to be echoed by other banks.

The Future of Cryptocurrency

So, what does the future hold for cryptocurrency? It is difficult to say. However, it is clear that banks and governments are not keen on the idea.

This could make it difficult for cryptocurrency to achieve widespread global adoption. How difficult will depend on global governance.

Only time will tell what the future holds for cryptocurrency. However, one thing is for sure: the controversy surrounding it is not going away anytime soon

Discuss the threats and opportunities for businesses in the UK if and when your business is ready to explore the protection and growth from cryptocurrencies.

Join our online forum to meetup online to inform your business decision-making.

#CryptoNews #CryptoAnalysis #CryptoOpinions #CryptoRiskReview #CryptoReport #CryptoForum

As the world becomes more digitised, cryptocurrencies have become a popular form of payment for individuals and businesses alike. With the rise of cryptocurrencies like Bitcoin, Ethereum, and Litecoin, many businesses are now considering accepting these currencies as a form of payment. Additionally, some businesses are even paying their employees and contractors in cryptocurrencies. In this article, we will discuss how businesses can get paid in crypto through the BusinessRiskTV.com marketplace.

What is Cryptocurrency?

Cryptocurrency is a digital or virtual currency that uses cryptography for security. Cryptography is a technique for secure communication that is used to keep transactions secure and private. Cryptocurrencies use a decentralized system that allows for peer-to-peer transactions without the need for intermediaries like banks or governments.

One of the most popular cryptocurrencies is Bitcoin. Bitcoin was created in 2009 by an unknown person using the pseudonym Satoshi Nakamoto. Bitcoin is decentralised, meaning it is not controlled by any government or financial institution. Instead, it is maintained by a network of users who validate and record transactions on a public ledger called the blockchain.

Other popular cryptocurrencies include Ethereum, Litecoin, and Ripple. These cryptocurrencies are also decentralised and operate on similar blockchain technology.

Why Get Paid in Cryptocurrency?

There are several reasons why businesses might want to get paid in cryptocurrency. First, cryptocurrencies offer fast and secure transactions without the need for intermediaries. This means that businesses can receive payments instantly, without having to wait for banks or other financial institutions to process the transaction.

Second, cryptocurrencies offer lower transaction fees compared to traditional payment methods. This can save businesses money in the long run, especially if they receive a large volume of payments.

Finally, cryptocurrencies offer a level of anonymity and privacy that is not possible with traditional payment methods. This can be particularly useful for businesses that operate in industries where privacy is important, such as adult entertainment or gambling.

How to Get Paid in Cryptocurrency through BusinessRiskTV.com Marketplace

BusinessRiskTV.com Marketplace is an online platform that connects businesses with buyers and sellers around the world. The platform allows businesses to buy and sell goods and services in a secure and efficient manner. Additionally, the platform also supports cryptocurrency payments, making it easy for businesses to get paid in cryptocurrency.

To get started, businesses will need to sign up for a BusinessRiskTV.com Marketplace account. Once the account is created, businesses can list their products or services for sale on the platform. When a buyer makes a purchase, the seller will receive payment in the currency of their choice, including cryptocurrency.

To receive payments in cryptocurrency, businesses will need to provide their cryptocurrency wallet address to the buyer. The buyer will then send the payment to the provided wallet address. Once the payment is received, the seller can withdraw the funds to their bank account or continue to hold the cryptocurrency.

Benefits of Using BusinessRiskTV.com Marketplace

There are several benefits of using BusinessRiskTV.com Marketplace to get paid in cryptocurrency. First, the platform offers a secure and efficient way for businesses to sell their products or services. The platform uses advanced security measures to protect user data and prevent fraud.

Second, BusinessRiskTV.com Marketplace supports multiple payment options, including cryptocurrency. This makes it easy for businesses to receive payments in the currency of their choice.

Finally, BusinessRiskTV.com Marketplace offers a global audience, allowing businesses to reach buyers and sellers from around the world. This can help businesses expand their customer base and increase their revenue.

Potential Risks of Using Cryptocurrency

While there are many benefits to using cryptocurrency, there are also potential risks that businesses should be aware of. One of the main risks is the volatility of cryptocurrency prices. Cryptocurrency prices can fluctuate rapidly, which can result in large gains or losses for businesses.

Additionally, cryptocurrencies are not regulated by governments or financial institutions, which can make them vulnerable to fraud and hacking

Finally, businesses should be aware of the potential legal and tax implications of using cryptocurrency. Regulations regarding cryptocurrency vary from country to country, and businesses should consult with a legal or tax professional before accepting cryptocurrency payments.

