The Untapped Goldmine: Why Protecting and Improving Your Reputation is Vital for Business Success

In today’s hyper-connected world, a business’s reputation is no longer a hidden gem; it’s a dazzling billboard flashing brightly in the digital marketplace. Consumers are savvier than ever, armed with instant access to a plethora of information and empowered to share their experiences widely. This means that protecting and improving your reputation is no longer a luxury, but a business imperative.

As a business risk management expert, I’ve witnessed firsthand the devastating impact of a tarnished reputation. A single negative review can snowball into lost customers, plummeting sales, and even legal repercussions. Conversely, a stellar reputation can be a goldmine, attracting and retaining customers, boosting employee morale, and opening doors to new opportunities.

Here’s why prioritising your reputation is the smartest investment you can make:

1. Customer Acquisition and Retention:

-

Trust is the lifeblood of any business. A strong reputation signifies trustworthiness and reliability, making you the preferred choice over competitors in the eyes of potential customers.

-

Positive word-of-mouth is the ultimate marketing tool. Happy customers become brand advocates, singing your praises to their network and driving organic growth.

-

Loyal customers are repeat customers. A positive reputation fosters customer loyalty, leading to consistent business and reducing acquisition costs.

2. Competitive Advantage:

- In a crowded marketplace, reputation sets you apart. A stellar reputation differentiates you from the competition and positions you as a leader in your industry.

- Attract and retain top talent. A strong reputation attracts talented individuals who want to be associated with a respected brand. This translates to a more skilled and engaged workforce.

- Negotiate better deals. Suppliers and partners are more likely to offer favourable terms to businesses with a good reputation, reducing your operational costs.

3. Crisis Resilience:

- Reputations act as a buffer during times of crisis. When faced with challenges, a strong reputation can help mitigate negative publicity and maintain customer trust.

- Faster recovery from setbacks. Customers are more forgiving of mistakes when a business has a proven track record of ethical conduct and customer care.

- Builds brand equity. A positive reputation enhances your brand value, making your business more attractive to potential investors or buyers.

Investing in Reputation Management:

Protecting and improving your reputation is an ongoing process, not a one-time fix. Here are some key strategies:

- Monitor your online presence. Actively track online reviews, social media mentions, and news articles to identify potential issues early on.

- Respond promptly and professionally to negative feedback. Address concerns sincerely and transparently,demonstrating your commitment to customer satisfaction.

- Prioritise customer service. Train your staff to deliver exceptional service at every touchpoint, exceeding customer expectations and creating positive experiences.

- Embrace transparency and ethical conduct. Be open and honest in your communication, and ensure your business practices are aligned with ethical standards.

- Engage with your community. Build relationships with stakeholders, participate in industry events, and support local causes to foster goodwill and positive brand perception.

Remember, your reputation is not owned by you; it’s earned through consistent effort and commitment. By prioritising reputation management, you unlock a treasure trove of benefits that can propel your business towards sustainable success.

Protecting and improving your reputation is not just a risk mitigation strategy; it’s a recipe for growth and prosperity. In today’s competitive landscape, neglecting your reputation is akin to leaving money on the table. So, invest wisely, nurture your good name, and watch your business flourish under the radiant glow of a stellar reputation.

From Fiasco to Phoenix: 3 Businesses that Rose from the Ashes of Reputational Crisis

A tarnished reputation can feel like a death knell for a business. Yet, history is dotted with stories of brands that, through swift action, unwavering transparency, and unwavering commitment to doing the right thing, not only weathered the storm but emerged stronger than ever. Let’s delve into three inspiring examples of businesses that, against all odds, navigated their reputational crises with grace and grit, ultimately earning back the trust and loyalty of their customers.

1. Netflix and the Qwikster Debacle: In 2011, Netflix attempted to split its streaming service from its DVD rental segment under the new brand “Qwikster.” The public backlash was swift and brutal. Customers felt betrayed, the stock price plummeted, and social media erupted with negative sentiment. Netflix took immediate action, acknowledging their misstep, apologising for the confusion, and quickly reversing the decision. Their CEO held a Q&A session directly addressing customer concerns, demonstrating humility and openness. The result? A surge in customer appreciation, a restored stock price, and a valuable lesson in understanding their core audience.

2. Domino’s Pizza and the “Doughgate” Scandal: In 2009, a YouTube video showing two Domino’s employees tampering with food went viral, triggering a PR nightmare. Domino’s could have swept the incident under the rug, but instead, they chose radical transparency. The CEO immediately apologised, fired the employees involved, and launched a “Make the Dough Right” campaign, featuring CEO Patrick Doyle in self-deprecating commercials addressing the issue head-on. This transparency and vulnerability resonated with customers, leading to increased media coverage, improved food safety protocols, and ultimately, a stronger brand image.

