BusinessRiskTV – Navigating Uncertainty, Securing Opportunity

In a world where geopolitical sparks ignite monetary policy infernos, business leaders and investors need a clear lens. BusinessRiskTV provides the critical risk management insights and analysis you need to protect your enterprise and personal wealth. We help you spot the threats and seize the competitive advantage in volatile markets. For the latest economic forecasts and risk mitigation strategies, subscribe to BusinessRiskTV today.

—

Global Money Printing To Begin Again and Its Potential Effect On Cryptocurrency Gold and Treasury Bonds and Gilts Valuations

As global leaders respond to the escalating conflict in the Middle East, the phrase “money printing” is back in the spotlight. For business leaders and investors, understanding the ripple effects of renewed Quantitative Easing (QE) on assets like Cryptocurrency, Gold, and Treasury Bonds and Gilts is not just smart—it’s essential for survival in March 2026.

Will Global Money Printing Really Begin Again in 2026?

Yes, the stage is set for a new era of “gradual money printing,” driven by the need to finance massive fiscal deficits and escalating military engagements. According to macro strategist Lyn Alden, we are in the late stage of a long-term debt cycle where central banks coordinate with fiscal authorities to expand the money supply, achieving “soft deleveraging” through inflation . The potential for a prolonged US-Iran conflict is a primary catalyst, historically forcing the Federal Reserve to lower rates or engage in Quantitative Easing (QE) to cover the immense costs of war .

What Is The Potential Effect On Cryptocurrency Valuations?

Renewed global liquidity injections are likely to act as a supercharger for cryptocurrency valuations, reinforcing its status as a hyper-sensitive hedge against fiat devaluation. Data shows that since 2016, weekly changes in Global Liquidity correlate most strongly with crypto returns, outpacing even gold and silver . BitMEX co-founder Arthur Hayes argues that “the longer [the US] engages in the extremely costly activity of Iranian nation-building, the higher the likelihood that the Fed lowers the price and increases the quantity of money,” a scenario he believes will drive Bitcoin prices higher . Essentially, Cryptocurrency is trading as a “systematic barometer” of global liquidity .

How Will Gold Perform As A Safe Haven During Renewed QE?

Gold is expected to outperform as a premier safe-haven asset, driven by central bank diversification and its historical role as a neutral reserve asset during geopolitical crises. Unlike previous cycles, this gold strength is structural, not just speculative. Central banks are increasing gold allocations to reduce reliance on US Dollar-denominated assets following geopolitical frictions and asset-freezing incidents . History reinforces this: during World War I and II, governments printed money aggressively, weakening currencies and strengthening the case for gold as a store of value . With Gold recently nearing all-time highs, it remains a critical hedge against the uncertainty in the marketplace .

What Is The Outlook For Treasury Bonds And Gilts In An Inflationary War Economy?

Treasury Bonds and Gilts face a challenging environment, caught between their traditional safe-haven status and the inflationary pressures of war financing and money printing. While investors may initially flock to government debt for safety, the long-term outlook is complicated by “financial repression”—where interest rates are held below inflation to erode the real value of the debt . The need to finance a potential US$500 billion defence spend, alongside strong GDP growth, could drain liquidity from bond markets as money shifts to the “real” economy . This suggests that while Treasury Bonds and Gilts offer stability, their real returns may be undermined by the very policies designed to support them.

—

12 Ways To Choose The Best Investment For Your Business And Personal Wealth In Light Of The War In Middle East In March 2026

Given the complex interplay of war, monetary policy, and market psychology, here are 12 actionable strategies to protect and grow your capital.

- Prioritise a “Three-Pillar” Portfolio Structure: Diversify across high-quality global equities, hard assets (gold, Bitcoin, energy infrastructure), and liquid cash to navigate volatility and capture growth in different scenarios .

- Treat Gold as a Core Strategic Hedge: Increase allocation to gold not as a short-term trade, but as a long-term insurance policy against currency debasement and a multipolar monetary system shift .

- Use Crypto for Asymmetric Liquidity Exposure: View Bitcoin and major cryptocurrencies as high-beta plays on global liquidity. Buy on dips, as they offer immense upside if money printing accelerates, but be prepared for 20-25% corrections below trend .

