9 Reasons Why the Last 6 Months of PPI Should Worry Business Leaders: A Looming Threat of Consumer Inflation

As global business leaders, navigating the ever-shifting economic landscape is a constant challenge. Recently, a trend has emerged that should raise a red flag: the persistent rise in the Producer Price Index (PPI) over the past six months. While consumer inflation often grabs the headlines, a surging PPI can be a powerful leading indicator of future price hikes for consumers, posing a significant threat to businesses.

This article delves into nine compelling reasons why the rising PPI should be a cause for concern for business leaders, explores the potential problems it presents, and provides practical suggestions to safeguard your business from the impending wave of consumer inflation.

Understanding the Threat: The Producer Price Index (PPI)

The PPI measures the average change in wholesale prices of goods and services sold by domestic producers. It essentially reflects the cost businesses incur to acquire the materials and services they need to operate. A rising PPI signifies that businesses are paying more for their inputs, which can ultimately translate into higher prices for consumers down the line.

Nine Reasons Why the Rising PPI Should Worry You

-

Erosion of Profit Margins: When your input costs rise due to a surging PPI, it becomes increasingly difficult to maintain your existing profit margins. You’ll either have to absorb the cost increases, reducing profitability, or pass them on to consumers through higher prices.

-

Consumer Price Inflation (CPI) on the Horizon: The PPI often acts as a leading indicator for the CPI, which measures changes in the prices consumers pay for goods and services. A sustained rise in PPI can foreshadow a similar increase in CPI, squeezing consumer disposable income and potentially dampening demand for your products.

-

Inventory Valuation Issues: Businesses hold inventory at various stages of production. With rising input costs, the value of your existing inventory may not accurately reflect current market prices. This can lead to accounting discrepancies and potential losses when you sell your finished goods.

-

Supply Chain Disruptions: The factors driving the PPI increase, such as supply chain bottlenecks or raw material shortages, can persist and disrupt your ability to source materials efficiently. This can lead to production delays, stockouts, and lost sales opportunities.

-

Eroding Consumer Confidence: When consumers anticipate rising prices, they tend to postpone non-essential purchases. This can lead to a slowdown in demand, impacting your sales volume and overall revenue.

-

Eroding Business Confidence: A rising PPI can also dent business confidence. Businesses may be hesitant to invest in expansion or new product development due to uncertainty about future input costs and consumer demand.

-

Shifting Consumer Preferences: As prices rise, consumers may become more price-sensitive and gravitate towards cheaper alternatives or even reduce their overall consumption. This can force businesses to compete on price alone, eroding brand value and differentiation.

-

Potential for Stagflation: In a worst-case scenario, a combination of rising inflation and stagnant economic growth (stagflation) can emerge. This creates a precarious situation where businesses face higher input costs, lower demand, and limited pricing power.

-

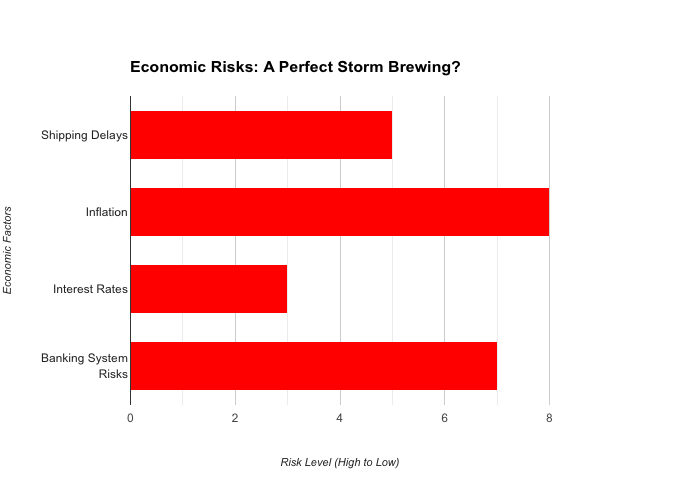

Policy Responses and Market Volatility: Governments and central banks may respond to rising inflation by raising interest rates. While intended to curb inflation, this can increase borrowing costs for businesses, impacting investment and overall economic activity. Additionally, the prospect of rising interest rates and government interventions can create market volatility, further hindering business planning.

Protecting Your Business from the Inflationary Wave

Given the potential problems outlined above, it’s crucial to take proactive steps to shield your business from the impending wave of consumer inflation. Here are some suggestions:

-

Diversify Your Supplier Base: Reduce your reliance on a single supplier for any critical inputs. Spreading your purchases across multiple suppliers can provide some buffer against price fluctuations from any one source.

-

Negotiate Long-Term Contracts: Lock in supplier prices for extended periods through long-term contracts. This can provide some cost stability during volatile market conditions.

-

Explore Alternative Materials: Research and consider substituting more expensive inputs with readily available or cheaper alternatives. This may require adjustments to your production processes, but it can help mitigate cost increases.

-

Optimise Inventory Management: Implement lean inventory practices to minimise the amount of raw materials and finished goods you hold. This reduces your exposure to potential valuation issues if input costs continue to rise.

-

Invest in Efficiency: Focus on streamlining your production processes and optimising resource utilisation. This can help offset rising input costs by reducing overall production expenses.

-

Focus on Value Proposition: Clearly communicate the unique value proposition of your products or services to justify potential price increases. Emphasise quality, brand reputation, or superior customer service to differentiate yourself from budget-conscious competitors.

-

Review Pricing Strategy: Conduct a thorough review of your pricing strategy. Consider implementing value-based pricing, which focuses on the perceived value your product delivers to customers, rather than solely on cost. This can help you maintain profitability even with moderate price adjustments.

-

Communicate Transparently: Maintain open communication with your customers regarding rising input costs and potential price adjustments. Explain the rationale behind any price increases and emphasise your commitment to maintaining product quality and value.

-

Embrace Innovation: Continuously explore opportunities for innovation in your products, services, or business model. This can help you stay ahead of the curve, differentiate yourself from competitors, and potentially command premium pricing even in an inflationary environment.

Conclusion

The rising PPI is a significant concern for global business leaders. By understanding the potential problems it presents and taking proactive steps to safeguard your business, you can navigate the coming wave of consumer inflation with greater resilience. Remember, a proactive approach, combined with a focus on value creation and efficient operations, will position your business for success even in challenging economic times.

-

Get help to protect and grow your business whatever the business environment

Subscribe for free business risk alerts, risk analysis and risk reviews

Read more business risk management articles