3. Johnson & Johnson and the Tylenol Tampering Crisis: In 1982, seven people died after cyanide-laced Tylenol capsules appeared on store shelves. This unprecedented tragedy could have destroyed Johnson & Johnson’s reputation. However, they opted for immediate action and complete transparency. They recalled all Tylenol products, implemented tamper-proof packaging, and cooperated fully with investigators. The CEO addressed the nation directly, expressing empathy and outlining their commitment to safety. This crisis resulted in the Tylenol Murders Act, strengthening tamper-proofing regulations, and solidified Johnson & Johnson’s reputation as a responsible and trustworthy company.

These three cases offer invaluable takeaways for businesses facing reputational crisis:

- Act swiftly and decisively. Acknowledge the problem, apologise if necessary, and take immediate steps to address the issue.

- Embrace transparency and honesty. Hiding from the truth will only fuel the fire. Be open with your customers and stakeholders, communicate clearly,and show how you’re addressing the problem.

- Prioritise customer trust. Remember, it’s your customers who ultimately determine your success. Focus on regaining their trust by demonstrating genuine care and commitment to improvement.

- Turn crisis into opportunity. Learn from your mistakes, implement improvements, and use the experience to strengthen your brand and build resilience for the future.

Navigating a reputational crisis is never easy, but it’s not insurmountable. By following the lead of these three inspiring examples, businesses can not only weather the storm but emerge stronger, more resilient, and more beloved by their customers. Remember, a crisis can be a crucible, an opportunity to refine your values, rebuild trust, and ultimately, emerge as a phoenix soaring above the ashes of adversity.

Mastering the Digital Echo Chamber: Best Practices for Monitoring and Managing Your Online Reputation

In today’s hyper-connected world, your online reputation isn’t just a reflection of your brand—it’s the megaphone amplifying every customer’s whisper. A single negative review can reverberate across the digital landscape, shaping audience perception and impacting your bottom line. Conversely, a glowing online presence can attract loyal customers, boost brand value, and open doors to exciting opportunities.

So, how do you navigate this complex digital ecosystem and ensure your online reputation shines brighter than ever? By implementing these best practices in monitoring and managing your online reputation:

1. Become a Digital Detective:

-

Cast a wide net: Monitor mentions of your brand across diverse platforms, including social media, review sites, news outlets, forums, and blogs. Tools like Google Alerts, Brand24, and Mention can be your digital bloodhounds.

-

Listen beyond the obvious: Don’t just track brand mentions; tune in to sentiment analysis. Tools like SentiStrength and Brandwatch can help you understand the emotional undercurrent of conversations surrounding your brand.

-

Follow the competition: Keep an eye on how your competitors are managing their online reputation. Learn from their successes and identify potential blind spots in your own strategy.

2. Foster Open Communication:

- Engage with your audience: Respond to comments, reviews, and questions promptly and professionally. Show that you value their feedback and are committed to open communication.

- Embrace transparency: Address negative feedback head-on.Acknowledge mistakes, apologise when necessary, and outline steps you’re taking to improve. Transparency builds trust and demonstrates your commitment to customer satisfaction.

- Turn detractors into advocates: Proactively reach out to dissatisfied customers and work towards resolving their concerns. A personal touch can turn a negative experience into a positive one.

3. Proactive Reputation Management:

- Craft a compelling online presence: Invest in a user-friendly website, active social media profiles, and positive online content. Showcase your brand values, customer testimonials, and success stories.

- Encourage positive reviews: Make it easy for satisfied customers to leave positive reviews on relevant platforms. Offer incentives, send post-purchase emails, and respond to all reviews with appreciation.

- Partner with influencers: Collaborate with relevant online personalities to spread the word about your brand and build trust with their audience.

4. Crisis-Proof Your Reputation:

- Develop a crisis communication plan: Outline clear roles, communication channels, and response protocols for handling negative publicity or online crises. Practice makes perfect, so conduct regular simulations to ensure your team is prepared.

- Stay calm and collected: Don’t let emotions dictate your response during a crisis. Stick to the facts, communicate transparently, and prioritise the safety and well-being of your customers and employees.

- Learn from the experience: Once the dust settles, analyse what went wrong and identify areas for improvement. Use this knowledge to strengthen your crisis preparedness and build a more resilient brand.

Remember, managing your online reputation is an ongoing process, not a one-time fix. By actively monitoring, engaging with your audience, and proactively shaping your online narrative, you can ensure your brand resonates positively in the digital echo chamber. In this way, you’ll attract loyal customers, build trust, and pave the way for long-term success in the ever-evolving digital landscape.

Bonus Tip: Leverage the power of positive content! Encourage user-generated content through contests, campaigns, and interactive experiences. Positive visuals and authentic customer stories can be powerful tools for building a strong online reputation.

