Navigating a Murky Economic Landscape: Insights for American Business Leaders in the Wake of Recent Financial Developments

Keith Lewis 14 November 2023

The recent US debt auction failure and Moody’s Credit Rating Agency downgrade of the USA credit rating to negative from stable have sent shockwaves through the global financial system, raising concerns about the future cost of borrowing for the US government and the potential for further interest rate hikes by the Federal Reserve. For American business leaders, these developments underscore the need to carefully consider the implications of these events on their respective industries and make informed decisions to secure their long-term financial health.

The US Debt Auction Failure: A Wake-Up Call

In late October, a highly anticipated US Treasury auction of 30-year bonds fell short of expectations, with demand significantly lower than anticipated. This disappointing outcome has raised concerns about the appetite for US debt among investors, a crucial factor in determining the government’s borrowing costs.

The auction’s failure can be attributed to several factors, including rising interest rates, global economic uncertainty, and concerns about the US government’s fiscal trajectory. These factors have combined to make US Treasuries less attractive to investors, who are seeking higher returns and perceived lower risk in other asset classes.

Moody’s Downgrade: A Signal of Growing Concerns

Adding to the turmoil in the US financial markets, Moody’s Credit Rating Agency downgraded the USA credit rating to negative from stable, citing the nation’s rising debt levels and the increasing political gridlock that is hindering efforts to address fiscal challenges.

This downgrade is a significant development, as it signals to investors a heightened risk of default on US debt. As a result, investors may demand higher interest rates for US Treasuries, further increasing the government’s borrowing costs.

Implications for Future US Government Borrowing Costs and Federal Reserve Interest Rate Hikes

The recent debt auction failure and Moody’s downgrade have significant implications for the future cost of borrowing for the US government. As investors demand higher returns to compensate for the perceived increased risk, the government will face higher interest rates on its debt.

This situation could have a ripple effect throughout the economy, as higher borrowing costs for the government could translate into higher interest rates for businesses and consumers. This could lead to slower economic growth and increased financial strain on households and businesses.

In response to these developments, the Federal Reserve is likely to continue its policy of raising interest rates in an effort to combat inflation. However, the central bank will need to carefully balance the need to curb inflation with the risk of further slowing economic growth.

Advice for American Business Leaders

In this uncertain economic environment, American business leaders face the challenge of navigating a number of complex issues, including rising interest rates, supply chain disruptions, and labor market shortages. To effectively manage these challenges, business leaders should:

- Stay informed about economic developments: Closely monitor economic news and trends to gain insights into the changing economic landscape and make informed business decisions.

- Evaluate financial risks: Assess the potential impact of rising interest rates, supply chain disruptions, and labor market shortages on their respective businesses.

- Develop contingency plans: Formulate contingency plans to address potential challenges and mitigate their impact on business operations.

- Maintain strong financial discipline: Exercise prudence in financial management to ensure the financial health of their businesses.

- Communicate effectively with stakeholders: Keep employees, customers, and investors informed about the company’s financial performance and plans to address economic challenges.

Conclusion

The recent US debt auction failure and Moody’s downgrade of the USA credit rating to negative from stable have created uncertainty and volatility in the US financial markets. American business leaders need to carefully consider the implications of these events on their respective industries and take proactive measures to manage the risks they pose. By staying informed, evaluating financial risks, developing contingency plans, maintaining strong financial discipline, and communicating effectively with stakeholders, business leaders can navigate this challenging economic environment and position their businesses for long-term success.

USA Financial Risks 2024

Risks to U.S. Banks from Falling Bond Prices in November 2023

Keith Lewis 6 November 2023

I am concerned about the following risks to US banks from falling bond prices in November:

- Reduced net interest margin (NIM): NIM is the difference between the interest income that banks earn on loans and the interest expense they pay on deposits. When bond prices fall,interest rates rise, which can lead to a decline in NIM. This is because banks typically have to raise deposit rates more quickly than they can raise loan rates. A decline in NIM could reduce bank profitability and make it more difficult for them to meet their capital requirements. They’re more likely to be bankrupt but you don’t know it till too late!

- Losses on bond holdings: U.S.banks hold a large portfolio of bonds, including government bonds, corporate bonds, and mortgage-backed securities.When bond prices fall, banks can suffer losses on their bond holdings. These losses could be particularly significant if interest rates rise sharply as has been the case in recent months.

- Increased credit risk: Falling bond prices and rising interest rates can also lead to an increase in credit risk. This is because businesses and consumers may be more likely to default on their loans if the economy weakens and interest rates rise. An increase in credit risk could lead to higher loan losses for banks. More American businesses are failing.

Fractional Banking and Commercial Real Estate Loans Not Being Renewable

Fractional banking is a system in which banks only keep a fraction of their deposits on reserve and lend out the rest. This allows banks to create money and expand the credit supply. However, fractional banking also exposes banks to risk. If a large number of depositors withdraw their money at the same time (a Bank Run), a bank may not have enough reserves to meet their demands. This could lead to a bank failure.

Commercial real estate loans are typically made for longer terms and have higher interest rates than other types of loans. This is because commercial real estate is a illiquid asset, meaning that it can be difficult to sell quickly if a borrower defaults. Trillions in loans are due for renewal. Any commercial real estate loans that were made during the boom years of the early 2000s will come due. If these loans cannot be refinanced, borrowers may default, which could lead to significant losses for banks. This will lead to currently unrealised losses for banks particularly regional banks.

Advice to Business Leaders in the USA

In light of the risks to U.S. banks from falling bond prices, fractional banking, and commercial real estate loans not being renewable, I offer the following advice to business leaders in the USA:

- Be prepared for higher borrowing costs: As interest rates rise, businesses will have to pay more for loans. This could put a strain on corporate cash flow and profitability. Businesses should consider hedging against rising interest rates and diversifying their funding sources.

- Maintain strong credit quality:Banks are more likely to lend to businesses with strong credit quality. Businesses should focus on maintaining a healthy balance sheet and paying off debt.

- Consider alternative financing sources: In addition to traditional bank loans, there are a number of alternative financing sources available to businesses, such as venture capital, private equity,and crowdfunding. Businesses should explore all of their options to find the financing that is right for them.

Here are some additional tips for business leaders in the USA:

- Stress test your business: Run stress tests to see how your business would perform under different economic scenarios,such as rising interest rates, a recession, or a decline in demand for your products and services.

- Develop a contingency plan: If your business experiences financial difficulties, have a contingency plan in place. This plan should outline steps that you can take to reduce costs, increase revenue, and secure additional financing.

- Communicate with your stakeholders: Keep your stakeholders, such as employees,customers, and suppliers,informed of the challenges that your business is facing and the steps that you are taking to address them.

By following these tips, business leaders in the USA can reduce their exposure to the risks posed by falling bond prices, fractional banking, and commercial real estate loans not being renewable.

