Imagine this: 2025. A meticulous government audit descends upon Fort Knox. The results? Startling. Shocking. The vault, once a symbol of American financial might, holds significantly less gold than officially recorded. Panic? You bet. This isn’t a Hollywood script; it’s a potential reality that could shake the foundations of the global financial system. We’ve seen central banks, particularly China, aggressively stockpiling gold. We’ve also witnessed the Bank of England’s gold reserves dwindling. And now, whispers of a potential Fort Knox discrepancy. What does it mean? Let’s dive in.

Fort Knox, Gold, and the Global Financial Precipice: A Ticking Time Bomb?

The truth, as Nietzsche warned, can shatter illusions. And the illusion of absolute gold security could be about to crack. This article isn’t just about gold; it’s about the very bedrock of trust in our financial systems. We’ll dissect nine critical risks stemming from global gold storage, a topic too often swept under the rug. Let me be clear: this isn’t just academic. The recent surge in physical gold shipments to New York, driven by a widening price gap between US futures and London spot prices, is a flashing red light. Bloomberg data confirms it: Comex inventories are spiking, reaching levels unseen since the pandemic. Institutional investors are voting with their feet, and they’re sending a clear message.

Furthermore, the World Gold Council reports accelerating central bank gold purchases in the final quarter of 2024. Goldman Sachs has just raised its 2025 gold price forecast to $3,100 per ounce, citing structurally higher central bank demand, particularly from China. But, here’s the kicker: in a world of escalating trade tensions and geopolitical uncertainty, that price could easily climb to $3,300. And guess what? Bank of America’s global fund manager survey predicts gold will outperform US equities in 2025, especially in a full-blown trade war. They see gold as the ultimate safe haven, beating the dollar and long-term bonds.

Now, let’s consider the digital frontier. Could a hybrid system, blending physical gold with digital tokens, create a new, globally trusted reserve currency? It’s a radical idea, but one that warrants serious consideration. If Fort Knox reveals a shortfall, the need for a transparent, verifiable gold-backed system will become paramount. This article provides actionable insights for risk managers, investors, and policymakers. We’ll explore the implications of these trends and offer strategies to navigate the turbulent waters ahead. You need to understand these dynamics. Your portfolio depends on it.

So, what are the nine risks we’re facing? Let’s break them down:

- 1. Confidence Crisis:

- A Fort Knox shortfall shatters trust in official reserves.

- 2. Price Volatility:

- Expect wild swings in gold prices, potentially destabilising markets.

- 3. Currency Wars:

- Nations may scramble to secure gold, exacerbating geopolitical tensions.

- 4. Dollar Decline:

- Reduced confidence in US gold holdings could weaken the dollar’s global dominance.

- 5. Central Bank Re-evaluation:

- Central banks may rethink their reserve strategies, diversifying away from traditional assets.

- 6. Trade War Escalation:

- As the fund managers survey indicated, gold will be a key player in trade wars, causing further economic disruption.

- 7. Digital Gold Disruptions:

- The introduction of digital gold, if not handled carefully, could create new vulnerabilities.

- 8. Supply Chain Issues:

- The elevated movement of physical gold, shows that supply chains for precious metals are becoming stressed.

- 9. Increased speculation:

- The increased price difference between futures and spot prices, and the increased central bank purchases, are causing a huge amount of market speculation.

The prospect of a digital gold standard offers a tantalising solution. Imagine a blockchain-based system, where each digital token represents a verifiable quantity of physical gold. This could provide the transparency and security that traditional systems lack. However, the implementation would be complex, requiring international cooperation and robust regulatory frameworks.

The key takeaway? We’re at a critical juncture. The convergence of these factors – Fort Knox, central bank activity, and market anomalies – demands our attention. Risk managers must stress-test their portfolios against these scenarios. Policymakers must prioritise transparency and international cooperation. And investors must be prepared for increased volatility.

We must face the truth, even if it shatters our illusions. Because in the world of finance, ignorance is not bliss – it’s a liability. The gold market is sending us a clear message. Are we listening?