By implementing these best practices, you can turn your online presence from a potential minefield into a fertile ground for brand growth and customer loyalty. So, go forth and conquer the digital echo chamber, one positive interaction at a time!

Social Media: The Double-Edged Sword of Reputation Management

In today’s digital age, social media reigns supreme as the public square of the internet. It’s where brands can connect with audiences on a personal level, build communities, and amplify their message. But just like any powerful tool, social media can be a double-edged sword when it comes to reputation management.

The Amplification Effect:

A single tweet or Facebook post can go viral in an instant, spreading like wildfire across the digital landscape. This can be a blessing for positive content, propelling brands into the spotlight and generating positive buzz. However, the flip side is equally potent. A negative review or disgruntled customer’s rant can quickly snowball into a full-blown PR crisis, damaging your reputation and eroding trust.

The Power of Engagement:

Social media offers an unparalleled opportunity for two-way communication. Unlike traditional media, where brands blast messages at a passive audience, social media allows for direct interaction with customers. You can listen to their feedback, address concerns in real-time, and build relationships through authentic engagement. This proactive approach can turn potentially negative situations into opportunities to showcase your commitment to customer satisfaction and strengthen your reputation.

Building a Positive Online Persona:

Developing a strong social media presence is crucial for reputation management. Craft engaging content that reflects your brand values and resonates with your target audience. Share stories, behind-the-scenes glimpses, and customer testimonials to create a human connection. Show that you’re more than just a logo – you’re a brand with a personality, purpose, and a mission.

Navigating the Crisis Storm:

Even the most carefully managed social media presence can encounter turbulence. When faced with a negative online situation, stay calm and collected. Respond promptly and professionally, acknowledging the issue and outlining steps you’re taking to address it. Transparency and authenticity are key to mitigating damage and regaining trust.

Leveraging Influencers:

Partnering with relevant social media influencers can be a powerful tool for reputation management. These individuals already have established audiences and credibility within your target demographic. By collaborating with them on campaigns or product endorsements, you can tap into their influence and reach a wider audience with a positive message.

Remember, social media is a living, breathing ecosystem. It requires constant monitoring, active engagement, and a strategic approach to keep your reputation shining bright. By following these best practices and staying on top of trends, you can ensure that social media becomes a powerful ally in your reputation management journey.

Additional Tips:

- Monitor social media mentions across all platforms. Utilise tools like Brand24 or Hootsuite to stay ahead of the conversation.

- Develop a crisis communication plan. Outline steps for addressing negative feedback and potential PR nightmares.

- Train your employees on social media best practices. Make sure everyone within your organisation understands the importance of responsible online behaviour.

- Stay positive and authentic. Don’t be afraid to show your human side and let your brand personality shine through.

By embracing the power of social media and using it strategically, you can transform it from a potential reputation minefield into a valuable tool for building trust, engaging customers, and solidifying your brand’s positive image in the digital world.

Reputational damage, also known as defamation, can occur in various ways:

- Written statements: This includes online reviews, social media posts,news articles, letters, and even business reports.

- Spoken statements: Public speeches, slander, and gossip can also fall under defamation if they harm someone’s reputation.

- Visual representations: Photos,videos, and even cartoons can be considered defamatory if they portray someone in a false or negative light.

The legal consequences of reputational damage can vary depending on several factors:

- The severity of the damage: A minor negative comment may not rise to the level of defamation, while a false accusation of criminal activity could have serious legal ramifications.

- The jurisdiction: Defamation laws differ from country to country and even within individual states.

- Whether the statement is a fact or an opinion: Generally, opinions are protected under free speech, while statements presented as facts are more likely to be considered defamatory if they are untrue.

In many cases, the injured party can pursue legal action against the person or entity responsible for the reputational damage. This may involve:

- Civil lawsuits: Seeking monetary damages to compensate for the harm caused to their reputation.

- Injunctions: Court orders restraining the defendant from further damaging the plaintiff’s reputation.

- Criminal charges: In certain cases,particularly where the defamation involves false accusations of serious crimes, criminal charges may be brought against the perpetrator.

However, it’s important to note that defamation laws are often complex and require careful consideration:

- Truth is a defence: If the statements made are demonstrably true, they cannot be considered defamatory.

- Privilege: Certain communications,such as those made in court proceedings or legislative sessions, are generally protected from defamation claims.

- Public figures: Public figures often have a higher bar to prove defamation,as they are expected to face a greater degree of scrutiny.

It’s crucial to remember that this is just a general overview, and seeking legal advice from a qualified professional is essential if you are facing a situation involving reputational damage. They can provide specific guidance based on the specific circumstances of your case and the applicable laws in your jurisdiction.

