12 key points for business leaders to consider regarding tokenisation developments

Are you interested in tokenisation? Should you be? What are the benefits and downsides of tokenisation?

1. Tokenisation Explained:

Tokenisation refers to the process of converting an asset into a digital token on a blockchain ledger. This digital representation allows for secure, fractional ownership and efficient trading of assets.

2. Potential Benefits:

- Increased Liquidity: Tokens can be easily bought and sold on secondary markets, enhancing asset liquidity.

- Fractional Ownership: Assets can be divided into smaller tokens, enabling broader investor participation.

- Reduced Costs: Streamlined transactions through smart contracts can reduce operational costs.

- Improved Security: Blockchain technology offers enhanced security and transparency compared to traditional methods.

3. Business Leader Awareness:

Business leaders should be aware of the potential advantages tokenisation offers for their organisations. This includes exploring new funding opportunities, streamlining supply chains, and enhancing customer engagement through tokenised loyalty programmes.

4. Regulatory Considerations:

Regulatory frameworks for tokenisation are still evolving. Business leaders must stay informed about relevant regulations to ensure compliance.

5. Collaboration Projects:

Initiatives like the collaboration between Visa, Mastercard, Swift, and major banks on tokenised assets highlight the growing industry interest. These projects aim to establish standardised protocols for global tokenisation.

6. Business Model Innovation:

Tokenisation opens doors to innovative business models. Businesses can explore new tokenised products and services to generate revenue streams.

7. Cybersecurity Risks:

Blockchain technology, while secure, is not immune to cyberattacks. Businesses must implement robust cybersecurity measures to protect their tokenised assets.

8. Integration Challenges:

Integrating tokenisation into existing business processes can be challenging. Leaders need to carefully plan for system integration and employee training.

9. Scalability Considerations:

Blockchain scalability is an ongoing area of development. Businesses should consider the scalability of chosen blockchain platforms to accommodate future growth.

10. Investor Education:

Investor education is crucial for successful tokenisation projects. Businesses must clearly communicate the benefits and risks associated with tokenised assets.

11. Evolving Standards:

Tokenisation standards are still evolving. Businesses should be adaptable to accommodate future changes and upgrades.

12. Continuous Monitoring:

Closely monitor the tokenisation landscape to identify new opportunities and emerging risks. Stay informed about regulatory developments and industry best practices.

By understanding these key points, business leaders can make informed decisions about how to leverage tokenisation for their organisation’s benefit.

What are potential threats?

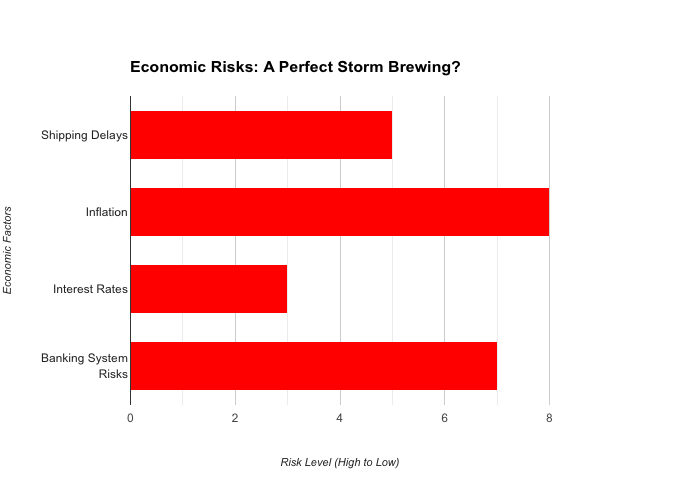

In addition to the 12 points mentioned previously, here are some potential threats associated with tokenisation that business leaders should be aware of:

1. Regulatory Uncertainty: The lack of clear regulations around tokenisation creates uncertainty for businesses. This can make it difficult to plan for the future and may discourage some companies from exploring this technology.

2. Volatility and Market Manipulation: Tokenised assets are often traded on secondary markets which can be volatile.This volatility could expose businesses to financial risks. Additionally, the newness of the market increases the risk of manipulation by malicious actors.

3. Smart Contract Vulnerabilities: Smart contracts, the self-executing code on blockchains, can contain vulnerabilities. These vulnerabilities could be exploited by hackers to steal assets or disrupt operations.

4. Counterparty Risk: In tokenised transactions, there is still a reliance on intermediaries like custodians or exchanges.The failure of one of these intermediaries could lead to losses for businesses.

5. Technological Immaturity: Blockchain technology is still under development. This means that there may be technical glitches or unforeseen issues that could impact tokenised assets.

6. Lack of Standardisation: The absence of standardised protocols for tokenisation across different platforms can create interoperability challenges and hinder wider adoption.

7. Exacerbation of Wealth Inequality: Tokenisation could potentially make it easier for wealthy investors to participate in certain asset classes, further widening the wealth gap.

By being aware of these potential threats, businesses can take steps to mitigate them. This might involve conducting thorough due diligence, implementing robust security measures, and staying informed about the latest regulatory developments.

Get help to protect and grow your business

Subscribe for free business risk alerts and risk reviews

Read more business risk management articles for free