In Hidden History: The Secret Origins of the First World War, Gerry Docherty and Jim Macgregor argue that WWI wasn’t a series of diplomatic blunders, but a calculated destruction of Germany orchestrated by a secret “Elite” in London.

From a Business Risk Management (BRM) perspective, this narrative serves as a masterclass in identifying “Black Swan” events that are actually “Grey Rhinos”—highly probable, high-impact threats that are often ignored until it’s too late.

Business Risk Analysis: The “Hidden History” Lens

If we treat the geopolitical landscape of 1914 as a market, the book highlights several critical risk categories:

-

Systemic Corruption & Collusion: The authors suggest that a small group (the “Secret Elite”) manipulated national policy for long-term strategic gain. For a business, this represents Counterparty Risk—the danger that the “rules of the game” are being written by competitors or regulators behind closed doors.

-

Information Asymmetry: The book claims the public was fed a narrative of “Belgian neutrality” to mask deeper agendas. In business, relying on mainstream data or “consensus” can lead to a failure in Strategic Forecasting.

-

Geopolitical Contagion: The transition from a localised Balkan conflict to a global catastrophe illustrates how quickly Supply Chain Disruption and Market Volatility can scale when hidden alliances are triggered.

6 Reasons Why History Could Repeat Itself Soon

Current global dynamics mirror the pre-1914 era in several unsettling ways:

-

Thucydides’ Trap: Just as the British Empire feared a rising Germany, the current tension between the U.S. and China creates a structural risk where a dominant power feels forced to suppress a challenger.

-

Echo Chambers & Propaganda: The “Secret Elite” used the press to whip up anti-German sentiment. Today, AI-driven algorithms and social media echo chambers can radicalise populations and manufacture consent for conflict faster than ever.

-

Complex Alliance Webs: Much like the secret treaties of 1914, modern mutual defence pacts and “informal” military partnerships mean a spark in a small region (like the South China Sea or Eastern Europe) could force a global decoupling.

-

Resource Scarcity & Energy Shifts: The 1914 era was about the shift from coal to oil and control of the Berlin-Baghdad railway. Today, the race for rare earth minerals and semiconductor dominance creates similar “must-win” flashpoints.

-

Economic Financialisation: The book argues high-finance interests drove the war. Today’s global economy is heavily leveraged; a massive debt crisis could tempt leaders to use “war footing” as a distraction or a way to reset the financial system.

-

Technological Arrogance: In 1914, leaders believed the war would be “over by Christmas” due to superior tech. Today, the belief that Cyber Warfare or Precision Strikes will lead to “short, clean” conflicts often ignores the reality of unpredictable escalation.

How Business Leaders Can Protect Their Interests

To avoid being collateral damage in a “Hidden History” style escalation, leaders should move from reactive to proactive resilience:

-

Geographical Decentralisation: Stop relying on a single region (e.g., China or Eastern Europe) for manufacturing. Implement a “China + 1” or “Friend-shoring” strategy to ensure the business survives if a specific border closes.

-

Scenario Planning (Beyond the Probable): Don’t just plan for a 5% inflation hike; plan for “Total Market Decoupling.” Run war-game exercises where your primary market becomes inaccessible overnight.

-

Vertical Integration of Essentials: If your business depends on a specific raw material, seek to own the source or secure 10-year physical contracts. Relying on the “Just-in-Time” spot market is a death sentence during a geopolitical pivot.

-

Cyber & Narrative Resilience: Protect your brand from being “weaponised.” Ensure your internal communications and data security are robust enough to withstand state-sponsored disinformation or infrastructure attacks.

-

Maintain “Swiss-Style” Neutrality: Where possible, diversify your board and your investments across different geopolitical blocs. Being too “nationalised” in your operations makes you an easy target for sanctions or expropriation.

The Lesson: History suggests that the greatest risks aren’t the ones we see on the news, but the ones being discussed in private rooms by those who benefit from the chaos.

Executive Scenario Planning Template Example

Focus: Geopolitical Resilience & Strategic Redundancy

This template is designed to help executive teams move past “business as usual” and confront the non-linear risks highlighted by Docherty and Macgregor. It focuses on the “Hidden History” premise: that the biggest threats are often pre-planned or systemic, rather than accidental.