- Be Cautious of Long-Dated Government Bonds: With yields potentially suppressed by central bank policy but inflation risks rising, the risk/reward for long-dated Treasury Bonds and Gilts is unattractive. Focus on short-duration, high-quality fixed income for stability .

- Look for Opportunities in Energy and Industrials: Shift equity exposure from pure-play tech growth towards sectors that benefit from rising fiscal spending and commodity prices, such as energy infrastructure, industrials, and utilities .

- Build a Cash Reserve for Volatility: “Cash and liquidity” is a strategic asset. It allows you to deploy capital during inevitable market pullbacks triggered by the Middle East war headlines .

- Avoid Snap Decisions Based on Geopolitical Headlines: History shows that making rash decisions to de-risk portfolios during conflicts is rarely profitable. Maintain a long-term focus and use volatility to rebalance .

- Consider Commodities for Diversification: With the Strait of Hormuz tensions affecting 20% of global energy needs, broad commodities (including metals and energy) offer a hedge against supply shocks and inflation .

- Separate Business Capital from Personal Wealth: Protect your personal wealth from operational business risks. Personal capital should be allowed to compound in a diversified portfolio, separate from company liquidity needs .

- Gain Exposure to Global, Not Just US, Markets: A modest allocation to developed markets and emerging economies like India can help manage currency and concentration risks tied to any single nation’s fiscal path .

- Re-evaluate the “Bitcoin Halving” Cycle: Focus less on the four-year halving cycle and more on the 5-6 year Global Liquidity cycle, which appears to be a stronger driver of demand in 2026 .

- Seek Active Management for Commodities: Given the fast-moving nature of the Middle East conflict and intra-commodity volatility, actively managed strategies can better navigate these shifts than passive buy-and-hold approaches .

“Governments don’t control growth or rates; markets do. But governments can print money. This ‘monetary inflation’ is the government’s antidote to economic ailments.” – Michael Howell, Crossborder Capital .

“Trust matters more than size — and gold continues to be one of the strongest symbols of that trust.” – Anupama Jha, Zee News .