Conclusion

The risks to U.S. banks from falling bond prices, fractional banking, and commercial real estate loans not being renewable are significant. Business leaders should be aware of these risks and take steps to mitigate them. By stress testing their businesses, developing contingency plans, and communicating with their stakeholders, business leaders can reduce their exposure to these risks and increase the resilience of their businesses.

The problem for business leaders in America from the collapse of the money supply growth rate in USA

Here is a graph of the annual M2 money supply growth rate in the USA over the last 30 years:

Graph showing the annual M2 money supply growth rate in the USA over the last 30 years

The graph shows that the M2 money supply growth rate has been volatile over the last 30 years, but it has generally been trending downwards. In 2023, the M2 money supply growth rate is expected to be -3.67%, which is the lowest level since 1997.

The latest economic data shows the annual M2 money supply growth rate has been negative for the past three quarters, meaning the amount of money available is shrinking rapidly.

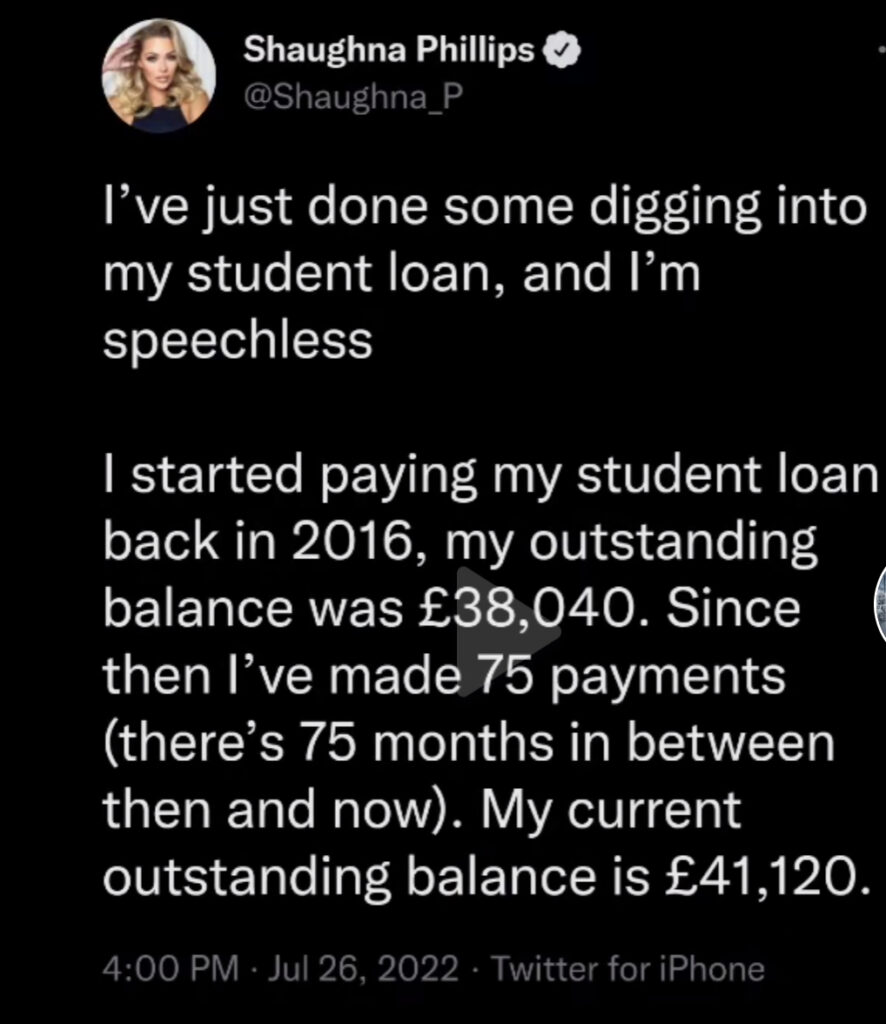

In the past 110 years, the only other time Americans have seen the money supply drop this sharply was in the early 1930s, during the height of the Great Depression.

There is a significant difference this time around, however. In the 1930s, when the money supply annual rate turned negative, prices dropped as well. In our current situation, prices are still going up despite the collapse in the money supply. To the extent we’re seeing it today, this has never occurred before.

Fox Business News October 2023

A reduced M2 money supply can have a number of problems for businesses. First, it can make it more difficult for businesses to borrow money. This can lead to lower investment and slower economic growth.

Second, a reduced M2 money supply can lead to deflation. Deflation is when prices for goods and services are falling. Deflation can be harmful to businesses because it can lead to lower profits and job losses.

Third, a reduced M2 money supply can make it more difficult for businesses to repay their debts. This can lead to bankruptcies and higher unemployment.

Here are some specific examples of how a reduced M2 money supply can harm businesses:

- Reduced investment: Businesses may be less likely to invest in new projects or expand their operations if they have difficulty borrowing money or if they are concerned about a potential recession. This can lead to slower economic growth.

- Lower sales: If consumers are spending less money due to deflation, businesses will sell less of their products and services. This can lead to lower profits and job losses.

- Higher costs: Businesses may have to pay higher interest rates on their loans and higher prices for their inputs if the M2 money supply is reduced. This can also lead to lower profits and job losses.

- Bankruptcies: Businesses that are struggling to repay their debts may be forced to declare bankruptcy if the M2 money supply is reduced. This can lead to job losses and further economic damage.

Overall, a reduced M2 money supply can have a number of negative consequences for businesses. It can make it more difficult for businesses to borrow money, invest, and repay their debts. It can also lead to deflation and lower sales. These factors can lead to lower profits, job losses, bankruptcies, recession and new Great Depression. Are you ready?

The Convergence of Hazards that Could Crash the US Economy into Recession or Depression in 2024

The US economy is facing a number of serious challenges in 2023, including over-printing of money, inflation, and a driving of private sector into bankruptcy. These challenges could converge in 2024, leading to a recession or even a depression.

This article will explore the nature of these challenges, how they could converge, and the potential consequences for the US economy. We will also discuss some of the steps that can be taken to mitigate these risks.

Over-printing of money

The Federal Reserve has been printing money at an unprecedented rate in response to the COVID-19 pandemic. This has led to a significant increase in the money supply, which is one of the main drivers of inflation.

In addition, the Federal Reserve has been keeping interest rates low in order to stimulate the economy. This has made it easier for businesses and consumers to borrow money, but it has also contributed to inflation.

Inflation

Inflation is the rate at which prices for goods and services are rising. The US is currently experiencing its highest rate of inflation in decades.

Inflation is caused by a number of factors, including the over-printing of money and supply chain disruptions. It can have a devastating impact on the economy, as it erodes the purchasing power of consumers and businesses.

Driving private sector into bankruptcy

High inflation and rising interest rates are making it difficult for businesses to operate. Many businesses are struggling to keep up with the rising costs of goods and services, and they are passing those costs on to consumers.