1. The “Hidden Ally” Audit

In 1914, secret agreements forced nations into a war they hadn’t publicly debated. Businesses often have similar “hidden” dependencies.

-

Mapping Dependencies: List your Top 5 critical vendors. Do they share a single point of failure (e.g., all rely on the same shipping lane, the same energy grid, or the same political regime)?

-

The “What If” Trigger: If Country X imposes an immediate export ban on a key component tomorrow, how many days can your operations survive?

-

Action: Identify one “Non-Aligned” alternative supplier for every critical dependency.

2. Narrative & Information Risk Analysis

The “Secret Elite” used media to shape public perception. In a modern crisis, your brand could be caught in the crossfire of state-sponsored disinformation.

-

Vulnerability Assessment: Is your brand heavily tied to a specific national identity? How would your customers in “Region B” react if your home country (Region A) entered a conflict?

-

Communication Protocol: Do you have a “Dark Site” or a crisis communication plan ready if your primary digital channels are hit by a regional internet blackout or a state-level cyberattack?

3. Scenario Matrix: Four Degrees of Disruption

Use this table to evaluate your readiness for different levels of escalation:

| Disruption Level | Scenario Example | Business Impact | Mitigation Priority |

| Level 1: Friction | Increased tariffs / Trade war | Margin compression | Pricing agility & tax optimization |

| Level 2: Segregation | Sanctions / Regional internet split | Loss of specific market access | Ring-fencing regional assets |

| Level 3: Hard Decoupling | Complete trade embargoes | Supply chain collapse | Localization of manufacturing |

| Level 4: Kinetic Conflict | Global War / Infrastructure hit | Total operational halt | Physical security & cash liquidity |

4. Financial “War Chest” Strategy

The book argues that those with liquid assets and prior knowledge thrived during the transition to war.

-

Liquidity Stress Test: In a scenario where credit markets freeze (similar to 1914 or 2008), do you have enough non-digital or highly liquid reserves to cover 6 months of payroll?

-

Currency Diversification: Are your cash reserves held in a single currency? Consider a “Geopolitical Basket” (e.g., USD, CHF, Gold, or decentralised assets) to hedge against a systemic collapse of one fiat system.

Next Steps for the Leadership Team:

-

Assign a “Red Team”: Appoint three team members to play “Devil’s Advocate” for every major strategic expansion. Their job is to find the “Hidden History” reason why the expansion will fail.