Cryptocurrency is becoming an increasingly popular form of payment for businesses around the world. By accepting cryptocurrency payments, businesses can benefit from fast and secure transactions, lower transaction fees, and increased privacy. BusinessRiskTV.com Marketplace is an online platform that supports cryptocurrency payments, making it easy for businesses to get paid in cryptocurrency. However, businesses should also be aware of the potential risks and legal and tax implications of using cryptocurrency. By understanding these risks and taking appropriate measures, businesses can benefit from the advantages of cryptocurrency while minimising potential drawbacks.

The question of whether or not cryptocurrencies are securities has been debated for years. The Securities and Exchange Commission (SEC) has taken the position that most cryptocurrencies are securities, while the Commodity Futures Trading Commission (CFTC) has argued that they are commodities.

The SEC’s position is based on the Howey Test, a legal test that is used to determine whether an investment is a security. The Howey Test asks three questions:

The SEC argues that cryptocurrencies meet all three criteria of the Howey Test. First, investors put money into cryptocurrencies. Second, investors expect to make a profit from their investment. Third, those profits are to come from the efforts of the developers of the cryptocurrency, who are working to create a new and innovative technology.

The CFTC, on the other hand, argues that cryptocurrencies are commodities. Commodities are defined as “any good, article, service, right, or interest in which there is an actual or potential commerce.” The CFTC argues that cryptocurrencies meet this definition because they are bought and sold on exchanges, and their prices are determined by supply and demand.

The debate over whether or not cryptocurrencies are securities is likely to continue for some time. The SEC and the CFTC are both powerful regulatory agencies, and they have different views on how to regulate cryptocurrencies. It is possible that the courts will eventually have to decide the issue.

In the meantime, investors should be aware of the risks associated with investing in cryptocurrencies. Cryptocurrencies are a new and volatile asset class, and they are not regulated by the government in the same way that stocks and bonds are. As a result, investors could lose all of their money if they invest in cryptocurrencies.

The classification of cryptocurrencies is a complex and evolving issue. Some argue that cryptocurrencies are securities, while others believe that they are commodities or currencies. The classification of cryptocurrencies has important implications for regulation and taxation.

Securities

A security is an investment contract that provides the investor with an expectation of profits. Securities are regulated by the Securities and Exchange Commission (SEC). The SEC has stated that it believes that many cryptocurrencies are securities.

Commodities

A commodity is a good or service that is bought and sold on an exchange. Commodities are regulated by the Commodity Futures Trading Commission (CFTC). The CFTC has not yet taken a position on whether or not cryptocurrencies are commodities.

Currencies

A currency is a medium of exchange that is used to purchase goods and services. Currencies are not regulated by the SEC or the CFTC.

The classification of cryptocurrencies is still up for debate. However, it is important to understand the potential implications of different classifications. For example, if cryptocurrencies are classified as securities, then they would be subject to the same regulations as stocks and bonds. This could make it more difficult for businesses to raise money through cryptocurrency ICOs.

The regulation of cryptocurrencies is a rapidly evolving area of law. The SEC, the CFTC, and other regulators are still working to develop a comprehensive framework for regulating cryptocurrencies.

It is likely that the regulation of cryptocurrencies will continue to evolve in the coming years. As cryptocurrencies become more popular, regulators will need to develop new rules and regulations to protect investors and ensure market integrity.

If you are considering investing in cryptocurrencies, it is important to do your research and understand the risks involved. Here are a few tips for investing in cryptocurrencies safely:

By following these tips, you can help to protect yourself when investing in cryptocurrencies.

Is Ethereum a security?

Is Cardano a security or commodity?

Crypto News

What do you need to know today about business risk on BusinessRiskTV

Business Risk News : if your objective is freedom and success you will need objectivity, clarity and independence of thought from your news source to discover freedom and success in business. The wider news media is useless to you as it has its own agenda. If your recognise that this is the real truth and understand why that impacts on your ability to make your business a success then you will want to come back to BusinessRiskTV Risk News more often for help to inform your better decision making process to achieve success in business with less uncertainty. Don’t let yourself be brainwashed by the agenda of others not aligned to your business objectives.

Keep up to date with emerging risks. Read and watch changing threats and opportunities via our risk management articles and videos. Pick up news on business risk information, jobs and future risks on horizon. Hear other peoples opinions on current business risks.