This is leading to a decrease in consumer spending, which is further damaging the economy. In addition, rising interest rates are making it more expensive for businesses to borrow money, which can lead to bankruptcy.

Pushing up unemployment

As businesses fail, unemployment will rise. This will lead to a further decrease in consumer spending, which will further damage the economy.

Convergence of hazards

The over-printing of money, inflation, and driving private sector into bankruptcy could converge in 2024, leading to a recession or even a depression.

A recession is defined as two consecutive quarters of negative economic growth. A depression is a more severe recession that lasts for several years.

If the US economy does enter a recession or depression, it will have a devastating impact on businesses, consumers, and the government.

Potential consequences

A recession or depression could lead to a number of serious consequences, including:

- Increased unemployment

- Business closures

- Decreased consumer spending

- Lower tax revenue

- Higher government debt

- Social unrest

Steps to mitigate the risks

There are a number of steps that can be taken to mitigate the risks of a recession or depression, including:

- The Federal Reserve can raise interest rates to bring inflation under control.

- The government can cut spending and raise taxes to reduce the budget deficit.

- Businesses can invest in productivity-enhancing technologies to reduce costs.

- Consumers can save more money and reduce their debt levels.

However, it is important to note that these steps may not be enough to prevent a recession or depression, especially if the current economic challenges continue to worsen.

Conclusion

The US economy is facing a number of serious challenges in 2023, including over-printing of money, inflation, and a driving private sector into bankruptcy. These challenges could converge in 2024, leading to a recession or even a depression.

The government, businesses, and consumers should take steps to mitigate the risks of a recession or depression, but it is important to note that these steps may not be enough to prevent a downturn.

Additional thoughts on the convergence of hazards

In addition to the challenges discussed above, there are a number of other factors that could contribute to a recession or depression in the US in 2024. These include:

- The ongoing war in Ukraine and its impact on the global economy

- The potential for a housing market crash

- The rising cost of healthcare

- The aging population

- The increasing debt levels of the US government and corporations

It is important to note that the risks of a recession or depression are difficult to predict. However, the convergence of the hazards discussed above suggests that the risks are significant.

The US government, businesses, and consumers should take steps to prepare for a potential recession or depression. This includes developing contingency plans, diversifying investments, and saving money.

The US Big Cycle Debt Crisis: The Supply-Demand Gap and Its Impact on Other Western Economies in 2023, 2024, and Beyond

The United States is facing a major debt crisis. The national debt has reached $30 trillion, and the government is running record-breaking budget deficits. This has led to a supply-demand gap in the debt market, with too much debt being produced and not enough buyers.

This supply-demand gap is having a number of negative consequences for the US economy. First, it is driving up interest rates. Investors demand higher interest rates to compensate for the risk of holding US debt. This makes it more expensive for businesses to borrow money, which can slow economic growth.

Second, the supply-demand gap is making it more difficult for the government to finance its debt. The government is having to offer higher interest rates to attract buyers, which is driving up the cost of servicing the debt. This could lead to a financial crisis if the government is unable to meet its debt obligations.

Third, the supply-demand gap is having a negative impact on other Western economies. The US is the world’s largest economy, and its financial problems can have a ripple effect throughout the global economy. For example, if the US dollar weakens, it could make it more expensive for other countries to borrow money. This could lead to a slowdown in economic growth in other countries.

The supply-demand gap is likely to persist in 2023, 2024, and beyond. The US government is not expected to make any significant progress in reducing its budget deficits, and the aging population will put a strain on entitlement programs. This means that the demand for US debt is likely to remain weak, while the supply of debt is likely to continue to grow.

The implications of the supply-demand gap for other Western economies are also likely to be negative. The US is a major trading partner for many Western countries, and its financial problems could have a negative impact on their economies. In addition, the US dollar is the world’s reserve currency, and its weakness could make it more expensive for other countries to import goods and services.

The US big cycle debt crisis is a serious problem that needs to be addressed. If it is not addressed, it could have a number of negative consequences for the US economy and the global economy. There are a number of things that can be done to address the crisis, but it will require a concerted effort from the government, businesses, and individuals.

As of August 2023, the US level of borrowing to GDP is 122.8%. This means that the US government owes 1.228 times its annual GDP. The US government’s debt has been steadily increasing in recent years, and it is now at its highest level since the end of World War II – and set to rise fast. The Treasury has announced nearly another 2 trillion dollars of borrowing!

BusinessRiskTV

Table of debt to GDP ratio for the 20 worst countries as at August 2023:

| Rank | Country | Debt to GDP Ratio (2023) |

|---|---|---|

| 1 | Japan | 255.1% |

| 2 | Greece | 207.2% |

| 3 | Italy | 151.2% |

| 4 | Lebanon | 145.9% |

| 5 | Sierra Leone | 134.4% |

| 6 | Sudan | 133.4% |

| 7 | Zambia | 128.4% |

| 8 | Portugal | 127.1% |

| 9 | Argentina | 126.1% |

| 10 | Cabo Verde | 123.2% |

| 11 | Libya | 122.4% |

| 12 | Singapore | 131.0% |

| 13 | Bahrain | 128.0% |

| 14 | United States | 122.8% |

| 15 | Uruguay | 121.4% |

| 16 | Slovenia | 119.8% |

| 17 | Hungary | 118.9% |

| 18 | Spain | 116.6% |

| 19 | Belgium | 105.0% |

| 20 | France | 102.9% |

As you can see, Japan has the highest debt to GDP ratio in the world, at 255.1%. This means that the Japanese government owes 2.551 times its annual GDP. Greece is in second place, with a debt to GDP ratio of 207.2%. Italy and Lebanon are also in the top 10, with debt to GDP ratios of 151.2% and 145.9%, respectively.

These countries have high debt to GDP ratios for a variety of reasons. Some of these countries have been through financial crises in the past, which have led to increased government debt. Others have high levels of government spending, which has also contributed to their debt problems.

High debt to GDP ratios can be a problem for countries, as they can make it difficult to service the debt and can lead to financial instability. However, it is important to note that not all countries with high debt to GDP ratios are in trouble. Some countries, such as Japan, have been able to manage their debt effectively – so far!

Some of the things that can be done to address the US debt crisis include:

- Reducing the budget deficit: The government can reduce the budget deficit by raising taxes, cutting spending, or a combination of both.

- Reforming entitlement programs: The government can reform entitlement programs, such as Social Security and Medicare, to make them more sustainable.

- Improving economic growth: The government can improve economic growth by investing in infrastructure, education, and research and development.

- Promoting international cooperation: The government can work with other countries to address the global debt crisis.

The US big cycle debt crisis is a complex problem, but it is one that we cannot afford to ignore. We need to take action now to address the crisis and prevent it from causing even more damage to our economy and our society.

In addition to the economic impacts, the US big cycle debt crisis could also have a number of political and social impacts. For example, it could lead to increased political polarization and social unrest. It is important to be aware of these potential impacts and to take steps to mitigate them.

