Navigating the Uncertain Seas: Key Elements for Your 2024 Risk Management Plan

As we stand at the precipice of 2024, the economic landscape appears shrouded in a veil of uncertainty. The IMF warns of a “fragile recovery,” the ECB echoes concerns of “heightened financial stability risks,” while the Bank of England and the Federal Reserve contemplate further interest rate cuts. In this climate of volatility, having a robust risk management plan in place is no longer a mere option, but a critical imperative for business leaders.

This article, penned by an experienced business risk management expert, serves as your guide in navigating these uncertain waters. We will delve into the key elements you must include in your 2024 risk management plan, drawing on insights from leading global financial institutions to equip you with the tools necessary to weather the coming storm.

1. Embrace a Forward-Looking Perspective:

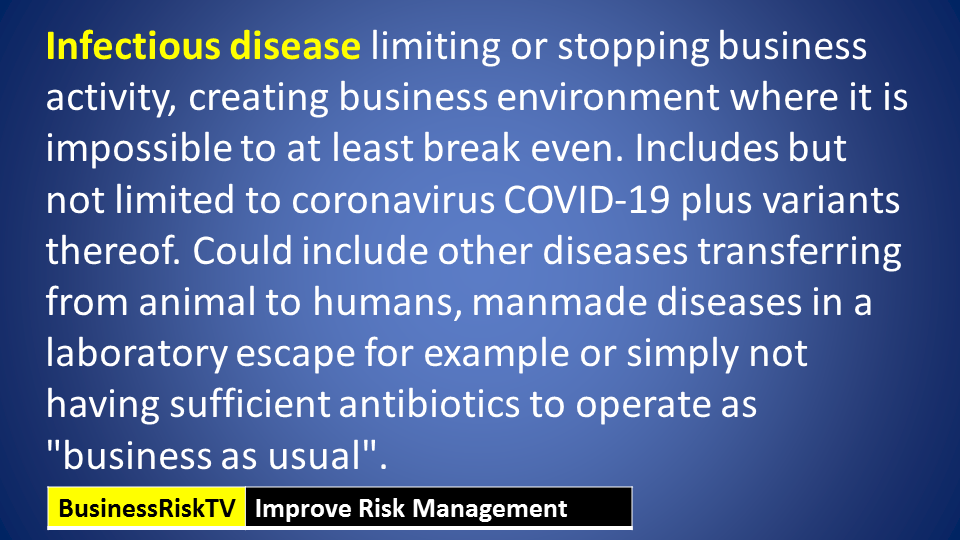

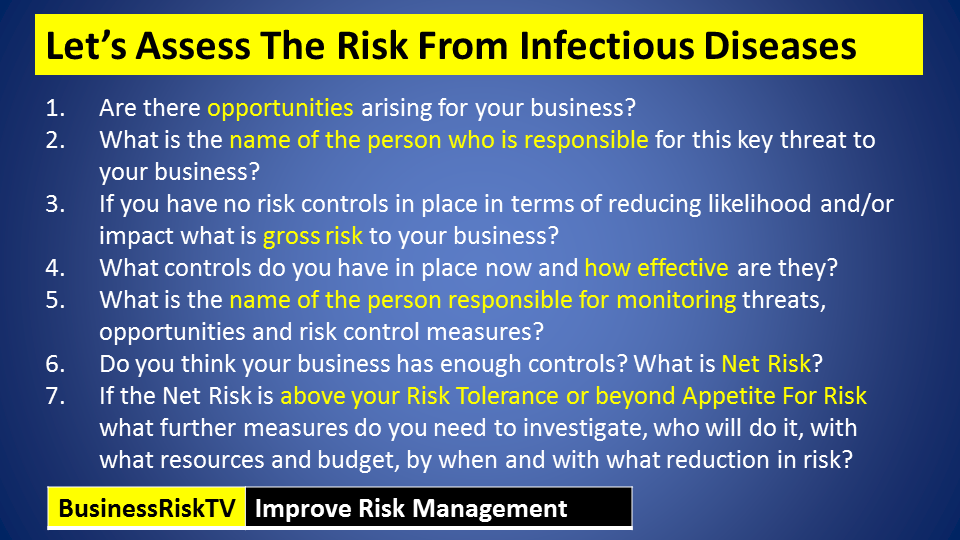

Traditional risk management often adopts a reactive stance, focusing on mitigating known threats. However, in today’s rapidly evolving environment, such an approach is akin to navigating a storm with outdated weather charts. In 2024, it is crucial to adopt a forward-looking perspective, actively scanning the horizon for emerging risks and proactively constructing safeguards.