How can risk owners inform their enterprise risk decision-making

Understand the threats and sees business opportunities in Brazil Russia India China and South Africa

BusinessRiskTV.com BRICS Business Risk Reviews Brazil Russia India China South Africa #BusinessRiskTV #ProRiskManager #BRICS #Brazil #Russia #India #China #SouthAfrica #Argentina #Iran #SaudiArabia #Ethiopia #Egypt #UnitedArabEmiratesUAE

The BRICS bloc of developing nations has expanded to 11 with the admission of Argentina, Egypt, Ethiopia, Iran, Saudi Arabia, and the United Arab Emirates. The decision was made at the 15th BRICS summit, held in Johannesburg, South Africa, on August 24, 2023.

The expansion of BRICS is seen as a major step in the bloc’s efforts to reshuffle the global order. The bloc’s members represent over 40% of the world’s population and 25% of the global economy. With the addition of the six new members, BRICS will become even more diverse and influential.

The new members of BRICS bring a variety of strengths to the bloc. Argentina is a major agricultural exporter and has a strong manufacturing sector. Egypt is a regional power in North Africa and the Middle East. Ethiopia is a rapidly growing economy with a young and dynamic population. Iran is a major oil producer and has a strategic location in the Middle East. Saudi Arabia is the world’s largest oil exporter and has a powerful military. The United Arab Emirates is a financial and trade hub in the Middle East.

The expansion of BRICS is likely to have a significant impact on the global economy and geopolitics. The bloc is now better positioned to challenge the dominance of the United States and other Western powers. It is also likely to play a more active role in global affairs, such as climate change and trade.

The decision to expand BRICS was not without controversy. Some critics have argued that the bloc is becoming too large and unwieldy. Others have expressed concerns about the human rights records of some of the new members. However, the leaders of BRICS have dismissed these concerns, arguing that the bloc is committed to promoting democracy, development, and peace.

The expansion of BRICS is a major development that is likely to have a significant impact on the global order. The bloc is now well-positioned to play a more prominent role in global affairs. It will be interesting to see how BRICS evolves in the years to come.

The Significance of the New BRICS Members

The admission of six new members to BRICS is a significant development that has the potential to reshape the global order. The new members, Argentina, Egypt, Ethiopia, Iran, Saudi Arabia, and the United Arab Emirates, bring a variety of strengths to the bloc, including their large populations, growing economies, and strategic locations.

The addition of these countries will make BRICS more diverse and representative of the global community. It will also give the bloc a stronger voice in international affairs. BRICS is now well-positioned to challenge the dominance of the United States and other Western powers.

The new members of BRICS also have a number of shared interests. They are all developing countries that are seeking to grow their economies and improve the lives of their citizens. They are also all concerned about the rise of protectionism and unilateralism in the global economy.

The expansion of BRICS is likely to have a number of positive implications for the global economy. It will create new opportunities for trade and investment, and it will help to promote economic development in the developing world. It will also make the global economy more resilient to shocks and crises.

The expansion of BRICS is also likely to have a positive impact on global geopolitics. The bloc is now better positioned to play a more active role in resolving conflicts and promoting peace. It is also likely to be more effective in addressing global challenges such as climate change and terrorism.

Overall, the expansion of BRICS is a positive development that has the potential to make the world a more prosperous and peaceful place. It is a sign that the developing world is rising to challenge the dominance of the West.

The Challenges Facing BRICS

While the expansion of BRICS is a positive development, it also faces a number of challenges. One challenge is that the bloc is now so large and diverse that it may be difficult to reach consensus on important issues. Another challenge is that some of the new members have poor human rights records. This could damage the reputation of BRICS and make it more difficult for the bloc to achieve its goals.

Despite these challenges, BRICS has the potential to be a force for good in the world. The bloc can help to promote economic development, peace, and stability in the developing world. It can also help to challenge the dominance of the West and create a more just and equitable global order.

The future of BRICS is uncertain, but it has the potential to be a major player in the global arena. The bloc will need to overcome its challenges and learn to work together effectively if it is to achieve its full potential.

The 15th BRICS summit will be held in Johannesburg, South Africa on 22-24 August 2023. The theme of the summit is “BRICS and Africa: Partnership for Mutually Accelerated Growth, Sustainable Development and Inclusive Multilateralism”.