The US big cycle debt crisis is a serious problem, but it is one that we can solve. By working together, we can address the crisis and prevent it from having a devastating impact on our economy and our society.

Fitch Downgrades US Credit Rating to AA+, citing Fiscal Deterioration and Governance Concerns

Fitch Ratings, one of the world’s leading credit rating agencies, downgraded the United States’ long-term credit rating from AAA to AA+ on Tuesday, August 1, 2023. The downgrade comes as a result of concerns about the country’s fiscal deterioration and governance.

Fitch cited three main reasons for the downgrade:

- Expected fiscal deterioration over the next three years. The agency projects that the US government’s budget deficit will widen to 10.9% of GDP in 2023, before narrowing to 7.2% of GDP in 2025. This is due to a combination of factors, including the aging population, rising healthcare costs, and the ongoing war in Ukraine.

- A high and growing general government debt burden. The US government’s debt is now over $30 trillion, or 120% of GDP. This is the highest level of debt in the country’s history.

- Erosion of governance relative to ‘AA’ and ‘AAA’ rated peers. Fitch has expressed concerns about the political brinkmanship that has characterized recent debt ceiling negotiations. The agency believes that this has eroded confidence in the US government’s ability to manage its finances.

The downgrade to AA+ is a significant blow to the US government’s reputation. It will make it more expensive for the government to borrow money, as investors will demand a higher risk premium. This could have a negative impact on the US economy, as it could lead to higher interest rates and slower growth.

The downgrade also has implications for US businesses. Businesses that rely on government contracts may be more vulnerable to higher borrowing costs. Additionally, the downgrade could make it more difficult for US businesses to raise capital from foreign investors.

The Fitch downgrade is a wake-up call for the US government. It is a reminder that the country’s fiscal health is not sustainable. The government needs to take action to reduce the deficit and debt, or else it could face even more serious consequences in the future.

Higher Costs of US Borrowing Due to Higher Risk

The Fitch downgrade will likely lead to higher costs of borrowing for the US government. This is because investors will demand a higher risk premium to compensate for the increased risk of default. The higher borrowing costs could have a negative impact on the US economy, as it could lead to higher interest rates and slower growth.

The higher borrowing costs will also make it more difficult for the government to finance its spending. This could lead to cuts in government programs or tax increases.

Printing More Money Increasing Debt

The Fitch downgrade also raises concerns about the government’s ability to finance its debt. If the government is unable to borrow enough money to meet its obligations, it may be forced to print more money. This would increase the country’s debt burden and could lead to inflation.

Implications for US Businesses

The Fitch downgrade has implications for US businesses. Businesses that rely on government contracts may be more vulnerable to higher borrowing costs. Additionally, the downgrade could make it more difficult for US businesses to raise capital from foreign investors.

The downgrade could also lead to a decline in the value of the US dollar. This would make it more expensive for US businesses to import goods and services.

Conclusion

The Fitch downgrade is a significant event that has the potential to have a negative impact on the US economy. The government needs to take action to address the country’s fiscal problems, or else it could face even more serious consequences in the future.

Are US Small Businesses Delaying Or Cutting Capital Expenditure and Hiring of Staff in 2023?

The US economy is facing a number of headwinds in 2023, including rising inflation, interest rates, and supply chain disruptions. These challenges are having a significant impact on small businesses, which are delaying or cutting capital expenditure and hiring.

A recent survey by the National Federation of Independent Business (NFIB) found that 41% of small businesses are delaying or cutting capital expenditure. This is up from 33% in the previous quarter. The survey also found that 23% of small businesses are delaying or cutting hiring. This is up from 17% in the previous quarter.

The reasons for these delays and cuts are varied. Some small businesses are facing higher costs, which is making it difficult for them to invest in new equipment or hire new employees. Others are concerned about the economic outlook and are hesitant to make long-term commitments.

The impact of these delays and cuts is likely to be felt throughout the economy. Small businesses are a major source of job creation, so fewer small businesses hiring means fewer jobs being created. This could lead to higher unemployment and slower economic growth.

It is too early to say whether layoffs are coming in 2023. However, the current economic conditions are making it difficult for small businesses to operate, and some may be forced to lay off employees.

There is also a hiring freeze in effect at some large companies. This means that these companies are not currently hiring new employees. This could have a ripple effect throughout the economy, as fewer people are hired, there will be less demand for goods and services, which could lead to further layoffs.

The US Layoffs 2023 Tracker

The US Layoffs 2023 Tracker is a website that tracks layoffs and hiring freezes in the United States. The tracker is updated daily, and it provides information on the number of layoffs, the industries that are being affected, and the reasons for the layoffs.

The tracker shows that there have been over 100,000 layoffs in the United States in 2023. The industries that have been most affected by layoffs include technology, retail, and manufacturing. The reasons for the layoffs vary, but they include rising costs, economic uncertainty, and supply chain disruptions.

The US Layoffs 2023 Tracker is a valuable resource for people who are looking for information on the current state of the US economy. The tracker can help people to understand the impact of layoffs on the economy, and it can also help people to make informed decisions about their employment.

U.S. job openings fell to the lowest level in more than two years in June 2023.

Labour Department JOLTS Report

Conclusion

The US economy is facing a number of challenges in 2023, and these challenges are having a significant impact on small businesses. Some small businesses are delaying or cutting capital expenditure, and others are delaying or cutting hiring. This could lead to layoffs in the future, and it could also have a negative impact on the overall economy.

It is important to monitor the US Layoffs 2023 Tracker for updates on the latest layoffs and hiring freezes. This tracker can help you to understand the impact of layoffs on the economy, and it can also help you to make informed decisions about your employment.

FDIC Reports $205 Billion in Hidden Losses in U.S. 4 Biggest Banks

The Federal Deposit Insurance Corporation (FDIC) released a report on July 11, 2023, that found that the four biggest banks in the United States had hidden losses of $205 billion. The report, which was based on an examination of the banks’ financial statements, found that the banks had been using accounting tricks to hide the true extent of their losses.

The four banks that were examined were JPMorgan Chase, Bank of America, Wells Fargo, and Citigroup. The report found that these banks had been using a variety of accounting tricks to hide their losses, including:

- Overstating their assets. The banks had been overstating the value of their assets, such as loans and securities, by billions of dollars. This made their balance sheets look stronger than they actually were.

- Understating their liabilities. The banks had been understating the value of their liabilities, such as debt and derivatives, by billions of dollars. This made their balance sheets look less risky than they actually were.

- Using off-balance sheet vehicles to hide their losses. The banks had been using off-balance sheet vehicles, such as special purpose entities, to hide their losses from investors.

The FDIC’s report is a major blow to the credibility of the four biggest banks. It also raises serious questions about the state of the U.S. financial system. The report’s findings suggest that the banks are not as well-capitalized as they have been portrayed, and that they may be more vulnerable to financial shocks than previously thought.

