The Informed Minority: Navigating the Maze of Manipulation in Life and Business

In the intricate tapestry of human existence, a silent battle often unfolds – the clash between an uninformed majority and an informed minority. This statement, while provocative, invites scrutiny to understand the interplay between knowledge, power, and ethical responsibility. In this context, “ethical values” become the moral compass guiding our personal and professional conduct, serving as a shield against manipulation by the informed few. By examining the origins of ethical values, their influence on work as people professionals, and their role in corporate responsibility, we can empower ourselves to navigate the complex ethical landscape of life and business.

Where Do Ethical Values Come From?

Before delving into the ethical battlefield, understanding the genesis of these values is crucial. Our ethical framework is woven from multiple strands:

- Cultural Fabric: Cultural norms and traditions deeply influence our sense of right and wrong. The values ingrained in our communities and families shape our perceptions of fairness, honesty, and responsibility.

- Religious Teachings: Religion offers moral directives that guide our behavior and decision-making. Whether we adhere to specific doctrines or embrace broader spiritual principles, the teachings of various faiths contribute to our ethical compass.

- Philosophical Schools: Philosophers across time have grappled with questions of morality, offering frameworks for ethical conduct. From consequentialism to deontology, these diverse perspectives continue to inform our understanding of right and wrong.

- Personal Experiences: Personal experiences, especially encounters with injustice, can significantly shape our ethical principles. Witnessing or experiencing harm can instill a strong desire to act with integrity and uphold justice.

These interwoven threads create a unique ethical tapestry for each individual, constantly evolving through introspection, learning, and engagement with the world around us.

Ethical Principles in Action: The People Professional’s Moral Compass

For people professionals, navigating the workplace arena presents specific ethical challenges. From recruitment and employee relations to performance management and conflict resolution, our actions require an unwavering commitment to ethical principles. These principles translate into tangible everyday practices:

- Fairness and Equity: Ensuring just treatment of all employees, regardless of background, identity, or position, is paramount. This includes eliminating bias in recruitment, upholding equal pay practices, and providing opportunities for development without discrimination.

- Honesty and Transparency: Open communication and truthful dealings are essential in building trust and fostering a positive work environment. This includes transparent communication about company policies, employee conduct expectations, and decision-making processes.

- Respect and Dignity: Every individual deserves to be treated with respect and dignity. This means valuing diverse perspectives, creating a harassment-free environment, and ensuring that employees feel safe and appreciated in the workplace.

- Confidentiality and Privacy: Protecting employee data and personal information is crucial. This includes respecting confidentiality in sensitive matters, obtaining consent for data collection, and ensuring secure storage and use of personal information.

By grounding our professional conduct in these core principles, we create a workplace environment where individuals feel valued, respected, and empowered to thrive.

Do Ethical Values Provide the Moral Compass?

While ethical values serve as a vital guide, adhering to them is not always straightforward. Complex situations arise where competing values clash, creating ethical dilemmas. In such scenarios, critical thinking and a commitment to doing the right thing are necessary. Consulting our internal moral compass, considering the potential consequences of our actions, and seeking guidance from ethical frameworks can help us navigate these challenges.

Furthermore, ethical leadership plays a crucial role in setting the tone for organisational conduct. Leaders who actively champion ethical values, foster open communication about ethical concerns, and hold themselves and others accountable for ethical lapses create a work environment where ethical decision-making thrives.

Corporate Responsibility: Protecting Human Rights in the Workplace

The ethical sphere extends beyond individual actions and encompasses the responsibility of corporations towards their employees, stakeholders, and the wider community. This responsibility manifests in upholding and protecting human rights within the workplace environment. This includes:

- Freedom from Discrimination: Ensuring a workplace free from discrimination based on protected characteristics like race, gender, religion, disability, or sexual orientation. This involves implementing anti-discrimination policies, providing sensitivity training, and addressing discriminatory practices swiftly and effectively.

- Safe and Healthy Working Conditions: Protecting employees from physical and mental harm by providing safe working conditions, adequate training, and access to support mechanisms. This includes addressing issues like bullying, harassment, and stress in the workplace.

- Fair Compensation and Working Hours: Upholding fair compensation practices that respect employees’ contributions and providing reasonable working hours that ensure work-life balance. This includes ensuring compliance with wage regulations, avoiding wage exploitation, and offering flexible work arrangements where feasible.

