Intelligent Risk-Taking: Friend or Foe of Effective Risk Management?

In the dynamic world of business, calculated risks are the lifeblood of innovation and growth. Yet, a robust risk management (RM) methodology forms the cornerstone of sustainable success. This begs the question: is risk management inherently opposed to intelligent risk-taking, or are there other culprits hindering strategic growth? This article delves into this complex relationship, analysing recent events like BlackRock’s ESG shift and Lloyd’s bank’s RM personnel redundancies to shed light on the true barriers to intelligent risk-taking.

The Balancing Act: RM vs. Growth

A well-defined RM methodology identifies potential threats, assesses their impact, and implements mitigation strategies. This proactive approach safeguards the organisation from unforeseen circumstances. However, overly stringent risk frameworks can stifle innovation. Fear of failure can paralyse decision-making, hindering the exploration of new ventures that may hold significant rewards. BlackRock’s recent partial withdrawal from rigid ESG (environmental, social, and governance) principles exemplifies this tension. BlackRock CEO Larry Fink acknowledged the need for a balance between ESG considerations and financial returns, suggesting overly restrictive ESG frameworks might inhibit investment opportunities [1].

The Culprits: Risk Owners or Risk Management?

The burden of promoting intelligent risk-taking shouldn’t solely fall on RM professionals. Risk owners – individuals accountable for specific risks – and senior management play a vital role. Risk owners might lack the necessary risk assessment skills, leading to a passive approach towards risk management. Similarly, senior management, preoccupied with short-term goals, may prioritise risk avoidance over calculated risks aligned with long-term strategy.

City A.M.’s report of Lloyd’s bank laying off RM personnel in the UK suggests a potential disconnect between RM practices and business strategy [2]. Here, the issue might lie in inadequate communication or a misalignment of risk appetite with the organisation’s goals. Layoffs may indicate a need for cultural change within the bank, promoting a risk-aware yet growth-oriented mindset.

The Role of Effective Risk Management

Effective RM methodologies are not inherently opposed to intelligent risk-taking. In fact, they can be powerful tools for promoting calculated risks:

- Risk Identification: A comprehensive risk assessment identifies not only threats but also opportunities. Anticipating future trends helps identify potential areas for strategic growth.

- Risk Prioritisation: By prioritising risks based on their likelihood and impact, resources can be strategically allocated. This allows for calculated risk-taking in areas with high potential rewards and lower risks.

- Risk Mitigation Strategies: Developing effective mitigation plans minimises the downsides of pursuing strategic risks. This allows for bolder exploration while safeguarding core business operations.

- Risk Appetite Definition: Setting clear risk tolerance levels empowers employees to make informed decisions within acceptable boundaries. This fosters a culture of calculated risk-taking while ensuring sound judgment.

- Continuous Monitoring and Review: Regularly reviewing risks and RM strategies ensures adaptability. This allows for course correction and promotes taking advantage of favourable market conditions.

BlackRock’s ESG shift offers a valuable lesson: overly restrictive RM frameworks can stifle growth. Conversely, Lloyd’s bank’s layoffs suggest potential misalignment between risk management and business strategy.

Here are 9 ways to ensure a holistic RM methodology supports business strategy and goals:

- Integrate RM into Business Strategy: Embed RM principles at all organisational levels, ensuring alignment with strategic objectives.

- Foster a Risk-Aware Culture: Encourage open communication about risk at all levels, promoting a culture of calculated risk-taking.

- Empower Risk Owners: Equip risk owners with the necessary skills to effectively assess and manage risks.

- Define Clear Risk Appetite: Set clear risk tolerance levels to provide a framework for informed decision-making.

- Prioritise Risk Management: Allocate adequate resources to ensure a robust and adaptable RM programme.

- Promote Communication: Foster open dialogue between risk owners, RM professionals, and senior management.

- Invest in Risk Management Tools: Utilise data-driven risk assessment tools to support informed decision-making.

- Regular Review and Updates: Regularly review risk assessments and RM processes to ensure continuous improvement.

- Celebrate Calculated Risk-Taking: Acknowledge and reward successful ventures that embrace calculated risks.