The report’s findings have also led to calls for increased regulation of the banks. Some lawmakers have proposed that the banks be required to undergo more rigorous stress tests, and that they be prohibited from using off-balance sheet vehicles.

The FDIC’s report is a wake-up call for the U.S. financial system. It is clear that the banks need to be more transparent about their financial condition, and that they need to be subject to more rigorous oversight. The report’s findings should also serve as a warning to investors, who need to be aware of the risks that they are taking when they invest in banks.

Impact of the Report

The FDIC’s report is likely to have a significant impact on the U.S. financial system. The report’s findings have already led to calls for increased regulation of the banks, and it is possible that the government will take steps to implement these reforms. The report’s findings have also shaken investor confidence in the banks, and it is possible that the banks will face difficulty raising capital in the future.

The long-term impact of the report is still uncertain. However, it is clear that the report has raised serious questions about the state of the U.S. financial system. The report’s findings should serve as a wake-up call for the government and for investors, and it is likely that the report will lead to significant changes in the way that the banks are regulated and monitored.

Conclusion

The FDIC’s report is a major blow to the credibility of the four biggest banks in the United States. The report’s findings also raise serious questions about the state of the U.S. financial system. The report is likely to have a significant impact on the banks, on investors, and on the government. The long-term impact of the report is still uncertain, but it is clear that the report has raised serious concerns about the health of the U.S. financial system.

The Threat to the U.S. Economy if China Does Not Buy More U.S. Debt

China is the largest foreign holder of U.S. debt, with over $1 trillion in Treasury bonds as of January 2023. This means that China is a major creditor to the United States, and its decision to buy or sell U.S. debt can have a significant impact on the U.S. economy.

In recent years, China has been reducing its holdings of U.S. debt. In 2013, China’s holdings peaked at $1.3 trillion, but they have since fallen by about 20%. There are a number of reasons for this decline, including:

- The Chinese economy is slowing down. China’s economic growth has been slowing in recent years, and this has led to a decrease in the demand for U.S. debt.

- The Chinese government is trying to reduce its reliance on the U.S. dollar. The Chinese government is concerned about the growing U.S. debt, and it is trying to reduce its reliance on the U.S. dollar by investing in other currencies and assets.

- The U.S.-China relationship is becoming more strained. The U.S.-China relationship has become more strained in recent years, and this has led to some Chinese investors becoming less willing to hold U.S. debt. In addition, BRICS is growing in strength whilst de-dollarisation is increasing.

If China continues to reduce its holdings of U.S. debt, it could have a number of negative consequences for the U.S. economy. These include:

- Higher interest rates. If China sells U.S. debt, it will increase the supply of U.S. Treasury bonds on the market. This will drive down prices and raise interest rates in America.

- Lower stock prices. Higher interest rates will make it more expensive for businesses to borrow money, which could lead to lower stock prices in America.

- Weaker economic growth. A decline in stock prices and higher interest rates could lead to weaker economic growth in America.

The U.S. government is aware of the risks posed by China’s declining holdings of U.S. debt. In an effort to mitigate these risks, the U.S. government has been trying to attract other investors to buy U.S. debt. However, this has been difficult, as many investors are concerned about the growing U.S. debt.

The future of China’s holdings of U.S. debt is uncertain. However, if China continues to reduce its holdings, it could have a significant impact on the U.S. economy.

Does China Hold U.S. Debt?

Yes, China is the largest foreign holder of U.S. debt. As of January 2023, China’s holdings of U.S. Treasury bonds totalled $1.095 trillion. This represents about 18% of all foreign holdings of U.S. debt.

What Percentage of U.S. Debt Is Held by China?

As of January 2023, China held about 18% of all foreign holdings of U.S. debt. This means that China is the largest foreign creditor to the United States.

Why Is China Reducing Its U.S. Debt Holdings?

There are a number of reasons why China is reducing its holdings of U.S. debt. These include:

- The Chinese economy is slowing down. China’s economic growth has been slowing in recent years, and this has led to a decrease in the demand for U.S. debt.

- The Chinese government is trying to reduce its reliance on the U.S. dollar. The Chinese government is concerned about the growing U.S. debt, and it is trying to reduce its reliance on the U.S. dollar by investing in other currencies and assets.

- The U.S.-China relationship is becoming more strained. The U.S.-China relationship has become more strained in recent years, and this has led to some Chinese investors becoming less willing to hold U.S. debt.

What would happen if China called in U.S. debt?

BusinessRiskTV

The decline in China’s holdings of U.S. debt poses a number of risks to the U.S. economy. These risks include higher interest rates, lower stock prices, and weaker economic growth. The U.S. government is aware of these risks and is taking steps to mitigate them. However, the future of China’s holdings of U.S. debt is uncertain, and it is possible that these risks will materialise in the future. What would happen to this risk of USA started military conflict with China!

M2 Money Supply in the U.S. Turning Negative in 2023

The M2 money supply in the United States has been on a downward trend since the beginning of 2023. In April 2023, it reached a negative value for the first time since the Federal Reserve began tracking it in 1959. This is a significant development with potentially far-reaching implications for the U.S. economy.

What is M2?

M2 is a measure of the total amount of money in circulation in the U.S. economy. It includes currency in circulation, demand deposits, money market funds, and other types of near-money. M2 is a broader measure of money than M1, which only includes currency in circulation and demand deposits.

Why is M2 Turning Negative?

There are a number of factors that have contributed to the decline in M2. One factor is the Federal Reserve’s aggressive monetary policy tightening. In an effort to combat inflation, the Fed has raised interest rates nine times since March 2022. This has made it more expensive for banks to borrow money, which has led to a decline in lending. As a result, consumers and businesses have less money to spend, which has slowed economic growth.

Another factor that has contributed to the decline in M2 is the end of COVID-19 government stimulus efforts. In 2020 and 2021, the government provided trillions of dollars in stimulus payments and loans to businesses and individuals. This helped to boost economic activity and prevent a deeper recession. However, as the economy has recovered, the government has begun to withdraw these stimulus measures. This has led to a decline in the amount of money in circulation.

What Happens When M2 Goes Negative?

A negative M2 money supply is a rare event. It has only happened a handful of times in U.S. history, most recently during the Great Depression. When M2 goes negative, it means that the amount of money in circulation is shrinking. This can have a number of negative consequences for the economy, including:

- A decline in economic growth

- Increased unemployment

- Falling asset prices

- A rise in inflation

What Does It Mean When M2 is Negative?

A negative M2 money supply is a sign that the economy is in trouble. It means that the Federal Reserve is not doing enough to stimulate economic growth. If the Fed does not take action to reverse the decline in M2, the economy could enter a recession.

What Can Be Done to Prevent a Recession?

