The 2026 Silver Supply Crisis: Is the COMEX Paper Market a Systemic Risk to Your Business?

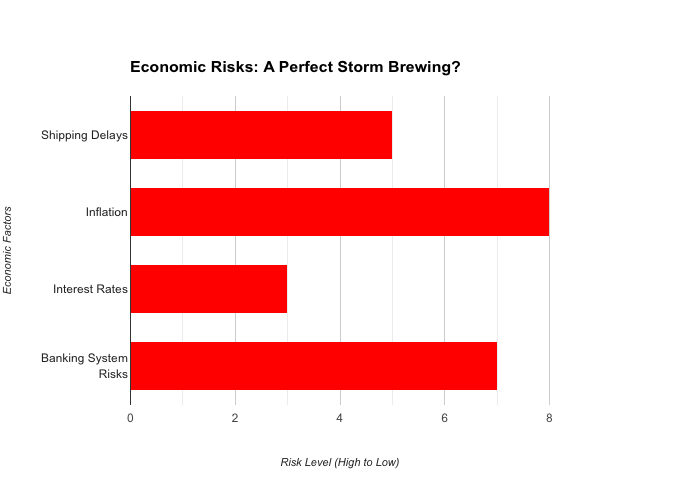

The global silver market has entered a period of unprecedented structural instability. In early 2026, the long-predicted “decoupling” of paper silver prices from physical reality has finally arrived. For business leaders in the technology, green energy, and automotive sectors, the reliability of the COMEX silver market is no longer a given—it is a critical vulnerability.

The Perfect Storm: China’s Export Ban and the Singapore Shutdown

The current crisis is driven by two massive geopolitical and logistical shifts that have fundamentally altered the flow of physical metal:

-

China’s Physical Fortress: As the world’s leading refiner, China’s decision to ban the export of physical silver has “ring-fenced” a massive portion of the global supply for its own domestic AI and solar infrastructure.

-

The Singapore Liquidity Gap: The sudden shutdown of major physical supply hubs in Singapore has removed a vital “safety valve” for Western manufacturers, leaving the market reliant on depleted COMEX and LBMA vaults.

Why the COMEX “Paper Market” is a Systemic Threat

The COMEX operates on a fractional reserve system. In a stable environment, only a small percentage of contract holders ever stand for physical delivery. However, as physical silver premiums skyrocket in the East, the “paper-to-physical” ratio has become unsustainable.

If industrial users lose confidence in the exchange’s ability to deliver physical metal, the resulting “short squeeze” could lead to a systemic failure, leaving businesses with useless paper hedges and no raw materials to maintain production lines.

6 Strategic Risk Management Measures for Business Leaders

To navigate the 2026 silver disruption, executive teams must pivot from traditional procurement to a strategic resilience model.

1. Secure Direct Mine-to-Manufacturer Off-take Agreements

Eliminate the “middleman” of the exchanges. By establishing direct contracts with primary silver miners in jurisdictions like Mexico, Peru, and Australia, businesses can guarantee a physical flow of metal that is not subject to the liquidity crises of paper markets.

2. Transition to Strategic Physical Stockpiling

The “Just-in-Time” delivery model is a liability in a deficit market. Business leaders should treat silver as a strategic asset, holding 6 to 12 months of physical inventory in secure, private, non-bank vaults to ensure operational continuity during exchange “force majeure” events.

3. Aggressive R&D in Material Substitution (Thrifts)

In sectors like photovoltaics (PV) and EV manufacturing, reducing silver intensity is now a competitive necessity. Invest in R&D to accelerate the adoption of copper-plated contacts or advanced conductive polymers to lower your “silver-per-unit” exposure.

4. Implement Vertical Integration with “Urban Mining”

The silver supply of the future is in the scrap of the past. Partnering with or acquiring e-waste recycling firms allows a company to create a closed-loop supply chain, reclaiming silver from end-of-life electronics to feed new production.

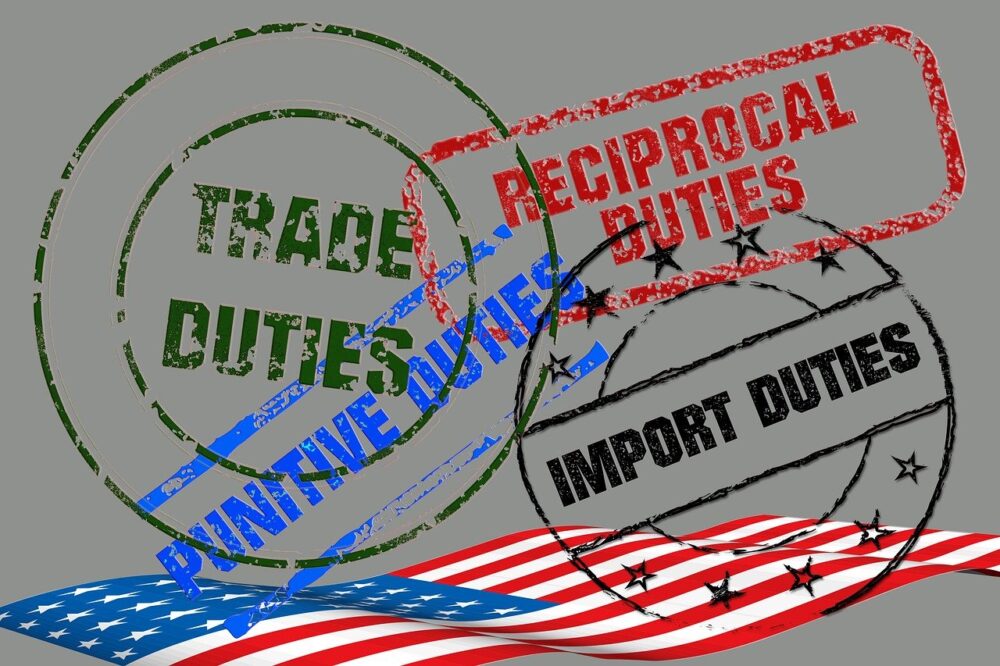

5. Geopolitical Supply Chain Diversification

With China’s export ban in place, businesses must aggressively vet new refining partners in “friendly” nations. Diversifying your refining sources across multiple geographic zones mitigates the risk of further export licenses or geopolitical tariffs.

6. Dynamic Pricing and Force Majeure Contract Audits

Review all downstream customer contracts. Ensure your pricing models allow for “raw material surcharges” to pass on extreme silver volatility. Additionally, audit your procurement contracts to ensure “delivery failure” by an exchange is not used by suppliers as a valid excuse for non-performance.

Conclusion: Adapting to the New Metallic Reality

The era of cheap, abundant, and easily hedged silver is over. The COMEX paper market remains a useful price discovery tool for now, but it can no longer be the sole foundation of an industrial supply chain. Leaders who act now to secure physical flows will thrive; those who rely on paper may find their production lines at a standstill.

#SilverCrisis2026 #SupplyChainRisk #BusinessResilience #BusinessRiskTV #RiskManagement

Get help to protect and grow your business faster with BusinessRiskTV

Find out more about growing your business faster with BusinessRiskTV

Subscribe for free business risk management ideas risk reviews and cost reduction tips

Connect with us for free business risk management tips

Read more business risk management articles and view videos for free

Connect with us for free alerts to new business risk management articles and videos

Silver Market Crisis and Business Risks