The summit will be attended by the leaders of Brazil, Russia, India, China and South Africa, as well as representatives from other BRICS countries and partner nations. The agenda for the summit is expected to include discussions on a range of issues, including:

Business leaders around the world can expect the BRICS summit to have a significant impact on the global economy. The BRICS countries are some of the fastest-growing economies in the world, and they are increasingly playing a leading role in global trade and investment. The summit is likely to provide a platform for the BRICS countries to discuss their shared economic interests and to coordinate their efforts to promote economic growth and development.

In addition to the economic agenda, the BRICS summit is also likely to address a number of other issues that are of interest to business leaders. These include:

The BRICS summit is a major event that will have a significant impact on the global economy. Business leaders around the world should pay close attention to the outcomes of the summit and to the implications for their businesses.

In addition to the economic agenda, the BRICS summit is also likely to discuss the issue of membership expansion. More than 40 countries have expressed interest in joining BRICS, and the summit could provide an opportunity for the BRICS countries to discuss the criteria for membership and to make a decision on whether to expand the group.

The inclusion of new members would strengthen BRICS and make it a more powerful force in the global economy. However, it is important to note that there are also some challenges associated with membership expansion. For example, it would be important to ensure that new members are committed to the BRICS principles and that they are able to contribute to the group’s work.

Overall, the 15th BRICS summit is a major event that will have a significant impact on the global economy. Business leaders around the world should pay close attention to the outcomes of the summit and to the implications for their businesses.

Here are some additional details about the theme of the 2023 BRICS summit and the countries that want to join BRICS:

The BRICS summit is a significant event that has the potential to shape the global economy. Business leaders around the world should pay close attention to the outcomes of the summit and to the implications for their businesses.

The BRICS countries – Brazil, Russia, India, China, and South Africa – are some of the largest and fastest-growing economies in the world. To further boost their economic cooperation, the idea of creating a common currency for these countries has been floated for several years. In this article, we will explore the pros and cons of a BRICS currency for these countries.

Pros of a BRICS currency:

Cons of a BRICS currency:

In conclusion, the idea of a BRICS currency has both potential advantages and drawbacks for the BRICS countries. While it could lead to greater economic cooperation, stability, and growth, it would also require significant political cooperation, structural reforms, and give up monetary independence. Ultimately, the decision of whether or not to adopt a common currency will depend on a careful consideration of the pros and cons, and a willingness to work together towards a common goal.

A business plan for non-BRICS country businesses to protect and grow their business in or with BRICS countries should include the following steps:

By following these steps, non-BRICS country businesses can protect and grow their business in the BRICS countries, taking advantage of the tremendous economic opportunities that these markets offer.

The BRICS countries, which include Brazil, Russia, India, China, and South Africa, are among the largest and fastest-growing economies in the world. As such, they have a diverse range of exports and imports. Here’s a general overview of what each of these countries tend to export and import:

It’s important to note that the exports and imports of each of these countries can be influenced by a range of factors, including domestic and global economic conditions, trade agreements, and government policies. Nevertheless, these countries play an important role in the global economy and their exports and imports are closely watched by businesses and governments around the world.

The West Is Broken Not The Global Economy?

BRICS Business Risk Review Magazine Live

BusinessRiskTV Risk Jobs Search and Recruitment

What is it about your business culture or reputation that should attract more job applications? How do you engage with your employees and fulfil their career progression aspirations? How well do you communicate with your existing employees and with those whom you wish to attract to your business? What opportunities are there for your employees to learn and develop their skills whilst improving your business development?

Have you overlooked the potential of your existing employees to fill your own skills gaps? Could you adjust your job descriptions to attract people who have the potential to grow into roll you need to fill? What could your business do in the short-term to manage what may be a short-term problem?

Many businesses under value the talent they have in their business already. The cost of replacing existing talent can include a higher salary to attract staff who leave, lost business waiting to fill job vacancies and the dissatisfaction of the employees left within the business.

The fuller engagement of employees in the journey of the business can pay dividends in terms of staff retention and avoidance of service quality issues.

Upskilling your workforce is essential for retaining and attracting new talent.

BusinessRiskTV

You may need to change your approach if resourcing is causing business development problems. The cause of your skills gap maybe your own doing or maybe a marketplace issue. Either way your skills gap will need to be addressed if it is to stop impeding your business progress. What is your plan to fill your skills gap?

Strategies for managing employee shortages

What should a business do during a recession?