The Federal Reserve has a number of tools that it can use to prevent a recession. One tool is to lower interest rates. This makes it cheaper for businesses and consumers to borrow money, which can help to boost economic activity. The Fed can also increase the amount of money in circulation by buying government bonds. This can help to offset the decline in M2 and prevent the economy from shrinking.

The Future of the M2 Money Supply

It is too early to say what the future holds for the M2 money supply. However, the recent decline is a cause for concern. If the trend continues, it could lead to a recession. The Federal Reserve will need to take action to prevent this from happening.

The decline in the M2 money supply is a significant development with potentially far-reaching implications for the U.S. economy. The Federal Reserve will need to take action to prevent the trend from continuing and to prevent a recession.

More articles:

- Has M2 ever been negative?

- What happens when M2 goes negative?

- What happens when M2 money supply decreases?

- What does it mean when M2 is negative?

Understanding why U.S. has inflation problem

It’s printed too much money for last 3 years

Why Do We Pay Taxes If We Can Print Money?

Have you ever wondered why we have to pay taxes? After all, the government can just print more money, right?

Let’s say the government printed a bunch of new money. What would happen? Well, for one thing, prices would go up. That’s because if there’s more money in circulation, people will be able to afford to pay more for things. This is called inflation.

Inflation can be a bad thing. It can make it harder for people to afford things, and it can also make the value of our money go down. So, even though the government could print more money, it’s not always a good idea.

Imagine you have a lemonade stand. You sell lemonade for $1 a cup. One day, you decide to print more money. You print a bunch of new $1 bills, and you start giving them out to people in exchange for lemonade.

At first, this seems like a great idea. You’re selling more lemonade, and you’re making more money. But then, something strange starts to happen. The price of lemonade starts to go up. People start demanding more money for their lemonade, because they know that there’s more money in circulation.

Soon, the price of lemonade has doubled. You’re still selling the same amount of lemonade, but you’re making half as much money. This is because the value of your money has gone down.

This is what happens when the government prints too much money. The value of the money goes down, and it becomes harder for people to afford things. This is called inflation.

Inflation is a bad thing. It can make it harder for people to live, and it can also make the economy unstable. That’s why the government shouldn’t just print money whenever it wants. It has to be careful about how much money it prints, or else it could cause inflation.

The Demand for U.S. Government Debt

The United States government has been in debt for centuries, but the amount of debt has grown significantly in recent years. As of June 8, 2023, the national debt is over $30 trillion. This is more than the entire GDP of the United States.

There are a number of reasons for the high level of U.S. debt. One reason is that the government has been running large budget deficits for many years. A budget deficit occurs when the government spends more money than it collects in taxes. The government has financed these deficits by borrowing money.

Another reason for the high level of U.S. debt is that the economy has been growing slowly in recent years. When the economy grows slowly, the government collects less tax revenue. This makes it more difficult for the government to pay off its debt.

The high level of U.S. debt has a number of implications. One implication is that the government will have to pay more interest on its debt. This will reduce the amount of money that the government has available to spend on other things, such as education, healthcare, and infrastructure.

Another implication of the high level of debt is that it could lead to inflation. Inflation occurs when prices rise. If the government prints too much money to pay off its debt, this could lead to inflation. Inflation can make it difficult for people to afford basic necessities, such as food, housing, and transportation. The government has printed too much money in recent years and continues to print too much money.

The demand for U.S. government debt has been high in recent years. This is because investors view U.S. debt as a safe investment. The U.S. government has a long history of paying its debts. Additionally, the U.S. dollar is the world’s reserve currency. This means that many countries hold U.S. dollars as a safe investment.

The high demand for U.S. government debt has helped in past to keep interest rates low. Low interest rates make it cheaper for the government to borrow money. This has helped to slow the growth of the national debt in past.

However, the high demand for U.S. government debt also has a number of risks. One risk is that the government could become too reliant on debt financing. If the government continues to run large budget deficits, it could eventually become unable to pay its debts. This could lead to a financial crisis. A financial crisis is growing.

Another risk is that the high level of debt could lead to inflation. If the government prints too much money to pay off its debt, this could lead to inflation. Inflation can make it difficult for people to afford basic necessities, such as food, housing, and transportation. Inflation has risen dramatically due to overprinting of money in America.

The demand for U.S. government debt is likely to remain high in the near future. However, the risks associated with the high level of debt should not be ignored. The government needs to take steps to reduce the national debt and to put the country on a sustainable fiscal path.

Here are some additional details about the demand for U.S. government debt:

- The majority of U.S. government debt is held by foreign investors. In 2022, foreign investors held about 60% of the national debt. Foreign investors will increasingly shun America as the de-dollarisation of the world economy progresses.

- The demand for U.S. government debt is likely to remain high as long as investors view U.S. debt as a safe investment. As de-dollarisation accelerates demand for U.S. government debt will reduce and American borrowing costs will rise reducing money to pay government services.

- The high demand for U.S. government debt has helped to keep interest rates low. As demand falls the need to increase U.S. interest rates will rise.

- The high level of debt also has a number of risks, such as the risk of inflation and the risk of the government becoming too reliant on debt financing. The U.S. government is already a debt junkie and it is unlikely to recover any time soon.

The government needs to take steps to reduce the national debt and to put the country on a sustainable fiscal path.

Are U.S. Banks Failing?

Forget for a moment the billions of dollars of hidden losses on US bank books from bonds temporarily suspended till 2024 by Fed bailouts in all but name!

The commercial real estate market is facing a number of challenges, including rising interest rates, a slowdown in economic growth, and a decline in demand for office space. As a result, banks are becoming less willing to lend to commercial real estate borrowers, and higher rates are making it harder for borrowers to refinance their loans.

How Many US Regional Banks Are There?

There are over 6,000 regional banks in the United States. These banks finance around 60% of all commercial real estate debt. Regional banks are less able to absorb losses than larger banks, and they are facing a lot of pressure from the current economic conditions.

Are Most US Banks Technically Near Insolvency?

Some experts believe that most US banks are technically near insolvency. This is because they have a lot of commercial real estate debt on their books, and the value of this debt is declining as interest rates rise and the economy slows down. If the commercial real estate market collapses, it could lead to a wave of bank failures.

What Can Be Done to Prevent a Bank Failure Crisis?

The government needs to take steps to prevent a bank failure crisis. One way to do this is to provide financial assistance to regional banks that are struggling. The government could also provide tax breaks and other incentives to encourage banks to lend to commercial real estate borrowers.

The commercial real estate market is facing a number of challenges, but there are also some steps that can be taken to prevent a bank failure crisis. With the right support, the market can overcome these challenges and continue to grow.

Here are some additional details about the challenges facing the commercial real estate market:

- Rising interest rates: The Federal Reserve has raised interest rates several times in recent months, and it is expected to raise rates again in the future. This is making it more expensive for borrowers to finance their projects, and it is also leading to lower property values.

