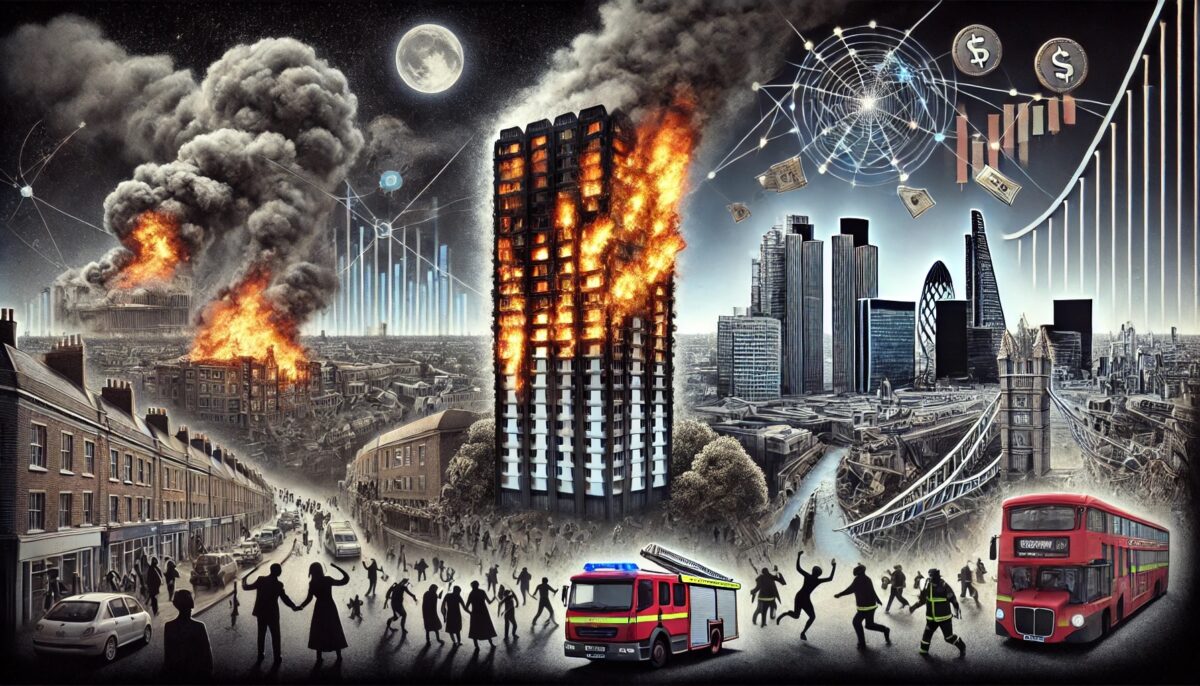

Grenfell Fire: A Tragic Reminder of Systemic Risk Management Failure and the Long Road to Accountability

The Grenfell Tower fire, a catastrophic event that claimed 72 lives on June 14, 2017, stands as a stark reminder of the potential for systemic risk management failures to result in devastating consequences. The fire’s aftermath has triggered extensive inquiries, public outrage, and a series of promises to ensure accountability and prevent similar disasters. Yet, as of September 2024, over seven years since the tragedy, the path to true accountability remains elusive. The recently released public inquiry report only underscores how risk management systems, designed to protect lives and property, repeatedly fail to prevent major risk events like Grenfell.

The Persistent Failure of Risk Management Systems

Risk management is a cornerstone of modern governance, designed to identify, assess, and mitigate risks that could harm individuals, organisations, or society at large. However, time and again, we witness these systems falter, allowing preventable disasters to unfold. The Grenfell Tower fire is not an isolated incident but part of a broader pattern where risk management frameworks are either inadequately designed, poorly implemented, or outright ignored.

The inquiry into the Grenfell Tower fire has highlighted significant flaws in the way risks were managed, from the construction materials used to the emergency response on the night of the fire. Despite existing regulations and safety protocols, these systems failed to prevent a disaster of this magnitude, raising questions about the effectiveness of risk management as a discipline.