Many very large businesses have already announced profit warnings. others have stopped recruiting. Central banks are stopping the release of cheap money into the economy. we have said for sometime now, that a global recession is coming to your business. have you prepared your business? What are you waiting for?

Rising unemployment is a common painful fact of a recession. With the current shortage of skills and high employment levels, many are burying their head in the sand about the economic factors which will bring about a global recession within the next 12 to 18 months. Too busy with other problems to think that far ahead, I hear you say? an understandable retort when business resources are limited. however, if you only invest your time and money in fighting current fires, you will always be reactive fighting current fires. taking some time to be more proactive, will enable you to breathe more easily and fight fewer fires.

How can your business prepare for and weather the coming global recession storm:

Will your business survive and thrive during a recession, perhaps a longer depression?

Do you think keeping what you’ve got is the only business strategy to survive a long recession? Could you grow your way out of a recession:

Some businesses and business owners will get rich during the coming global recession. Your business will be affected by the recession, but it doesn’t need to be all bad or fatal.

Managing debt down will be a crucial part of survival. That does not mean stopping spending. It means taking care to spend your money on the right things during a recession.

You need to look again at your decision-making. What are your priorities in a recession, compared to normal business environment?

Laying off workers may be a lazy business strategy. it is an easy obvious way to cut costs but it may mean that you are cutting your own business throat.

What is your business really good at? How can you do more of it? controlling cash flow and unnecessary spending is important, but that does not mean cutting investment in your business future.

Just because a business is big does not mean it will survive, nor does it mean that small businesses will suffer the most during a recession. Some of the biggest businesses that look amazing may have underlying issues that will sink them. small businesses who react quickly may be able to pick up the pieces.

The more resilient a business is, the more likely it will be to survive the multitude of risks facing businesses in the current business climate. As a business leader you may not have control over all risk events which occur in the global economy, but you can be prepared for every eventuality.

Recessions affect different businesses differently. Do you understand what could sink your business? Are your risk control measures working? Have you put in place appropriate risk control measures for impending imminent future risks that may develop. is your business prepared?

How to overcome an economic crisis after COVID-19

Products in demand during a recession

Businesses affected during a recession

When will the economic downturn happen

How to overcome economic problems thrown up by a recession

Causes and effects of a recession in the UK

Effects of a recession on families and businesses in the UK

How does our country get out of a recession

How can a business survive during a recession

Work with us to manage business risks better

Improve risk management with BusinessRiskTV.

How can business leaders increase their risk management knowledge and business intelligence to improve business decision-making?

The challenge is to know which risks to take.

BusinessRiskTV will help you make better business decisions.

Follow us on your preferred social media account or join the best business risk management forum for your country or industry.

Grow your business faster with less uncertainty impacting on your business objectives.

Increase your control over current and future business risks by acting proactively on the key risks to your business:

Ensure you are using your limited resources cost-effectively.

Some business risks are worth taking. Others are not. Prepare for and manage key risks to your business. Develop the best strategy when taking risks to ensure net positive impact on your business objectives.

Business innovation and new business ideas are linked to risk taking. Take calculated risks to grow your business faster.

Develop a systematic way to assess the risks to your future business success. Not all the opportunities for business growth are equal. Pick the best ones for your business with tips advice and support from BusinessRiskTV.

With limited resources including time and money, prioritising the deployment of resources in best way is most important aspect of effective risk management.

Buying insurance is not the panacea. An insurance portfolio brings its own risk to your business.

Well worded contractual agreements and legal risk management can limit liability and wasted money.

Undertaking good supplier risk management and customer management can also stop risk events or mitigate impact on your business.

Controlling the risks from business expansion can also boost returns on increased sales or revenue.

Many risks with the potential to impact on your business are beyond your control. This is simply another good reason to control the risks within your power to control.

In a dynamic business environment it is important you fully understand your risk exposure so you can pivot and respond to change or risk events.

Keep up to date with changing business marketplace for your country or industry.

How do you manage risks better

Work with us to grow your business faster with less uncertainty

Your business can get advice, help and knowledge or business intelligence to solve most problems. Do you ask others for help to improve your business? Entrepreneurs and business leaders are usually ambitious, independent, and optimistic—and often don’t like asking for help. However, an opportunity to quickly and practically explore potential business solutions can save you time and money.

Few people, if any, have all the best answers to common questions that need answering in a practical pragmatic way. If one solution doesn’t work for you, come back for ideas to inspire you to solve your business problem in a different way. Be positive. By finding out what doesn’t work for your business you are one step closer to finding out what will work.