Gazing into the Crystal Ball: Future Trends in Reputation Management

The digital landscape is ever-evolving, and the way we manage our reputations is no exception. As technology advances and consumer behavior shifts, reputation management must adapt to stay ahead of the curve. Here are some key trends we can expect to see in the future:

1. The Rise of AI-Powered Reputation Management:

Artificial intelligence (AI) is already making waves in the reputation management realm, and its impact is only set to grow. AI-powered tools can analyse vast amounts of data from social media, news outlets, and online reviews to identify potential reputational risks and opportunities. They can then recommend proactive strategies and automate tasks like responding to negative feedback.

2. Hyper-Personalisation and Localised Reputation Management:

With consumers increasingly demanding personalised experiences, reputation management will need to follow suit. This means tailoring messaging and strategies to specific audience segments based on their demographics, interests, and online behavior. Additionally, companies operating in multiple countries will need to localise their reputation management efforts to account for cultural differences and regulatory nuances.

3. Embracing the Power of User-Generated Content (UGC):

UGC, such as online reviews, social media posts, and influencer endorsements, is becoming an increasingly powerful driver of reputation. Businesses will need to find ways to encourage and leverage positive UGC, while also proactively addressing negative feedback. Building trust and authenticity through genuine interactions with customers will be key.

4. Navigating the Metaverse and Web3:

The rise of the metaverse and Web3 presents new challenges and opportunities for reputation management. As users create virtual identities and interact in immersive online environments, brands will need to find ways to build and maintain reputations within these new digital spaces. This may involve developing new storytelling techniques, engaging with virtual influencers, and ensuring data privacy and security in these decentralised platforms.

5. Prioritising Crisis Preparedness and Risk Mitigation:

In today’s interconnected world, crises can spread like wildfire online. Businesses will need to be more prepared than ever to handle reputational threats, with robust crisis communication plans and rapid response protocols in place. Proactive risk mitigation, including ethical business practices and transparency, will be crucial in preventing crises from happening in the first place.

By staying ahead of these trends and proactively managing their online reputations, businesses can ensure they thrive in the ever-changing digital landscape. Reputation management is no longer a luxury, it’s a necessity for success in the years to come.

Additionally, here are some bonus trends to keep an eye on:

- The integration of blockchain technology for secure and transparent data management.

- The increasing importance of employee advocacy and employer branding.

- The use of virtual reality and augmented reality for reputation building and crisis simulations.

- A focus on measuring and demonstrating the return on investment (ROI) of reputation management efforts.

Remember, the future of reputation management is about being proactive, adapting to change, and leveraging technology to build and maintain trust with your audience. By embracing these trends, you can ensure your brand shines brightly in the online world.

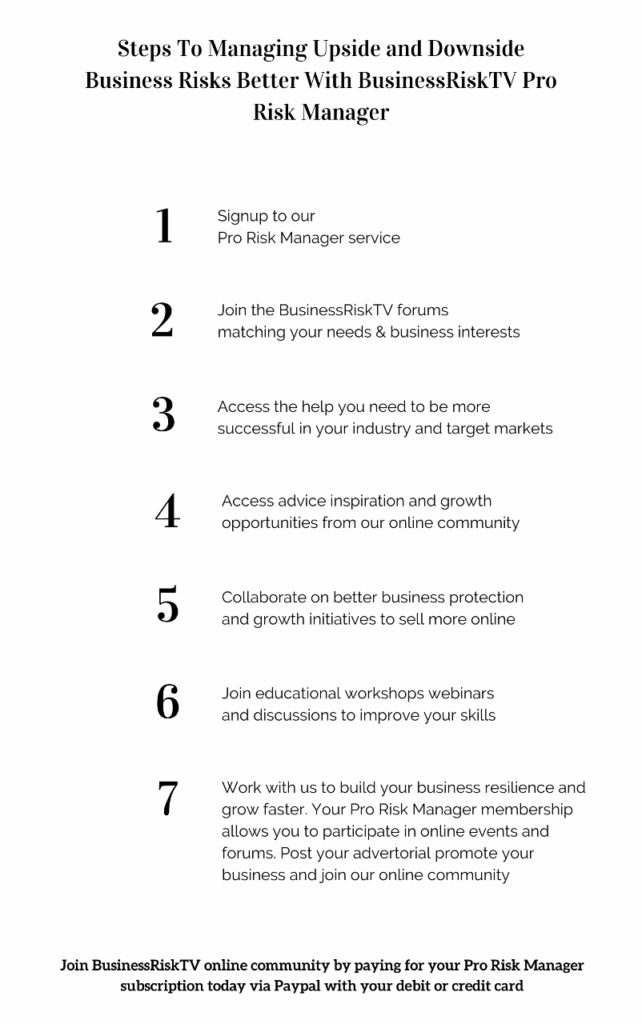

Get help to protect and grow your business

Find Out More

Subscribe for free risk alerts and risk reviews

Contact Us

Read more business risk management articles

Contact Us