This is not the first time we have seen such failures. The 2008 financial crisis, which brought the global economy to its knees, also stemmed from a failure in risk management within the financial sector. The crisis exposed the inadequacies of risk models, the over-reliance on flawed assumptions, and the failure of regulatory bodies to foresee and mitigate the impending disaster. The systemic collapse led to widespread economic hardship, yet accountability was minimal, with few held responsible for the crisis.

19 Reasons Why Risk Management Continues to Fail

The recurring failure of risk management systems can be attributed to a multitude of factors. Below are 19 reasons why these failures persist, often with tragic consequences:

1. Overconfidence in Risk Models: Risk models are often treated as infallible, despite being based on assumptions that may not hold in real-world scenarios. This overconfidence can lead to complacency and a false sense of security.

2. Inadequate Understanding of Risks: Organisations frequently underestimate or misunderstand the risks they face, leading to insufficient or misdirected risk management efforts.

3. Regulatory Capture: Regulators, who are supposed to oversee and enforce risk management practices, may become too close to the industries they regulate, leading to lax enforcement and oversight.

4. Complexity of Risk Environments: The increasingly complex nature of modern risks, particularly in interconnected global systems, makes it difficult for traditional risk management frameworks to keep pace.

5. Lack of Accountability: When risk management failures occur, it is often difficult to hold individuals or organisations accountable, leading to a lack of deterrence for future failures.

6. Failure to Learn from Past Mistakes: There is a tendency to repeat the same mistakes in risk management, as lessons from past failures are often ignored or forgotten over time.

7. Poor Communication: Risk management requires effective communication across all levels of an organisation, but information silos and communication breakdowns often impede the process.

8. Misaligned Incentives: In many organisations, short-term financial incentives take precedence over long-term risk management, leading to risky behaviour that is not adequately controlled.

9. Underinvestment in Risk Management: Organisations may underinvest in risk management resources, viewing it as a cost rather than an essential function, leading to inadequately designed systems.

10. Inadequate Training and Expertise: Those responsible for managing risks may lack the necessary training and expertise, resulting in ineffective risk management practices.

11. Failure to Account for Human Error: Risk management systems often fail to adequately account for human error, which can be a significant factor in major risk events.

12. Overreliance on Technology: While technology plays a crucial role in risk management, overreliance on automated systems can lead to a neglect of human judgment and critical thinking.

13. Cultural Barriers: Organisational culture can hinder effective risk management, especially if there is a reluctance to challenge the status quo or raise concerns.

14. Insufficient Risk Governance: Weak governance structures can result in poor oversight of risk management practices, leading to gaps in risk identification and mitigation.

15. Ignoring Low-Probability, High-Impact Events: Organisations often focus on high-probability, low-impact risks while neglecting low-probability, high-impact events that can cause significant damage.

16. Failure to Adapt to Changing Risk Landscapes: The risk landscape is constantly evolving, but risk management practices may not adapt quickly enough to address new and emerging risks.

17. Short-Term Focus: A focus on short-term goals and results can lead to the neglect of long-term risk management, increasing vulnerability to major risk events.

18. Inadequate Crisis Management Plans: When risks materialise, the lack of robust crisis management plans can exacerbate the situation, leading to greater harm and loss.

19. Lack of a Holistic Approach: Risk management is often siloed within organisations, with different departments managing risks in isolation rather than adopting a holistic, enterprise-wide approach.

The 2008 Financial Crisis: A Case Study in Systemic Risk Management Failure

The 2008 financial crisis serves as a poignant example of systemic risk management failure on a global scale. At the heart of the crisis was the widespread failure to manage the risks associated with complex financial instruments like mortgage-backed securities and credit default swaps. Banks, driven by the pursuit of short-term profits, took on excessive risks without fully understanding the potential consequences. Regulatory bodies, meanwhile, failed to provide adequate oversight, allowing these risks to build to a catastrophic level.