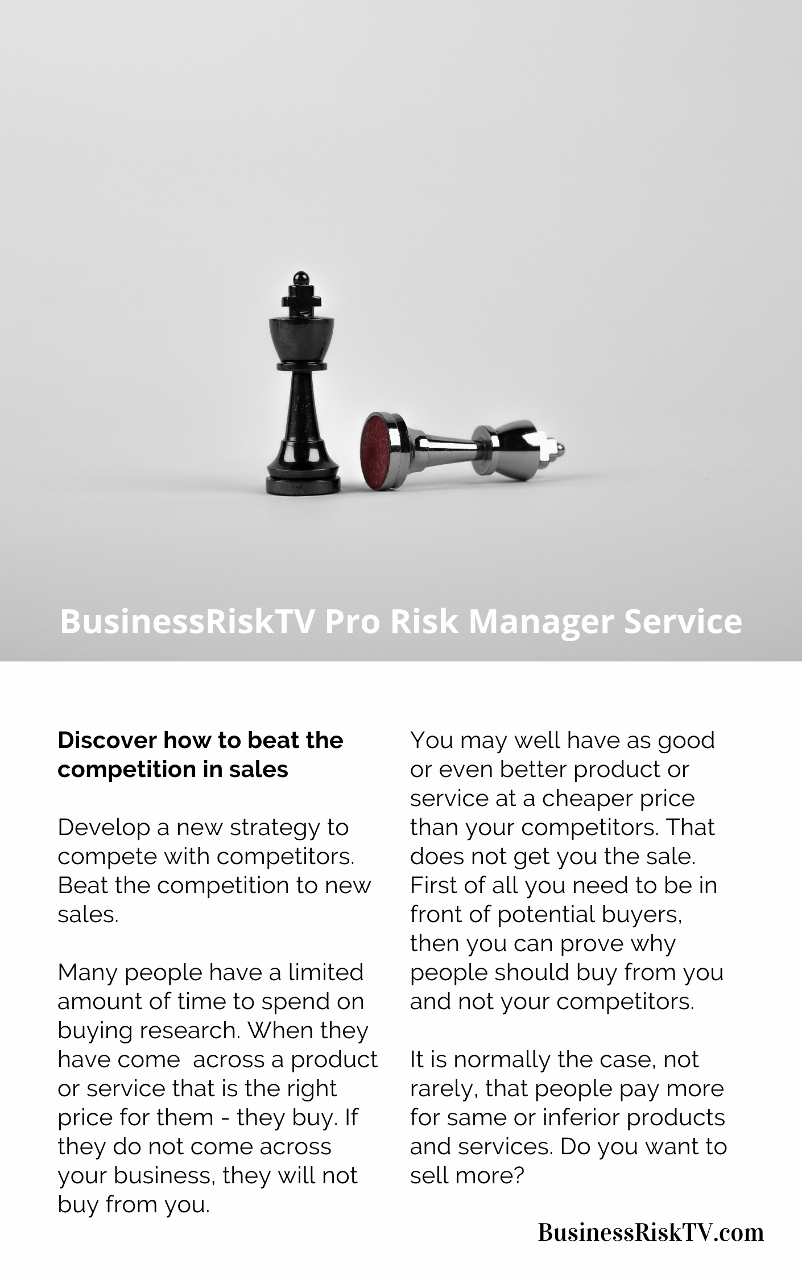

Why BusinessRiskTV?

BusinessRiskTV is your trusted network for business risk management insights . We deliver practical assessments to help you build resilience and spot opportunities, giving you the competitive advantage in uncertain times .

3 Facts to Back Up This Risk Analysis

- Liquidity Leads Crypto: Data from Crossborder Capital shows that weekly changes in Global Liquidity correlate strongly with asset returns, with cryptocurrency topping the list for sensitivity, outpacing even gold .

- Central Bank Gold Demand: Lyn Alden notes that central bank demand for gold is structurally higher due to geopolitical frictions, as nations seek neutral reserve assets amidst asset-freezing incidents

- Historical War-Time Printing: History confirms that major conflicts, like WWI and WWII, force governments to print money aggressively to fund military spending, leading to long-term currency pressure and inflation—a pattern repeating now.

Get help to protect and grow your business and personal wealth through wars

Find out more about growing and protecting business and personal wealth

Subscribe for free business risk management ideas risk reviews and cost of living reduction

Connect with us for free business risk management tips

Printing Presses Are Whirring Again. Are You Protected?

Printing Presses Are Whirring Again. Are You Protected?

Stop scrolling. The Fed is about to print trillions to fund a war. If you’re still sitting in cash or long-term bonds, you’re not being safe—you’re silently going bankrupt. Here is what is happening to Gold, Bitcoin, and your purchasing power RIGHT NOW.

Most investors are looking at the Middle East conflict and seeing destruction. Smart money is looking at the central bank response and seeing the biggest liquidity injection since COVID. One group is going to panic. The other is going to get rich. Which one will you be?

- The Catalyst: As the Iran conflict escalates, history (1985, 2001, 2020) shows the playbook: War Costs → Fed Prints → Dollar Drops. Arthur Hayes calls this an “organic connection between war, monetary policy, and crypto” .

- The Liquidity Map: Data from Crossborder Capital proves that Global Liquidity leads asset prices. Since 2016, crypto has been the most sensitive asset class to this trend—more than gold .

- The Trap: Bonds are not the safe haven you think. With the US economy booming at 5.4% GDP and defence spending soaring, money is flowing OUT of financial markets and INTO the real economy. This creates a zero-sum game for liquidity .

- The Opportunity: Lyn Alden suggests a simple fix: the “Three Pillars.” 1) High-quality global stocks. 2) Hard assets (Gold, Bitcoin, Energy). 3) Liquid cash to deploy when the volatility hits .

We built the full roadmap for navigating the March 2026 liquidity shift. It covers the 12 ways to protect your business and personal wealth from the war premium.

👉 Comment “PRINT” below or link to the full article on BusinessRiskTV.

👉 Or click the link in our bio to read it now. Your future purchasing power depends on the move you make today.

Global Money Printing 2026: Effect on Crypto, Gold, and Bonds Amid Middle East War

#GlobalMoneyPrinting #SafeHavenAssets #BusinessRiskTV #RiskManagement #MiddleEast2026

Read more business risk management articles and view videos for free

Connect with us for free alerts to new business risk management articles and videos

Global Money Printing 2026: Effect on Crypto, Gold, and Bonds Amid Middle East War