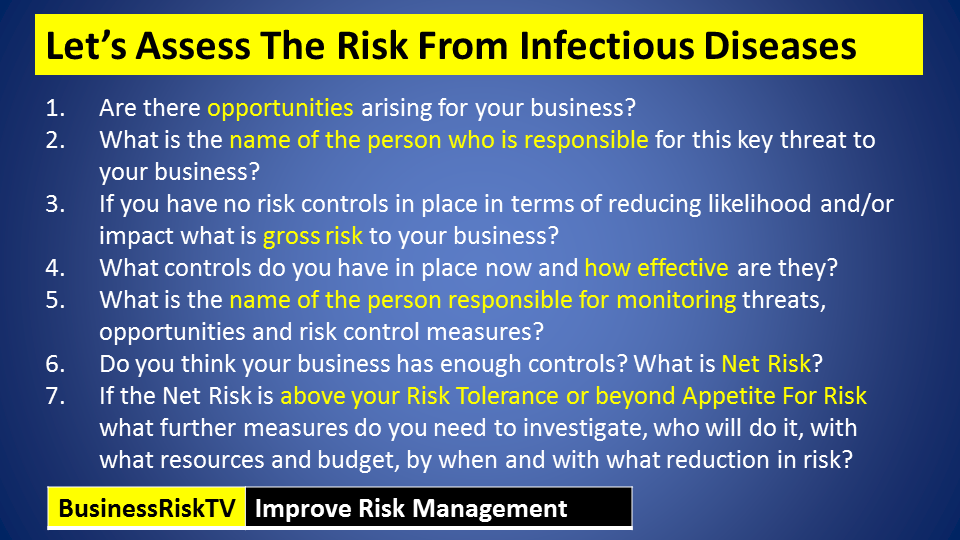

What 6 things should business leaders consider doing now to protect their business should this risk materialise?

The potential for a significant disruption in the gold market, as outlined in the article, presents serious implications for businesses. Here are 6 key actions business leaders should consider to mitigate potential risks:

1. Diversify Reserve Assets:

- Action:

- Don’t rely solely on traditional currency reserves. Explore diversification into other stable assets, including potentially other commodities, or even well researched digital assets.

- Rationale:

- A gold market shock could destabilise traditional currencies. Diversification provides a buffer against such volatility.

2. Stress-Test Financial Models:

- Action:

- Conduct rigorous stress tests of financial models, simulating scenarios with high gold price volatility and currency fluctuations.

- Rationale:

- This allows businesses to identify vulnerabilities and develop contingency plans.

3. Strengthen Supply Chain Resilience:

- Action:

- For businesses reliant on global supply chains, assess and mitigate potential disruptions caused by financial instability and trade tensions.

- Rationale:

- Financial shocks can ripple through supply chains, causing delays and increased costs.

4. Enhance Currency Risk Management:

- Action:

- Implement robust currency risk management strategies, including hedging and diversification of currency holdings.

- Rationale:

- Increased currency volatility is a likely outcome of a gold market disruption.

5. Monitor Geopolitical Developments:

- Action:

- Closely monitor geopolitical events and policy changes that could impact the gold market and global financial stability.

- Rationale:

- Geopolitical factors play a significant role in gold price movements.

6. Explore Digital Asset Strategies:

- Action:

- Investigate the potential of digital assets, including those linked to commodities, as a hedge against traditional financial risks.

- Rationale:

- The rise of digital assets could offer new avenues for risk management and diversification.

By taking these proactive steps, business leaders can better prepare their organisations for the potential financial turbulence that may arise.

Get help to protect and grow your business

Find out more about Business Risk Management Club

Subscribe for free business risk management tips risk reviews and cost cutting ideas

Read more business risk management articles and view videos for free

Read and view more :

- What are the financial risks if fort knox gold audit 2025 shows shortfall

- Impact of central bank gold buying on 2025 gold price forecast Goldman Sachs : influence of central bank actions and the specific Goldman Sachs prediction.

- How digital gold combined with physical reserves could create global currency standard : interested in the innovative concept of a hybrid gold-backed system?

- Why is there a large price difference between Comex gold futures and london spot price 2024 : understand the current market anomolies.

- Risks of global financial system if gold reserves are less than reported in central banks : looking for the larger picture of the global financial system?

Relevant hashtags :

- #GoldMarket

- #FinancialRisk

- #CentralBanks

- #FortKnoxAudit

- #DigitalGold

What are the business risks if Fort Knox gold audit 2025 shows shortfall