If you come up against a hurdle to your business success, jump over with the help and support of BusinessRiskTV.

Perhaps encouragingly, because if asked people tend to want to help. If you don’t find the complete business solution to your business problem, you may find one piece of the jigsaw that is a catalyst to inspire you to complete the rest by yourself.

There are a number of ways. Some are free to BusinessRiskTV subscribers. Others are only for our members.

Our service creates many opportunities for you to protect and grow your business faster with less uncertainty holding you back.

We don’t have to work in isolation. You can get help and support for your business from BusinessRiskTV membership. In addition, we facilitate collaboration with other business leaders near you and globally, so you have opportunities to ask other like-minded business leaders how they have already overcome your business hurdles. If you ask politely, respecting their need to solve their own business problems, you will find they can offer insight into how you can improve your business, from their experience of managing their business risks.

A balanced business risk management strategy should not just look to stop bad things happening to your business. Your business risk management strategy should explore the best business growth opportunities to help you figure out how to expand your sales profitably faster.

We offer a range of opportunities to members to enable them to explore business growth when they want to.

The best way forward for your business may not be too complicated with a different look at your problem. Sometimes a different perspective of your problem from fresh eyes can unplug the blockage to your business successfully achieving your business objectives.

Talking online to like-minded people can be enormously rewarding. Even if your talking more to other business leaders does nothing more than confirm your own thoughts for best business solutions for your business, it is worth investing in talking more.

Are you making the most of tour investment in your current business relationships? Maybe by inviting them into our circle of like-minded business people you can help your existing business relationships produce more for mutual benefit. For example, our business risk management tools can help you and your existing business relationships identify new business development opportunities for mutual business growth.

We are sure you are ambitious for yourself and your business. Ask others for help, and broaden your network to get it. Seeking advice support and tips from new mentors, peers, partners, suppliers and even new customers can help you to help yourself and them. Examples include but not limited to:

A little more trust and transparency can be derived from better communication. We aspire to improving business risk management communication between all stakeholders in a business including the above stakeholders.

Find new innovative ways of doing business with BusinessRiskTV.

Find out more. Contact us now.

Mention code #Club

Sign up for free alerts to latest business news, risk analysis and business risk reviews to inform your business decision-making.

Get help and support for your business

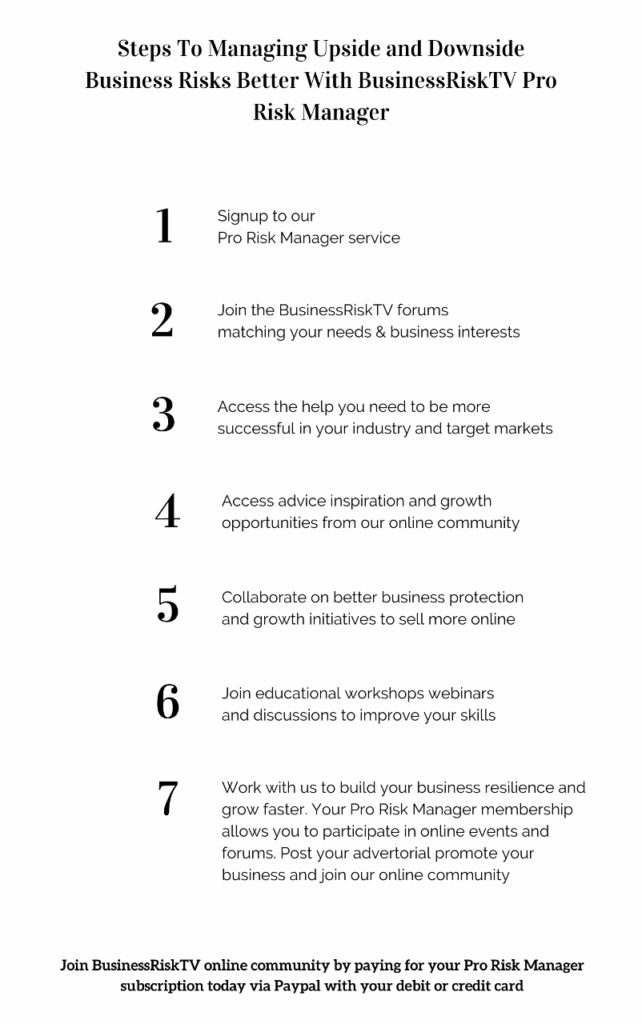

Increase your chances of success with BusinessRiskTV Risk Management Experts Webcasts

BusinessRiskTV regularly hosts free risk management webcasts run by risk expert trainers for your country or industry. The risk management webcasts are free to attend from any device you normally use to access key business risk information and business intelligence. Develop your risk knowledge and business risk management skills.

