The opening months of 2026 have confirmed a pivotal shift in the global economic landscape. The United States is experiencing a confluence of fiscal catalysts that are pumping hundreds of billions of dollars into the economy, with the potential to unlock trillions more in the near future. For business leaders around the world, this “Trillion-Dollar Tsunami” of liquidity presents a dual-edged sword: a massive opportunity for growth and a significant risk for those caught off guard.

This risk analysis on BusinessRiskTV.com examines the composition of this capital wave, explains why it is critical for non-US and US-based leaders to act now, identifies who will benefit most, and provides a strategic timeline for when these effects will materialise.

The Anatomy of the Stimulus: What Does the Money Consist Of?

To manage the risk and reward, we must first dissect the capital flows. The current injection is not a single stimulus check, but a multi-layered financial event rooted in tax policy and corporate finance.

1. The Personal Tax Refund Windfall ($220 Billion)

The primary driver of immediate liquidity is the “One Big Beautiful Bill Act” (OBBBA) , passed in July 2025. This legislation made several tax cuts retroactive to the beginning of 2025 . Because the IRS did not adjust withholding tables until 2026, most taxpayers did not see this money in their paychecks last year. Instead, they are receiving it now as a lump-sum refund .

- The Numbers: Wells Fargo estimates the total reduction in household income taxes for 2026 from these new provisions will be roughly $220 billion (0.7% of GDP) . Of this, approximately $80 billion to $100 billion will hit bank accounts specifically as tax refunds between February and April 2026 . The average refund is projected to rise by 18% to roughly $3,750, with some estimates suggesting it could go as high as $3,800.

- The Source: The money comes from new or expanded deductions, including the “no tax on tips,” “no tax on overtime,” an enhanced child tax credit (up to $2,200), and a new $6,000 bonus deduction for seniors .

2. The Corporate Repatriation Trigger (Trillions in Waiting)

While the refunds provide immediate juice, the long-term fuel is corporate repatriation. The permanent extension of the 2017 Tax Cuts and Jobs Act (TCJA) provisions provides “certainty and stability” for corporate tax planning . This certainty is the key that unlocks the estimated $2 trillion to $4 trillion in profits that US multinationals are holding overseas.

With tax rates permanently lower and a territorial tax system solidified, the financial incentive to keep cash abroad diminishes. We are already seeing the mechanics of this in global markets. For example, data from emerging markets shows foreign investors repatriating profits at significantly higher rates (e.g., a 27% YoY increase in outflows from one South Asian market), as global capital flows readjust to the new US tax reality .

Why This Matters Now: Protecting and Growing Your Business Faster

For global business leaders, this US liquidity event creates a volatile landscape of risk and opportunity. Ignoring it means allowing competitors to capture market share using cheaper capital.