The crisis exposed the flaws in the risk models used by financial institutions, which relied on historical data and failed to account for the possibility of a widespread housing market collapse. It also highlighted the dangers of regulatory capture, where regulators, influenced by the industry they were supposed to oversee, were reluctant to impose stricter controls.

The fallout from the financial crisis was severe, leading to the collapse of major financial institutions, a global recession, and widespread economic hardship. Yet, despite the magnitude of the crisis, accountability was limited. Few of the key players responsible for the risk management failures were held accountable, and the reforms implemented in the aftermath have been criticised as insufficient to prevent a future crisis.

Improving the Effectiveness of Risk Management Systems

Given the recurring failures of risk management systems, it is clear that significant improvements are needed to enhance their effectiveness. Below are several strategies that could help achieve this goal:

1. Strengthen Accountability Mechanisms: To ensure that risk management failures are addressed, it is crucial to establish clear accountability mechanisms. This includes holding individuals and organisations responsible for their actions, as well as implementing consequences for failures.

2. Adopt a Holistic Approach to Risk Management: Organiations should move away from siloed risk management practices and adopt a holistic, enterprise-wide approach that considers all types of risks and their interconnections.

3. Enhance Regulatory Oversight: Regulators must be empowered to enforce risk management standards rigorously and independently. This may require reforms to reduce the influence of industry on regulatory bodies and to increase transparency and accountability in the regulatory process.

4. Improve Risk Communication: Effective risk management requires clear and open communication across all levels of an organization. Efforts should be made to break down information silos and ensure that risk-related information is shared and understood by all relevant stakeholders.

5. Invest in Risk Management Resources: Organisations must recognise the value of risk management and allocate sufficient resources to support it. This includes investing in the necessary technology, personnel, and training to build robust risk management systems.

6. Incorporate Human Factors into Risk Management: To address the role of human error in risk management failures, organisations should incorporate human factors into their risk assessments and mitigation strategies. This includes understanding how cognitive biases, decision-making processes, and organisational culture can impact risk management.

7. Adapt to Emerging Risks: Risk management systems must be flexible and adaptive to respond to emerging risks. This requires continuous monitoring of the risk landscape and the ability to update risk management practices in response to new threats and opportunities.

8. Focus on Long-Term Risk Management: Organisations should balance short-term objectives with long-term risk management goals. This requires a shift in mindset to prioritise sustainability and resilience over immediate gains.

9. Develop Robust Crisis Management Plans: In addition to managing risks, organisations must be prepared to respond effectively when risks materialise. This requires the development and testing of robust crisis management plans that can be activated in the event of a major risk event.

10. Promote a Culture of Risk Awareness: Creating a culture of risk awareness within an organisation is essential for effective risk management. This includes encouraging employees to speak up about potential risks, providing regular training on risk management practices, and fostering an environment where risk is seen as a shared responsibility.

11. Utilise Advanced Risk Management Tools and Techniques: Advances in technology have provided new tools and techniques for risk management, such as data analytics, artificial intelligence, and predictive modelling. Organisations should leverage these tools to enhance their ability to identify, assess, and mitigate risks.

12. Implement Continuous Improvement Processes: Risk management should be viewed as an ongoing process rather than a one-time effort. Organisations should implement continuous improvement processes that regularly evaluate and update risk management practices based on feedback and lessons learned from past experiences.

13. Engage Stakeholders in Risk Management: Effective risk management requires the involvement of all stakeholders, including employees, customers, suppliers, regulators, and the broader community. By engaging stakeholders in the risk management process, organisations can gain valuable insights, build trust, and ensure that risk management practices align with the needs and expectations of all involved.

14. Integrate Risk Management into Strategic Planning: Risk management should be an integral part of an organisation’s strategic planning process. By incorporating risk considerations into decision-making at the highest levels, organisations can better anticipate and prepare for potential challenges that could impact their long-term success.

