Death of ESG? Long Live Holistic Risk Management: A Risk Management Expert’s Perspective

For over a decade, Environmental, Social, and Governance (ESG) investing has dominated sustainable investing conversations. Proponents lauded its ability to integrate ethical considerations into investment decisions, while critics questioned its effectiveness and pointed out potential greenwashing. A more holistic approach to business decision is worth considering: Holistic Risk Management (HRM).

This article argues that while ESG has valuable elements, it falls short of a comprehensive risk management framework. We’ll explore the limitations of ESG and delve into the benefits of Holistic Risk Management. Through nine key differences, we’ll illustrate how HRM offers a more robust and future-proof approach to sustainable investing.

The Rise and Fall of ESG

ESG investing aimed to consider a company’s environmental impact (pollution, resource use), social responsibility (labour practices, diversity), and governance (transparency, board structure) alongside traditional financial metrics. This focus resonated with investors seeking alignment with their values and a potential hedge against future environmental and social risks.

However, ESG faced several challenges:

- Lack of Standardisation: ESG ratings varied significantly between agencies, making comparisons difficult.

- Data Transparency Issues: Companies often lacked consistent and verifiable ESG data, leading to accusations of greenwashing.

- Focus on Short-Term Issues: ESG often prioritised easily measurable metrics over long-term, complex risks.

These limitations led some to question whether ESG truly delivered on its promise.

Enter Holistic Risk Management

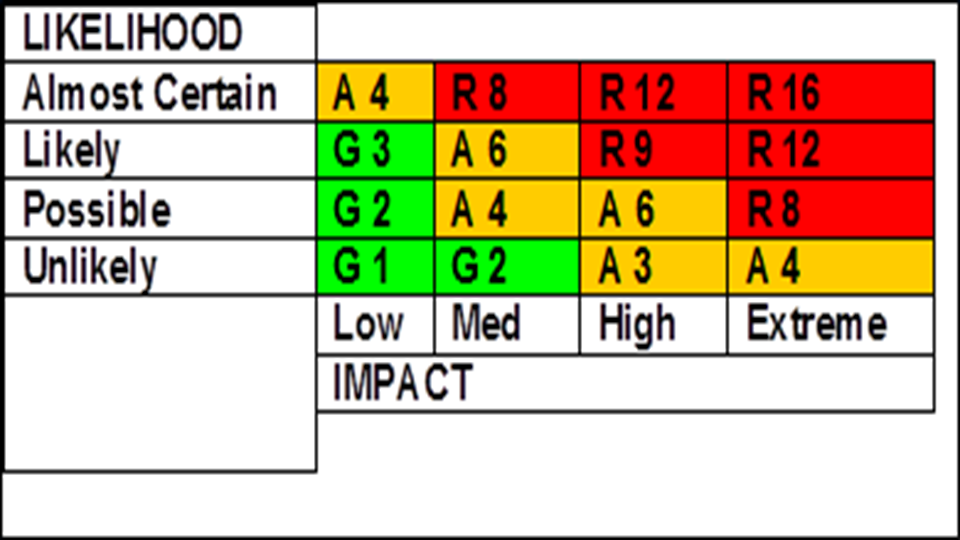

Holistic Risk Management (HRM) offers a more comprehensive approach. It integrates ESG factors alongside a wider range of risks, both financial and non-financial. Here’s how HRM expands upon ESG:

1. Broader Risk Universe: HRM goes beyond ESG to encompass technological disruptions, geopolitical instability, and supply chain vulnerabilities.

2. Long-Term Focus: HRM takes a long-term view, considering future risks like climate change, resource depletion, and societal shifts.

3. Scenario Planning: HRM utilises scenario planning to assess a company’s preparedness for diverse future possibilities.

4. Stakeholder Engagement: HRM emphasises stakeholder engagement, understanding the needs of employees, customers, and communities.

5. Risk Mitigation Strategies: HRM goes beyond mere risk identification, focusing on proactive strategies to mitigate and manage risks.

6. Integration with Business Strategy: HRM seamlessly integrates risk management with a company’s overall business strategy.

7. Continuous Improvement: HRM promotes a culture of continuous improvement, with regular risk assessments and adjustments to strategies.

8. Data-Driven Approach: HRM leverages data analytics to identify, measure, and manage risks more effectively.

9. Scenario-Specific Action Plans: HRM creates specific action plans for different risk scenarios, ensuring a tailored response.

The Power of Holistic Risk Management

By adopting HRM, companies gain several advantages:

- Enhanced Resilience: A comprehensive understanding of risks helps companies prepare for a wider range of challenges.

- Improved Decision-Making: Integrating risk considerations into strategic decision-making fosters better resource allocation and long-term sustainability. By proactively managing risks, companies can avoid costly pitfalls and seize opportunities that might arise from changing circumstances.

- Competitive Advantage: Strong risk management practices build investor confidence. Companies that demonstrate a commitment to HRM become more attractive to investors seeking sustainable and resilient investment opportunities. This can lead to a lower cost of capital and increased access to funding.

ESG: A Stepping Stone, Not a Destination

ESG remains a valuable tool for focusing on environmental, social, and governance issues. It has undoubtedly played a role in raising awareness of these critical factors and pushing companies to improve their practices. However, its limited scope and focus on readily quantifiable metrics fail to capture the complete risk landscape.

HRM: The Future of Sustainable Investing

Holistic Risk Management offers a more holistic approach, enabling companies to build long-term resilience and navigate an increasingly complex world. Regulatory bodies and investors are increasingly acknowledging the limitations of ESG and recognizing the value of HRM. For example, the Financial Stability Board (FSB) has emphasized the importance of considering climate-related risks within risk management frameworks.

A Call to Action

The future of sustainable investing lies in embracing a holistic approach. Here’s what different stakeholders can do to move forward:

- Risk Management Professionals: Advocate for the adoption of HRM within your organisations. Educate senior management on the benefits of HRM and its role in achieving long-term sustainability.

- Investors: Encourage companies to move beyond ESG by prioritising HRM in your engagement strategies. Integrate questions about a company’s risk management framework and its approach to non-financial risks into your investment decision-making process.

- Standard-Setting Bodies: Develop robust and standardised frameworks for HRM disclosure. This will allow investors to make informed comparisons between companies and hold them accountable for their risk management practices.

By working together, we can create a more sustainable and resilient investment landscape for the future. Holistic Risk Management offers a comprehensive approach that considers not just the financial bottom line, but also the environmental and social impacts of investment decisions. By embracing HRM, we can ensure a future where profitability and sustainability go hand-in-hand.

Get help to protect and grow your business with holistic risk management

Subscribe for free business risk alerts and risk reviews