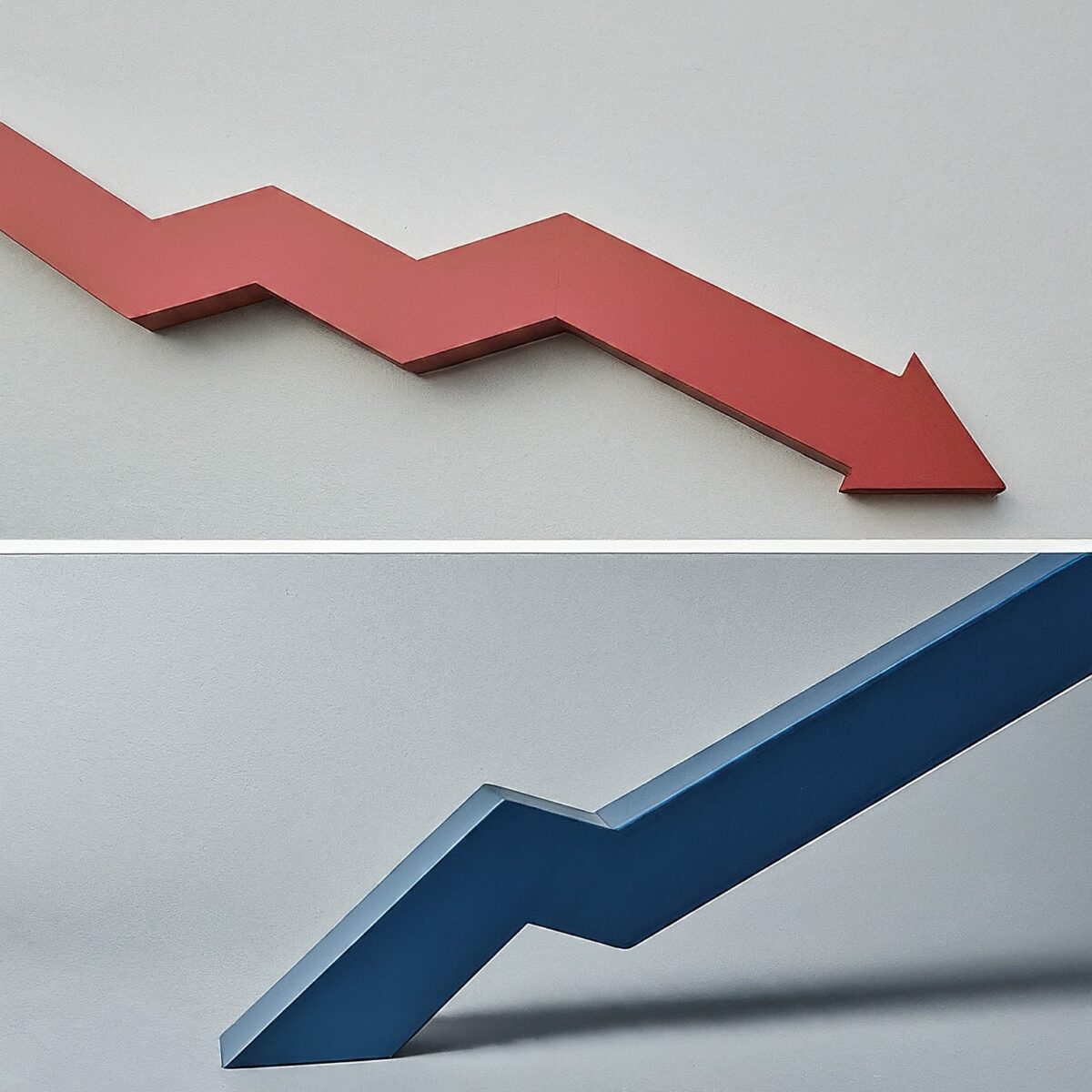

The “K-Shape” Risk: Uneven Distribution of Wealth

Bank of America analysts warn that this stimulus will likely exacerbate the “K-shaped” economy, where the wealthy accelerate while the middle class slows .

- Higher-Income Beneficiaries: Changes to the SALT (State and Local Tax) deduction cap and investment tax breaks disproportionately favour higher earners.

- Lower-Income Lifeline: For lower-income households, tax refunds represent a massive percentage of their annual disposable income. Historically, these households spend this money immediately.

- The Action: Businesses must segment their customer base. Luxury goods and financial services may see a surge in investment activity, while consumer staples and retail must prepare for a spike in volume from lower-income brackets who are “splurging” on deferred “nice-to-have” items .

The Consumption vs. Investment Divide

Approximately half of the new stimulus from higher earners is expected to flow into the stock market rather than the retail economy. This presents a risk for B2C companies expecting a broad-based sales boom, but an opportunity for B2B service providers, M&A advisors, and wealth managers.

Global Capital Drain

For businesses operating outside the US, this is a major risk factor. The “pull” of the US market—fueled by these tax cuts and permanent repatriation allowances—sucks liquidity out of other markets . Non-US firms may face tighter credit conditions at home as domestic investors chase higher yields or safer returns in the US.

Strategic Preparations: What Business Leaders Should Do Now

With the filing season opening on January 26 and refunds flowing immediately, leaders are already in the “execution window” . Here is your risk management checklist.

For CEOs and Strategists:

- Scenario Planning: Model for a “liquidity surge” in H1 2026. Assume that consumer spending will get a 0.3% boost to GDP, which has already been factored into bullish forecasts by major financial institutions.

- Competitive Intelligence: Monitor which competitors now have access to repatriated cash piles. They will likely use this liquidity for aggressive M&A, R&D investment (leveraging new credits), or price wars .

For CFOs and Finance Teams:

- Capital Structure Optimisation: If you are a US multinational, review your cash management strategies. The penalty for keeping cash overseas has diminished. Repatriate strategically to fund share buybacks or reduce debt, but beware of the market timing.

- Supply Chain Financing: The injection of cash into small and medium-sized enterprises (SMEs) via refunds may improve the financial health of key suppliers. Review supplier credit terms to capitalise on their improved liquidity.

For Marketing and Sales Leaders:

- Adjust Withholding Assumptions: The “no tax on tips and overtime” rules will leave specific sectors (hospitality, personal services) with significantly more take-home pay. Target these sectors with tailored messaging immediately.

- Wealth Segmentation: Recognise the “K-shape.” High-end retailers should market to the investor class benefiting from capital gains treatment, while value brands should target the disposable income spike from the expanded Earned Income Tax Credit and Child Tax Credit .

Who Will Benefit Most and When?

Understanding the timing of these benefits is crucial for risk mitigation and resource allocation.

The Immediate Winners (Q1-Q2 2026)

- Tax Preparation & Fintech: Companies like Impress Tax Service and AmeriFile are already seeing a surge as individuals scramble to maximise complex new deductions.

- Discretionary Retail & Travel: Low-to-middle income households historically increase spending on goods, travel, and leisure by nearly 40% in the weeks following receipt of a refund . This wave is hitting now.

- Debt Management: Firms offering debt consolidation services will benefit as lower-income households use refunds to pay down liabilities .

The Medium-Term Winners (H2 2026 – 2027)

- M&A Advisory and Investment Banking: The “certainty” of permanent tax cuts, combined with the repatriation of corporate cash, will fuel deal-making. However, note that new tax rules in some jurisdictions are tightening interest deductions and MAT credits, which will change how deals are structured.

- The “No-Tax” Sectors: Restaurants, barbershops, nail salons, and construction (overtime workers) will see sustained increases in disposable income, benefiting B2B suppliers to these industries.

- Commercial Real Estate: As money flows from refunds into savings and investment, and corporate cash is repatriated, we may see increased activity in commercial real estate and capitol equipment purchasing (aided by Section 179 deductions) .

Conclusion

The “Trillion-Dollar” injection into the US economy is a complex, multi-phased event. For the vigilant business leader, it offers a rare opportunity to capture market share and fund growth. However, the risks of misreading the “K-shaped” distribution or the timing of the spend are high. By preparing now, global leaders can ensure they are positioned to ride the wave rather than be swept away by it.

Get help to protect and grow your business faster with BusinessRiskTV business solutions

Subscribe for free business risk management ideas risk reviews and cost reduction tips

Connect with us for free business risk management tips

Read more business risk management articles and view videos for free

Connect with BusinessRiskTV for free alerts to new business risk management articles and videos

#USEconomy #TaxRefund2026 #BusinessRiskManagement #BusinessRiskTV #RiskManagement

Trillion-Dollar USA Stimulus: Tax Refund & Repatriation Tsunami – A Business Risk Analysis for Global Leaders