- Slowdown in economic growth: The global economy is slowing down, and this is having a negative impact on the commercial real estate market. As businesses slow down, they are less likely to expand or relocate, and this is leading to lower demand for office space and other commercial properties.

- Decline in demand for office space: The demand for office space has been declining in recent years, and this is due to a number of factors, including the rise of remote work and the increasing popularity of co-working spaces. As the demand for office space declines, property values are also declining.

Here are some of the things that the government can do to prevent a bank failure crisis:

- Provide financial assistance to regional banks that are struggling.

- Provide tax breaks and other incentives to encourage banks to lend to commercial real estate borrowers.

- Buy up foreclosed properties and put them back on the market.

By taking these steps, the government can help to prevent a bank failure crisis and keep the commercial real estate market healthy.

Do you want to keep up with latest U.S. news analysis reviews and comment with USA Life and Business News Opinions and Reviews

Want all the latest USA business risk management news and USA enterprise risk analysis? Sign up to our BusinessRiskTV newsletter, Business Risk Alerts and Business and Economic Risk Reports email editor@businessrisktv.com or follow us on your favourite social media account.

US Business and Economy Magazine Business News Analysis and Review Articles

BusinessRiskTV.com for US

BusinessRiskTV.com is a leading online platform that provides businesses with the latest news, information, and insights on the latest business trends, risks, and opportunities. As a US-based business magazine, BusinessRiskTV.com has a wealth of resources and expertise that businesses can tap into to stay ahead of the competition.

In this article, we will take a closer look at BusinessRiskTV.com and explore how it can help businesses in the US and beyond to manage their risks, seize opportunities, and thrive in a fast-changing business environment.

What is BusinessRiskTV.com?

BusinessRiskTV.com is an online platform that provides businesses with the latest news, insights, and resources on a wide range of business topics, including risk management, business strategy, innovation, leadership, and more. The platform was launched in 2011 and has since become a leading source of information and guidance for businesses of all sizes and industries.

BusinessRiskTV.com is designed to be a one-stop-shop for businesses looking to stay ahead of the curve and navigate the challenges of the modern business world. The platform offers a range of resources, including articles, videos, podcasts, webinars, and more, that are all geared towards helping businesses manage their risks and seize opportunities.

Why use BusinessRiskTV.com?

There are several reasons why businesses in the US and beyond should consider using BusinessRiskTV.com. Here are just a few:

- Stay informed: BusinessRiskTV.com provides businesses with the latest news, insights, and analysis on a wide range of business topics. By staying informed, businesses can make more informed decisions and stay ahead of the competition.

- Manage risks: Risk management is a critical aspect of running any business. BusinessRiskTV.com provides businesses with the tools and resources they need to identify, assess, and manage risks effectively.

- Seize opportunities: In today’s fast-changing business environment, businesses need to be agile and adaptable. BusinessRiskTV.com helps businesses identify and seize opportunities that can help them grow and succeed.

- Learn from experts: BusinessRiskTV.com features insights and advice from leading business experts and thought leaders. By learning from these experts, businesses can gain new perspectives and ideas that can help them succeed.

- Connect with other businesses: BusinessRiskTV.com provides businesses with a platform to connect and network with other businesses. This can be invaluable for sharing ideas, collaborating on projects, and finding new opportunities.

What resources does BusinessRiskTV.com offer?

BusinessRiskTV.com offers a wide range of resources that businesses can use to manage their risks, seize opportunities, and stay ahead of the competition. Here are just a few of the resources available on the platform:

- Articles: BusinessRiskTV.com features a wealth of articles on a wide range of business topics, including risk management, business strategy, innovation, leadership, and more. These articles are written by leading business experts and provide businesses with valuable insights and advice.

- Videos: BusinessRiskTV.com features a range of videos on a wide range of business topics. These videos are designed to be informative, engaging, and easy to understand.

- Podcasts: BusinessRiskTV.com features a range of podcasts on a wide range of business topics. These podcasts are perfect for businesses on the go and provide valuable insights and advice that businesses can listen to while commuting, exercising, or doing other activities.

- Webinars: BusinessRiskTV.com offers a range of webinars on a wide range of business topics. These webinars are led by leading business experts and provide businesses with the opportunity to learn from the best.

- Newsletters: BusinessRiskTV.com offers a range of newsletters that businesses can subscribe to. These newsletters provide businesses with the latest news, insights, and analysis on a wide range of business topics.

- Events: BusinessRiskTV.com hosts a range of events throughout the year, including conferences, workshops, and networking events. These events provide businesses with the opportunity to connect with other businesses, learn from experts, and stay up-to-date on the latest business trends and opportunities.

How can businesses get involved with BusinessRiskTV.com?

There are several ways that businesses can get involved with BusinessRiskTV.com. Here are just a few:

- Read the articles and resources on the website: Businesses can access a wealth of free resources on the BusinessRiskTV.com website. By reading these articles and resources, businesses can stay informed and gain valuable insights and advice.

- Attend webinars and events: BusinessRiskTV.com hosts a range of webinars and events throughout the year. Businesses can attend these events to learn from experts and network with other businesses.

- Sign up for newsletters: Businesses can sign up for newsletters on the BusinessRiskTV.com website to stay up-to-date on the latest business news, insights, and analysis.

- Share content on social media: Businesses can share articles, videos, and other resources from BusinessRiskTV.com on social media to engage with their followers and spread the word about the platform.

- Become a contributor: Businesses can become a contributor to BusinessRiskTV.com by submitting articles, videos, and other resources to the platform. This is a great way to showcase expertise and gain exposure for a business.

BusinessRiskTV.com is a valuable resource for businesses in the US and beyond. The platform provides businesses with the latest news, insights, and resources on a wide range of business topics, including risk management, business strategy, innovation, leadership, and more. By using BusinessRiskTV.com, businesses can manage their risks, seize opportunities, and thrive in a fast-changing business environment. Whether it’s through reading articles, attending webinars, or networking with other businesses, there are many ways that businesses can get involved with BusinessRiskTV.com and benefit from its wealth of resources and expertise.

Subscribe to USA business news opinions risk analysis and reviews for free. Making business decisions without adequate business and economy information can lead to poor business outcomes from increased risks.

US business news magazine live online for free. Business news United States for business leaders in America and businesses trading with US. Access business news USA live. What are the biggest threats to business in USA? What are the opportunities for business growth in USA? Network the top business leaders in USA and trading with USA. Read and watch video stream USA business reviews. See what you like then buy quickly online in our virtual USA business exhibition areas.

Understanding the Future of the US Dollar as the Global Reserve Currency: Implications for Business Decision Makers

US Dollar Reserve Currency End?

Is the US dollar as the global reserve currency in its end game and what will happen to global economy if this happens. Is this the beginning of the end of the US dollar being the global reserve currency.

The question of whether the US dollar will lose its status as the global reserve currency is a topic of much debate among economists and financial experts. Some believe that the US dollar will eventually be replaced by another currency, while others argue that its dominant position is likely to continue for the foreseeable future.