The IMF stresses this need for vigilance, stating, “Global risks remain elevated, and policymakers need to be prepared for potential shocks.” This necessitates incorporating scenario planning into your risk management framework. Consider various plausible economic, geopolitical, and technological scenarios, and assess their potential impact on your business operations. By anticipating potential disruptions, you can develop adaptive strategies that allow you to pivot and thrive even in unforeseen circumstances.

2. Prioritise Financial Resilience:

With central banks hinting at interest rate cuts and a potential economic slowdown looming, financial resilience should be at the core of your 2024 risk management plan. The Bank of England warns of “heightened vulnerabilities in the financial system,” highlighting the need for businesses to shore up their financial reserves. You need to get ready to seize new business opportunities as well as threats in 2024.

Here are some actionable steps you can take:

- Conduct thorough stress testing to assess your ability to withstand various economic shocks.

- Diversify your funding sources to reduce dependence on any single lender.

- Tighten control over operational costs and implement measures to improve cash flow.

- Build financial buffers to weather potential downturns.

- Develop your ability as a business to be more innovative.

Remember, a robust financial position provides a critical safety net during turbulent times, allowing you to seize strategic opportunities while your competitors struggle.

3. Fortify Your Cybersecurity Defenses:

The digital landscape is increasingly fraught with cyber threats, ranging from sophisticated ransomware attacks to data breaches. As the ECB aptly states, “Cybersecurity risks remain a key source of financial stability vulnerabilities.” In 2024, businesses must prioritise fortifying their cybersecurity defenses to protect sensitive data and critical infrastructure.

Here are some essential steps to take:

- Invest in robust cybersecurity software and regularly update it.

- Implement rigorous employee training programs to raise awareness of cyber threats and best practices.

- Conduct regular penetration testing to identify and address vulnerabilities in your systems.

- Develop a comprehensive incident response plan to effectively handle cyber attacks.

Remember, a single cyber breach can inflict significant financial and reputational damage. By prioritising cybersecurity in your risk management plan, you can safeguard your business against these ever-evolving threats.

4. Foster a Culture of Risk Awareness:

Effective risk management extends beyond implementing policies and procedures. It requires fostering a culture of risk awareness within your organisation. The Federal Reserve emphasises the importance of “a strong risk culture,” stressing its role in identifying and mitigating emerging threats.

Here are some ways to cultivate a risk-aware culture:

- Encourage open communication and transparency regarding potential risks.

- Empower employees to report concerns and participate in risk identification processes.

- Regularly train employees on risk management practices and procedures.

- Reward employees for proactively identifying and mitigating risks.

By embedding risk awareness into your corporate fabric, you empower your employees to become active participants in safeguarding your business, creating a more resilient and adaptable organization.

5. Embrace Agility and Adaptability:

The volatile economic landscape of 2024 demands agility and adaptability. As the IMF aptly puts it, “Uncertainty remains high, and flexibility will be key.” This means being prepared to adjust your strategies and operations as circumstances evolve.

Here are some ways to cultivate agility:

- Decentralise decision-making to allow for quicker responses to changing circumstances.

- Implement flat organisational structures to facilitate information flow and collaboration.

- Invest in technologies that enable remote work and flexible business models.

- Regularly re-evaluate your risk management plan and make adjustments as needed.

Remember, businesses that can adapt to changing circumstances are better equipped to seize opportunities and navigate unforeseen challenges.

Conclusion:

The year 2024 promises to be a year of economic uncertainty and potential turbulence. However, by incorporating the key elements outlined in this article, you can develop a robust risk management plan that safeguards your business and positions you for success. Remember, effective risk management is not a one-time exercise, but an ongoing process. Continuously monitor the evolving landscape, update your plan accordingly, and foster a culture of risk awareness within your organisation. By remaining vigilant, adaptable, and financially resilient, you can navigate the uncertain seas of 2024 and emerge stronger on the other side.

In closing, let us leave you with the words of Christine Lagarde, President of the European Central Bank: “Resilience is not built overnight. It requires constant vigilance, preparedness, and adaptation. Let us be the generation that builds stronger foundations for a more resilient future.”

Get help to protect and grow your business

Subscribe for free business risk management alerts and risk reviews

Read more business risk management articles