By adopting these strategies, organisations can cultivate a balance between risk management and intelligent risk-taking, driving innovation and sustainable growth. Remember, effective risk management isn’t about eliminating risk entirely; it’s about embracing calculated risks for a prosperous future.

References:

- (1) BlackRock’s recent withdrawal from ESG principles can be referenced from news articles or financial publications.

- (2) The Lloyd’s bank layoffs can be referenced from City A.M.’s report:

- Lloyds Bank is cutting jobs in risk management as it sees risk management principles and practices and methodology as being a block to its transformation progress. The group’s chief risk officer Stephen Shelley said in a memo last month that it was “resetting our approach to risk and controls” following an internal review. Shelley noted that two-thirds of Lloyds’ executives thought risk management was impeding progress, while less than half of its workforce believed “intelligent risk-taking” was encouraged. He said Lloyds’ “initial focus is on non-financial risks” and a new model would allow it to “move at greater pace” on its group strategy. “We know people are frustrated by time-consuming processes and ingrained ways of working that impede our ability to be competitive and leave us lagging behind our peers,” Shelley added. The Financial Times first reported the news. A person familiar with the matter told City A.M. that the restructuring would see around 175 permanent roles at risk of redundancy, including 153 in the risk unit. However, the person added that the lender expected to create 130 vacancies focused on specialist risk and technical expertise. Some 3,600 people currently work in Lloyds’ risk division. Will loosening its risk controls “could potentially have catastrophic consequences for the future of the bank”. In this case, there are around 45 role reductions, after new roles being created are factored in.” Lloyds, which has around 60,000 total employees, launched a plan in February 2022 to invest £4bn over the next five years to diversify away from interest rate-sensitive income streams like mortgages and become a “digital leader”.

- Are risk management principles practices and methodology a block to corporate progression?

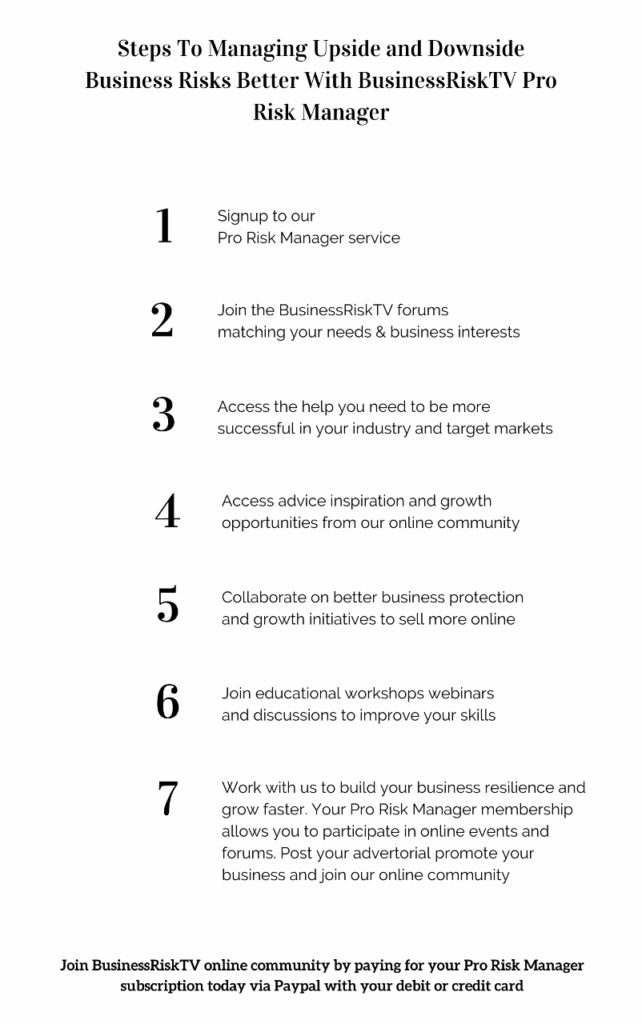

Get help to protect and grow your business

Subscribe for free business risk alerts and risk reviews

Read more business risk management articles