- Freedom of Association and Collective Bargaining: Protecting employees’ right to form or join unions and bargain collectively for better working conditions. This promotes worker empowerment and ensures their voices are heard within the organisation.

By committing to these core principles of human rights protection, corporations demonstrate their commitment to ethical conduct and fulfill their responsibility towards a just and equitable society. However, upholding ethical standards in the workplace environment presents ongoing challenges. Globalisation has expanded the ethical landscape, requiring corporations to consider the ethical implications of their operations across diverse cultural contexts. Issues of forced labor, environmental degradation, and unfair working conditions in supply chains necessitate diligent due diligence and proactive measures to ensure ethical sourcing and production practices.

Technology, too, presents novel ethical dilemmas. The use of artificial intelligence in recruitment and performance evaluation raises concerns about bias and fairness. Automation and job displacement require careful consideration of worker retraining and redeployment to mitigate negative impacts. The ethical implications of data privacy and security in the digital age demand robust data protection strategies and responsible data governance practices.

Addressing these challenges necessitates a multi-pronged approach. Firstly, continuous education and training are crucial for both individuals and organisations to stay abreast of evolving ethical issues and best practices. Workshops, seminars, and access to readily available ethical resources can equip individuals with the tools to make informed decisions in complex situations. Additionally, incorporating ethical considerations into organisational policies, procedures, and performance evaluation metrics can incentivise ethical behaviour and hold individuals accountable for upholding ethical standards.

Furthermore, fostering a culture of open communication and ethical reporting within organisations is essential. This encourages employees to voice concerns about potentially unethical practices without fear of retribution. Whistleblower protection mechanisms and accessible reporting channels create a safe and supportive environment for individuals to raise ethical concerns and ensure they are addressed promptly and effectively.

Ultimately, navigating the ethical maze of life and business requires a collective effort. Individuals must strive to understand the origins and application of ethical principles in their personal and professional lives. Organisations must commit to upholding ethical standards within their operations and across their supply chains. Governments and regulatory bodies must enact and enforce laws that promote responsible business practices and address emerging ethical challenges. By working together, we can create a world where ethical values not only guide individual decisions but also serve as the foundation for a just, equitable, and sustainable future.

The uniformed majority will always lose against an informed minority. So your job is to become informed about your life and business. Protect yourself and your business from the risks of manipulation by the minority.

Get help to protect and grow your business

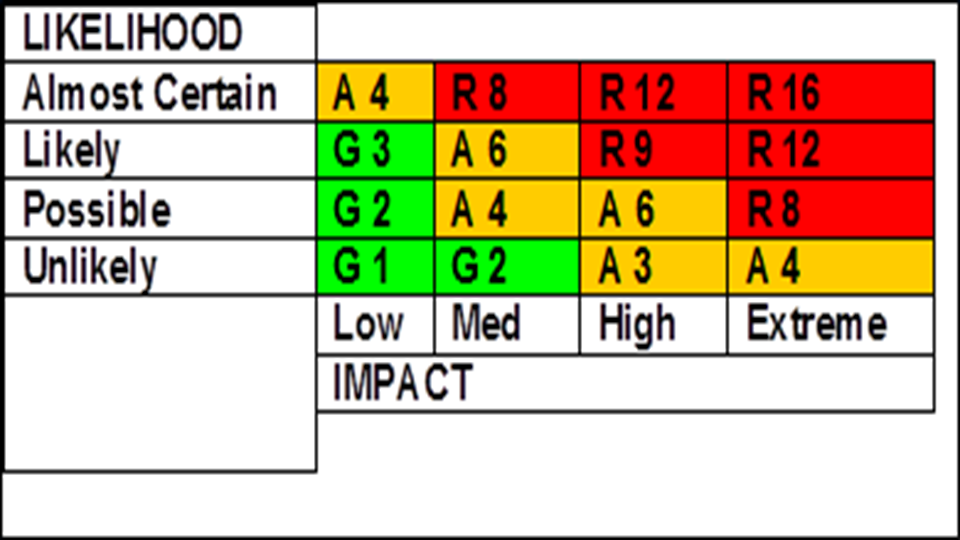

Subscribe for free business risk alerts and risk reviews

Read more business risk management articles