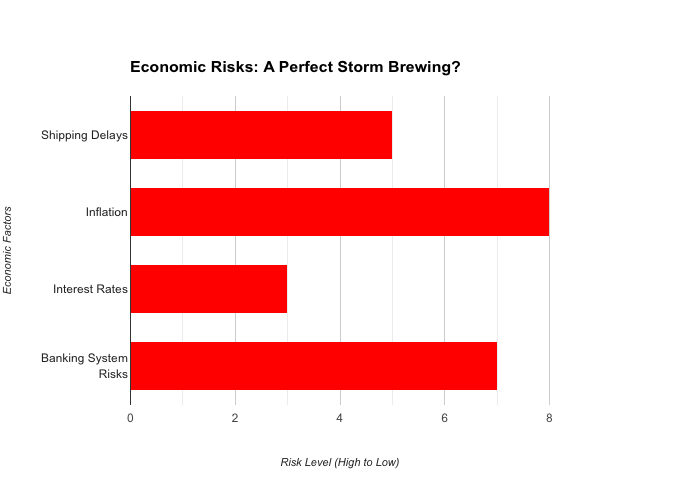

Imagine standing on the edge of a financial precipice, where the stability of the global economy teeters on the decisions made today. The United States, the world’s largest economy, faces a monumental challenge: nearly $10 trillion of its government debt is set to mature in and around 2025, all carrying an average coupon rate of 2.5%. Refinancing this colossal sum at current interest rates exceeding 5% could lead to unprecedented interest payments, consuming a significant portion of the federal budget. This scenario not only threatens America’s fiscal health but also casts a long shadow over global economic stability.

In this intricate dance of economics and policy, some speculate whether a recession in 2025 and 2026 might be a strategic, albeit perilous, manoeuvre to push down interest rates and bond yields, making borrowing more affordable. The stakes are high, and the implications vast, affecting businesses, governments, and individuals worldwide.

The Critical Importance of U.S. Debt Management

The United States’ ability to manage its debt is not just a national concern; it’s a linchpin of global economic stability. U.S. Treasury securities are considered one of the safest investments, serving as a benchmark for global financial markets. They influence everything from mortgage rates to corporate borrowing costs worldwide.

However, with $9.2 trillion of U.S. debt maturing in and around 2025, accounting for 25.4% of the country’s total debt, the challenge is immense. The rapid accumulation of debt, fueled by historic levels of deficit spending, has led to interest payments ballooning to over $1 trillion per year. This scenario raises concerns about the government’s ability to meet its obligations without resorting to measures that could destabilise the economy.

The Danger to Businesses in America and Worldwide

The repercussions of this debt crisis extend far beyond government balance sheets. Businesses, both in the United States and globally, could face significant challenges:

1. Increased Borrowing Costs: As the U.S. government competes for capital to refinance its debt, interest rates could rise, leading to higher borrowing costs for businesses.

2. Reduced Consumer Spending: Higher interest rates often translate to increased costs for consumers, leading to reduced disposable income and lower demand for goods and services.

3. Currency Volatility: Concerns over U.S. fiscal stability could lead to fluctuations in the value of the dollar, affecting international trade and investment.

4. Global Economic Slowdown: Given the interconnectedness of today’s economies, a U.S. debt crisis could trigger a global economic slowdown, impacting businesses worldwide.

Nine Strategies for Business Leaders to Mitigate Risk

In light of these potential challenges, business leaders must proactively implement strategies to safeguard their organisations:

1. Diversify Funding Sources: Relying solely on traditional bank loans may become costly. Exploring alternative financing options, such as issuing bonds or equity financing, can provide more stable capital sources.

2. Strengthen Balance Sheets: Reducing debt levels and increasing cash reserves can provide a buffer against economic downturns and increased borrowing costs.

3. Hedge Against Currency Risk: For businesses operating internationally, employing hedging strategies can protect against currency fluctuations that may arise from economic instability.

4. Enhance Operational Efficiency: Streamlining operations to reduce costs can improve margins and provide greater flexibility in challenging economic environments.

5. Focus on Core Competencies: Concentrating resources on core business areas can enhance resilience and reduce exposure to volatile markets.

6. Monitor Economic Indicators: Staying informed about economic trends and government fiscal policies enables timely decision-making and strategic adjustments.

7. Engage in Scenario Planning: Developing contingency plans for various economic scenarios ensures preparedness for potential downturns or financial crises.

8. Strengthen Supplier Relationships: Collaborating closely with suppliers can secure favourable terms and ensure supply chain stability during economic fluctuations.

9. Invest in Technology: Leveraging technology to improve productivity and reduce costs can provide a competitive edge in uncertain economic times.

Conclusion

The looming U.S. debt refinancing challenge is a clarion call for businesses to reassess their strategies and fortify their operations against potential economic headwinds. By understanding the gravity of the situation and proactively implementing risk mitigation measures, business leaders can navigate the complexities ahead and ensure sustained growth and stability in an unpredictable financial landscape.

Get help to protect and grow your business faster with BusinessRiskTV

Find out more about Business Risk Management Club

Subscribe for free business risk management tips risk reviews and cost reduction ideas

Read more business risk management articles and view videos

Financial Risk Forum BusinessRiskTV Financial Services Forum

Read more articles and view videos for free:

1. Will the US face a recession in 2025 and 2026 due to rising debt?

2. How US debt refinancing in 2025 could impact global markets

3. Why high interest rates in 2025 could trigger a financial crisis

4. What happens if the US defaults on its debt in 2025 or 2026?

5. How business leaders can prepare for a US economic downturn in 2025

Relevant hashtags:

1. #USDebtCrisis

2. #EconomicRisk2025

3. #RecessionWarning

4. #GlobalFinance

5. #BusinessStrategy

Why high interest rates in 2025 could trigger a financial crisis