15. Regularly Test and Update Risk Management Frameworks: Risk management frameworks should not be static. Organisations need to regularly test these frameworks through simulations, drills, and scenario planning to identify weaknesses and make necessary adjustments. This ensures that the systems remain effective and relevant in an ever-changing risk environment.

16. Educate and Train Employees Continuously: Continuous education and training are essential for maintaining a competent workforce that is aware of current risk management practices. Organisations should provide ongoing training opportunities to ensure that employees at all levels understand their roles in risk management and are equipped to handle risks effectively.

17. Foster Collaboration Across Sectors: The complexity of modern risks often requires collaboration across sectors, industries, and even countries. Organisations should seek partnerships and collaborations with other entities to share knowledge, resources, and best practices in risk management. This collaborative approach can lead to more comprehensive and effective risk management strategies.

18. Address Ethical Considerations in Risk Management: Ethical considerations should be at the forefront of risk management decisions. Organisations must ensure that their risk management practices do not disproportionately impact vulnerable populations and that they operate in a way that is socially responsible and just.

19. Promote Transparency in Risk Management Practices: Transparency is key to building trust with stakeholders. Organisations should be open about their risk management practices, including the risks they face, the strategies they are using to mitigate those risks, and the challenges they encounter. This transparency can help to build a culture of accountability and encourage continuous improvement.

Conclusion: The Long Road to Accountability and the Future of Risk Management

The Grenfell Tower fire and the 2008 financial crisis are both tragic examples of how systemic failures in risk management can lead to devastating consequences. These events have highlighted the limitations of current risk management practices and the need for significant improvements to prevent future disasters.

While the road to accountability for the Grenfell fire is likely to be long and fraught with challenges, it is essential that we learn from these failures and take meaningful action to improve our risk management systems. By addressing the underlying causes of risk management failures and implementing the strategies outlined in this article, we can create more resilient organisations and societies that are better equipped to manage the risks of the future.

However, this journey requires more than just technical fixes. It demands a cultural shift in how we approach risk, moving away from complacency and short-term thinking towards a mindset that prioritises long-term sustainability, ethical considerations, and the well-being of all stakeholders. Only then can we hope to prevent the recurrence of such tragedies and truly manage risks for the benefit of all.

In the end, the effectiveness of risk management will be determined not just by the systems we put in place, but by the commitment of individuals and organisations to uphold the principles of accountability, responsibility, and continuous improvement. The question remains whether society is willing to make the necessary changes to ensure that the lessons from Grenfell and countless other failures are not forgotten but used as a catalyst for lasting, meaningful reform.

This ongoing debate over the effectiveness of risk management, particularly in light of the Grenfell Tower fire, raises critical questions about our capacity to manage risks in a way that genuinely protects people and property. If we are to avoid repeating the mistakes of the past, we must ensure that risk management is not misused to provide misplaced confidence, but rather serves as a robust, dynamic tool for safeguarding the future.

Read more:

1. Systemic failures in risk management

2. Why risk management systems fail

3. Improving effectiveness of risk management

4. Grenfell fire and risk management failure

5. Risk management accountability and responsibility

6. Lessons from 2008 financial crisis on risk

7. Failures in corporate risk management

8. Risk management strategies for crisis prevention

9. Risk governance and compliance failures

10. Avoiding risk management disasters

Key Hashtags:

#RiskManagement #SystemicFailure #CrisisPrevention #AccountabilityMatters #GovernanceAndRisk #GrenfellFire #FinancialCrisis2008 #RiskStrategy #BusinessResilience #RiskAccountability #FireSafety #RiskManagement #Compliance #Governance #Risk #GRC #Manslaughter #BusinessRiskTV #ProRiskManager

—

This article attempts to cover the tragic implications of systemic risk management failures, drawing on recent events like the Grenfell Tower fire and the 2008 financial crisis. The aim is to provoke thought on how we can enhance the effectiveness of risk management systems to better protect society and ensure that accountability is not just a distant possibility but a reality.

Join our Business Risk Management Club

Subscribe for free business risk alerts and risk reviews

Read more business risk management articles for free