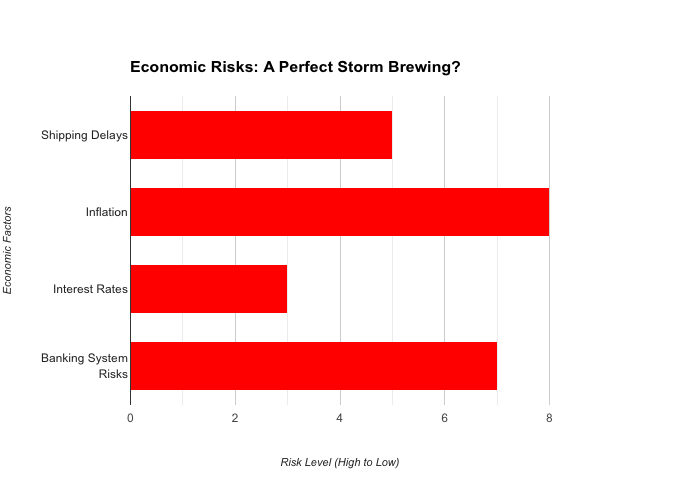

The Bank of England, in its misguided pursuit of inflation control, is inflicting significant self-harm upon the UK economy. Their weapon of choice? Quantitative Tightening (QT), a policy that involves the central bank actively selling off government bonds from its balance sheet. This seemingly technical manoeuvre has far-reaching consequences, directly impacting the cost of government borrowing and indirectly squeezing businesses and households.

The Bank of England’s Self-Inflicted Wound: How Quantitative Tightening is Crushing the UK Economy

Think of it like this: Imagine you’re trying to sell your house. Suddenly, a large institutional investor floods the market with similar properties. This oversupply inevitably drives down the price of your home. Similarly, the Bank of England’s aggressive bond sales are overwhelming the market, depressing the price of newly issued government bonds (falling bond prices = higher bond yields = higher cost of government borrowing = higher cost business and consumer borrowing = slower economic growth = higher unemployment and falling living standards).

Lower bond prices translate directly into higher yields. This means the government now has to pay significantly more interest on its debt. This increased borrowing cost has a domino effect. It forces the government to make tough choices, often leading to cuts in public services, impacting everything from healthcare and education to infrastructure projects.

But the pain doesn’t stop there. Higher government borrowing costs inevitably filter down to businesses and consumers. Banks, facing increased borrowing costs themselves, pass these expenses onto businesses through higher lending rates. This stifles investment, slows economic growth, and ultimately leads to job losses. Consumers also feel the pinch through higher mortgage rates and increased borrowing costs for everyday expenses.

The irony is that the Bank of England’s actions are exacerbating the very problem they are trying to solve. By raising borrowing costs and hindering economic growth, they are creating a self-fulfilling prophecy of higher inflation.

The Solution Lies in Stopping QT

The good news is that the solution is relatively straightforward: the Bank of England must immediately halt its QT programme. This would stabilise the bond market, reduce borrowing costs for the government, and ease the pressure on businesses and households.

Imagine a patient suffering from a self-inflicted wound. The first step towards recovery is to stop the bleeding. In this case, stopping QT is akin to staunching the flow of bonds into the market. This would allow the market to stabilise, prices to rebound, and borrowing costs to decrease.

Why is the Bank of England Doing This?

One might wonder why the Bank of England is pursuing this self-destructive path. The answer lies in their singular focus on inflation. While inflation is a serious concern, their current approach is akin to treating a fever with a sledgehammer. They are prioritising short-term pain over long-term economic health.

The Government Has the Power to Intervene

It’s crucial to understand that the government ultimately has the authority to direct the Bank of England’s actions. While the Bank of England operates with a degree of independence, its mandate is ultimately derived from the government.

The government has the power, and indeed the responsibility, to instruct the Bank of England to halt its QT programme. This is not an unprecedented move. Governments routinely intervene in the actions of central banks when the economic consequences of their policies become untenable.

A Political Decision with Real Consequences

The decision to allow the Bank of England to continue its QT programme is not merely a technical one; it is a deeply political choice. The government, by choosing inaction, is effectively choosing to allow the Bank of England to cripple the UK economy.

The consequences of this inaction are severe. We are talking about real people facing real hardships: families struggling to pay their mortgages, businesses teetering on the brink of collapse, and vital public services facing devastating cuts.

This is not about bureaucratic infighting; it’s about the well-being of the nation. The government must step in, assert its authority, and instruct the Bank of England to halt its QT programme.

Avoiding Austerity and Supporting Growth

By stopping QT, the government can prevent a further deterioration of the economic situation. This will allow businesses to thrive, create jobs, and boost economic growth. It will also free up much-needed resources for public services, ensuring that our healthcare system, education system, and other vital institutions can continue to function effectively.

The Bottom Line

The Bank of England’s QT programme is a self-inflicted wound that is threatening to cripple the UK economy. The government must act decisively to stop this destructive path. By instructing the Bank of England to halt its bond sales, the government can stabilise the market, reduce borrowing costs, and pave the way for a more prosperous future.

This is not about interfering with the independence of the Bank of England; it’s about protecting the interests of the British people. The government must not allow bureaucrats to crash the economy. The time for action is now.

Disclaimer: This article presents an opinion on the potential economic impacts of the Bank of England’s QT policy. It is not intended as financial advice. This article aims to provide a concise and engaging analysis of the Bank of England’s QT policy and its potential consequences for the UK economy. By highlighting the potential benefits of halting QT and emphasising the government’s role in guiding monetary policy, this article seeks to inform and influence the ongoing debate surrounding the UK’s economic future.

Get help to protect and grow your business faster

Find out more about Business Risk Management Club Corporate Membership

Subscribe for free business risk management tips reviews and cost reduction ideas

Read more business risk management articles and watch videos for free

Read and watch more risk analysis :

-

Bank of England Quantitative Tightening Impact on UK Government Borrowing Costs 2025 – the link between QT and increased government borrowing costs.

-

How does Bank of England QT policy affect UK public services – a key consequence of increased borrowing costs, relevant to readers concerned about the impact on public services.

-

Is the Bank of England’s QT policy harming the UK economy? – for those interested in the economic implications of QT.

-

Should the UK government intervene in Bank of England’s QT policy? – the government’s role in influencing monetary policy.

-

Impact of Bank of England QT on UK business investment and growth – businesses and investors who are concerned about the economic impact of QT on their operations.

Relevant hashtags :

- #BoEQT

- #UKEconomy

- #CostOfLivingCrisisUK

- #PublicSpendingCuts

- #UKPolitics

- #BusinessRiskTV

- #ProRiskManager

- #RiskManagement

Pro-tips For Risk Owners

Bank of England Quantitative Tightening Impact on UK Government Borrowing Costs 2025