Develop your risk knowledge, business intelligence and business risk management skills with Pro Risk Manager service. Our Pro Risk Manager Service will help you explore the evolution of holistic enterprise-wide risk management in response to the ever-developing world of risks.

Enterprise-wide risk management educational risk management webinars and risk management workshops designed to explore common challenges business leaders face every day. Solve corporate governance, business risks and compliance (GRC) issues quicker and cheaper with help from our Business Experts Hub participating in online risk management webcasts.

Risk Management Experts Webcasts BusinessRisk Business Experts Hub

Manage your business performance better with BusinessRiskTV

What is risk diversification? Diversification is for idiots explored. What are the dangers of over diversification in business? Concentration of effort on key risks builds better business protection and can grow a business faster with less uncertainty. Diversification is not good or bad – horses for courses! There are benefits of diversification, but not at expense of liquifying your business success.

If you do not know how to manage business risks you need to diversify your risk management strategy more to protect your business from your incompetence.

Of course you should hedge your bets in business decision making if you do not know what you are doing! Do you know your key business threats and opportunity’s ? Are you sure you know? If so go ahead full steam. If you do not know then maybe you should understand your business risks better before managing your business risks to maximise your business performance?

If you know how to analysis your business risks and truly value your business assets, then maybe you should invest most of your time and money in what you know rather than uncertainty! If you want your business to perform averagely maybe you should spread your risk decisions, or alternatively, if you want maximum performance from your existing resources you should focus on what’s best for your business? Spread your business investment wider if you feel more comfortable with that but do that knowing you do not truly understand your key business risks.

Risk Diversification Is A Protection Against Ignorance

Helping businesses to innovate to grow faster

Building wealth innovation stability and opportunities for people in business.

Make the leap! Expand your business thinking. Deliver a successful innovation strategy for your business in with BusinessRiskTV.com. Grow your profits through better products or services innovation and better external communication.

We support businesses innovate by our business experts, business intelligence and innovative business development tools.

Create more value for your customers, your employees and yourself. Harness what is already good in your business and let us help you take your business to the next level!

Reinvent or redesign your corporate strategy to drive faster business growth and generate more business value.

What is innovation strategy for your business in UK

Working to help you succeed in any business environment

Subscribe to BusinessRiskTV for free risk management news alerts, opinions and reviews to inform your key business decisions on survival and business improvement.

The pandemic, the war, the energy crisis, the food crisis and the health crisis will create economic chaos over the next couple of years. That does not mean you might as well shut up shop and go home! When chaos causes other business leaders to fold you need to become even more creative, flexible and dynamic. To prepare for the ensuing economic disaster you need to build on your hard work managing effects of pandemic to cover more issues including continuing supply problems, rising costs and bad debt. You may have thought that now a couple of years after the pandemic started you could start to breath more easily. Unfortunately the economic effects of the pandemic were smoothed out with unprecedented monetary support from global governments. However their magic money tree has died! You are on your own now. Now we will see who really are the good business leaders.

We do not yet know and will never know with certainty, what key risks we will have to deal with in business. This is why we are horizon scanning for you. Our risk management experts are analysing and assessing new risks. We are researching and developing new risk management solutions. Subscribe for free to BusinessRiskTV to keep up to date with potential new threats and opportunities for your business.

Business Risk Watch: Join us to be able to respond as quickly as possible to new or changing business risks.

Enterprise Risk Management Magazine: Read risk management articles and watch videos to discover how other business leaders are managing business risks.

Knowledge Marketplace: Use our Knowledge Marketplace to increase your country risk or industry risk knowledge.

Enterprise-wide risk management workshops: Receive free alerts to upcoming online risk management workshops you can attend from your mobile phone to improve your risk knowledge and discover new business intelligence.

Know Your Risk Profile To Know Your Business Better: Our Risk Profiling Workshops will help you understand your business threats and opportunities better.

The Marketplace: Our marketplace will help you buy sell to achieve your business objectives more easily.

In the midst of economic chaos there will be both opportunities and threats for your business

What type of business valuation are you interested in?