What happens to commodity prices in a recession

The coming global recession will slash demand for oil copper and the like. Prices for most commodities will fall. If the world falls into depression commodity prices will fall off a cliff including oil.

Some prices can rise temporarily as people seek a safe haven. People may flee to gold or a few commodities that they think will safe harbour their money during a recession. However a depression, which is more and more likely, causes most commodity prices to collapse.

June’s weaker demand for commodities signals that an economic global recession is coming closer.

BusinessRiskTV

Global recession is necessary to stop runaway global inflation. The hard landing is the only option now available due to the lacklustre response to control inflation by Central banks and global national government.

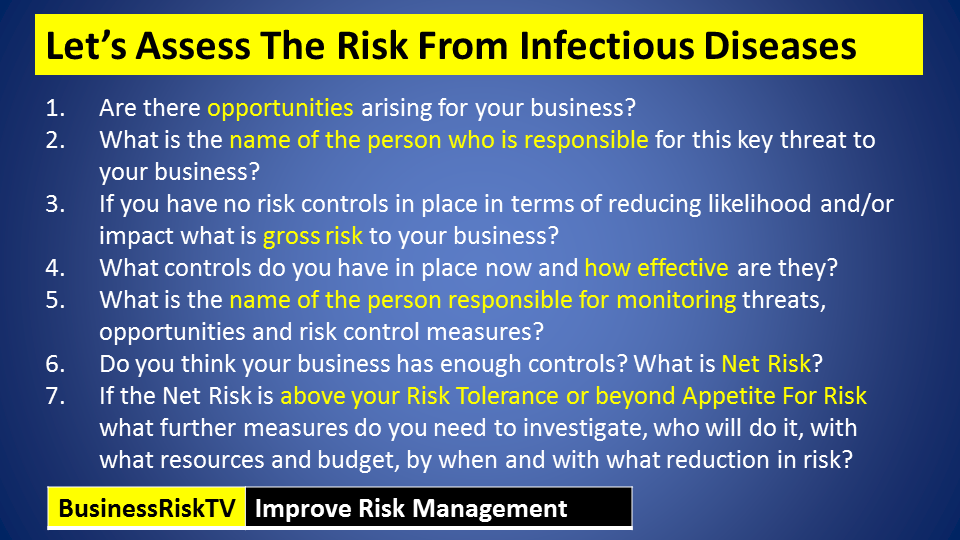

Agricultural demand and energy demand is likely to keep rising during the autumn and winter and will sustain high commodity prices. This is likely to be aggravated by poor geopolitical decision-making by incompetent national leaders and global bodies like WHO, UN and WEF puppet masters and pied pippers particularly as it relates to food, water and energy. It is likely that another health crisis will emerge in the autumn winter and spring and this is likely to be managed in a restrictive way due to the propensity of these international bodies to take more and more health and economic risk management control. In addition, as demand falls due to rising inflation it can be combined with increased supply chain disruption imposed by recommended risk management action by international bodies that national governments adopt. Worse WHO wants overseeing overriding control of the next wave of the pandemic or next health pandemic.

Demand is likely to stay the same or slightly lower, but our leaders can change the supply up or down with their decisions. Reducing supply will push up prices.

Global stagflation is a certainty. When not if.

BusinessRiskTV

Global commodity prices

Wheat and oil future prices are down in June based on the most actively traded futures. Weaker commodity prices in June indicate we are transitioning to a global recession. Although commodity prices will fall, inflation will increase and stay high whilst growth turns to recession. For example there will be less demand for oil, oil prices will fall, but prices of goods and services will remain high.

Surviving global recession: how do you prepare for a recession

Businesses that can offer business discounts and consumer discounts are more likely to survive as more people become price conscious.

Businesses that supply essentials or luxury items at a discount offer more in the marketplace compared to those businesses who have let their own costs of being in business balloon and cannot offer deals and discounts.

- Discount grocery and retail stores tend to have more footfall during a recession. Many supermarkets take advantage of their customers during the good times and suffer a loss of business and profitability when recessionary precious hit the consumers household budget.

- People still die during recession! After the management of global risks over the last two years more people will die. businesses which cater for death are likely to perform strongly throughout a recession.

- People turn to drink and drugs during a recession! Businesses providing alcohol and drugs will perform strongly during the coming recession.

- You still have to pay your taxes! Accountants and tax advisors are likely to still perform well during the recession.

- Everyone can afford a bit of lippy! Cosmetic businesses can perform well during a recession.

As for the rest of businesses, they must fully understand what’s important and what is not for their particular business model. Offering more value for money will become more important.

Risk Review 28 June 2022: Transitioning to a global recession in 2023