-

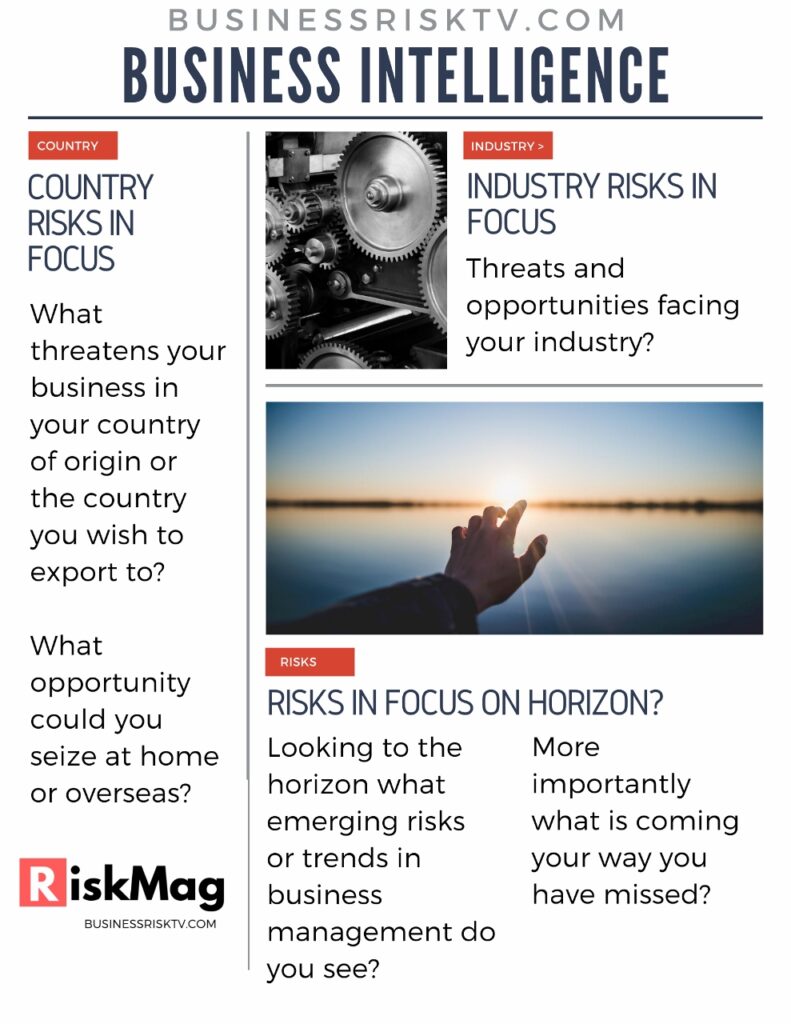

Quarterly Geopolitical Brief: Move beyond standard economic reports. Look at defence spending trends and undersea cable/satellite investments to see where the “Secret Elites” of today are placing their bets.

To keep this lean and focused, here is a “Red Team” questionnaire designed to puncture optimism bias and reveal the hidden systemic risks in your 5-year plan.

These questions are framed to uncover the “Secret Elite” style risks—those factors that aren’t on a standard balance sheet but can sink a company during a geopolitical shift.

Phase 1: The Dependency & “Invisible Hand” Test

-

The Single-Point-of-Failure Audit: If a “black swan” event permanently closed the borders of your primary manufacturing or service hub tomorrow, does the business have a “Plan B” that doesn’t rely on that same geographic region?

-

The Shadow Influence Check: Are our key strategic partners or investors also heavily invested in our direct competitors or in nations with conflicting interests? Who benefits if our current 5-year plan fails?

-

The Subsidy/Regulation Trap: Is our projected growth dependent on current government subsidies or “friendly” regulations? If a political shift occurred and those were stripped away to fund a “war footing” economy, is the project still viable?

Phase 2: Information & Infrastructure Resilience

-

The Narrative Pivot: If our brand becomes politically “toxic” in a major market due to circumstances entirely outside our control (e.g., a national conflict), can we “ring-fence” that region and continue operating elsewhere, or is our identity too centralised?

-

The Analog Fail-Safe: If a sophisticated cyber-offensive took down the primary cloud service providers we use for 30 days, do we have any “manual” or localised way to fulfill orders or maintain core operations?

-

The “Secret” Intelligence Gap: Are we making decisions based on “consensus data” (mainstream media/economic reports) that everyone else sees, or do we have “boots on the ground” insights into the physical movement of goods and local political sentiment?

Phase 3: Financial & Strategic Exit Ramps

-

The Liquidity Lock: If the global banking system experienced a “bank holiday” or a freeze on international transfers (similar to the start of WWI), do we have the local currency or physical assets to keep our global staff paid for 90 days?

-

The Sunk Cost Trap: At what specific “tripwire” (e.g., a specific sanction or a specific percentage of inflation) do we agree to abandon a major project rather than “doubling down” out of pride or previous investment?

-

The Leadership Vacuum: If our executive team were unable to communicate for 72 hours due to a total communications blackout, does the next layer of management have the clear authority and “commander’s intent” to make high-stakes decisions?

How to use this:

Distribute these questions to your leadership team. Have each member answer them anonymously first. You will often find that your “boots on the ground” staff (Ops, Supply Chain) see the “Hidden History” risks much more clearly than the C-suite.

#BusinessRisk #GeopoliticalRisk #HiddenHistoryWW1 #BusinessRiskTV #RiskManagement

Get help to protect and grow your business faster through any business environment you have to operate within

Learn more about growing your business through uncertain world

Subscribe for free business risk management ideas risk reviews and cost reduction tips

Connect with us for free business risk management tips

Read more business risk management articles and view videos for free

Connect with us for free alerts to new business risk management articles and videos

Hidden History & Business Risk: Is Your Strategy Prepared for a 1914-Style Global Reset?