If the US dollar were to lose its status as the global reserve currency, it would likely have a major impact on the global economy. The US dollar serves as a stable store of value and a means of payment for international transactions, so a change in its status could disrupt trade and investment flows. It could also lead to increased volatility in currency markets and put pressure on the US economy.

However, it’s important to note that the transition to a new global reserve currency is unlikely to happen overnight, and it would require a significant shift in the attitudes of investors, governments, and central banks. Additionally, there is no clear consensus on what the replacement for the US dollar would be, as no other currency currently possesses the combination of stability, liquidity, and widespread acceptance that the US dollar has.

In short, while the end of the US dollar as the global reserve currency is a possibility, it is not a foregone conclusion, and it’s difficult to predict when or if it will happen.

Monroe Doctrine

The Monroe Doctrine: A Historical Overview

The Monroe Doctrine was a foreign policy statement issued by President James Monroe on December 2, 1823. It declared that the United States would view any efforts by European powers to colonise or interfere in the affairs of North or South American nations as acts of aggression, requiring U.S. intervention. The doctrine has been a cornerstone of American foreign policy for nearly two centuries and remains an important aspect of the U.S.’s relationship with the rest of the world.

The origin of the Monroe Doctrine can be traced back to the early 19th century, when several European powers, including Spain, France, and Great Britain, were seeking to re-establish their colonial empires in the Americas. This alarmed the United States, which had recently won its own independence from Great Britain and was now seeking to establish itself as a major player in the Western Hemisphere. President Monroe saw the European powers’ attempts to re-establish their colonies as a direct threat to the independence and security of the United States and its neighbors.

In response, Monroe delivered his famous message to Congress on December 2, 1823. In it, he declared that the Western Hemisphere was no longer open to colonization by European powers and that the United States would view any efforts by these powers to establish colonies or interfere in the affairs of American nations as acts of aggression that would require U.S. intervention. Monroe also declared that the United States would not interfere in the internal affairs of European powers or their colonies, but would defend its own interests and those of its neighbors against any external threat.

The Monroe Doctrine had a profound impact on American foreign policy and remains an important aspect of the U.S.’s relationship with the rest of the world. Over the years, it has been invoked to justify a number of U.S. interventions in the Western Hemisphere, including the Mexican-American War, the Spanish-American War, and the U.S.’s interventions in Cuba and Nicaragua during the 20th century. Despite its controversial history, the Monroe Doctrine has remained a central tenet of American foreign policy and continues to shape the U.S.’s relations with the rest of the world.

In conclusion, the Monroe Doctrine is a historic foreign policy statement that declared the Western Hemisphere off-limits to colonization by European powers and established the United States as a protector of the independence and security of the nations of the Americas. Although it has been invoked to justify a number of U.S. interventions in the Western Hemisphere, the Monroe Doctrine remains an important aspect of American foreign policy and continues to shape the U.S.’s relationships with the rest of the world.

Would USA allow Russia to have an influence on USA politics business and lifestyle from the border of Cuba, Mexico or Canada?

Debt Ceiling: Business Risks USA

The United States has a legal limit on the amount of debt that the federal government can accumulate, known as the debt ceiling. This limit has been a source of controversy and concern for businesses, as it can lead to economic uncertainty and potentially harm the overall business environment.

One of the main risks to businesses from an immovable debt ceiling is the possibility of a government shutdown. If the government is unable to raise the debt ceiling, it may be forced to halt certain operations and furlough government employees. This can disrupt supply chains, slow down the processing of government contracts, and create other problems for businesses that rely on government services.

Another risk is that an inability to raise the debt ceiling could lead to a default on government debt. This would cause interest rates to rise, making it more expensive for businesses to borrow money. It could also lead to a drop in the value of the U.S. dollar, making imports more expensive and exports less competitive. This could hurt businesses that rely on international trade.

In addition, an immovable debt ceiling could lead to cuts in government spending, which can negatively impact businesses that rely on government contracts or rely on government-funded research and development. Furthermore, this could also lead to cuts in social security, Medicare and Medicaid benefits, which would negatively impact a large percentage of the population and therefore hurt businesses that rely on consumer spending.

Overall, an immovable debt ceiling can create economic uncertainty, disrupt business operations, and lead to cuts in government spending that can negatively impact businesses. It is important for policymakers to find a solution that allows the government to continue to meet its financial obligations while also promoting economic growth and stability.

In conclusion, an immovable debt ceiling could cause a chain of events that can have a negative impact on businesses and the economy as a whole. It is important for policymakers to work towards a solution that allows the government to continue to meet its financial obligations while also promoting economic growth and stability for businesses and citizens.

11 August 2023 – New York Federal Reserve Model Forecasts Recession in US by July 2024

The New York Federal Reserve (NY Fed) has released a new model that predicts a recession in the United States by July 2024. The model, which is based on the spread between 3-month and 10-year Treasury yields, has a 71% probability of being correct.

The NY Fed’s model is not the only one that is forecasting a recession. The Federal Reserve Bank of Cleveland has a model that predicts a 62.7% chance of a recession by February 2024, and the Federal Reserve Bank of San Francisco has a model that predicts a 53.8% chance of a recession by December 2023.

These forecasts are based on a number of factors, including the tightening of monetary policy by the Federal Reserve, the slowdown in economic growth, and the rising cost of living. The Federal Reserve is raising interest rates in an effort to combat inflation, but this is likely to slow economic growth. The war in Ukraine is also contributing to the economic slowdown, as it is disrupting supply chains and causing energy prices to rise.

The rising cost of living is another factor that is contributing to the risk of a recession. The Consumer Price Index (CPI) rose 8.6% in May, the highest rate of inflation in 40 years. This is putting a strain on household budgets and causing consumers to cut back on spending.

The combination of these factors is increasing the risk of a recession in the United States. The NY Fed’s model is the most accurate recession forecasting model in the world, and it has a 71% probability of being correct. This suggests that there is a very real risk of a recession in the United States by July 2024.

When has the New York Federal Reserve model previously correctly forecast a recession?

The NY Fed’s recession forecasting model has been correct twice in the past. In 1990, the model predicted a recession that began in July of that year. The model also predicted the recession that began in December of 2007.

When does the Federal Reserve forecast the next recession to occur?

The Federal Reserve does not currently have a forecast for the next recession. However, the central bank has acknowledged that the risk of a recession is increasing. In a speech in June, Federal Reserve Chair Jerome Powell said that the central bank is “strongly committed” to bringing inflation under control, even if it means causing some economic pain. Powell also said that the Federal Reserve is “not trying to induce a recession.”

However, the Federal Reserve’s actions to raise interest rates are likely to slow economic growth. This could lead to a recession, especially if the economy is already weak. The Federal Reserve will need to carefully balance the risks of inflation and recession in the coming months.

What can be done to prevent a recession?

There are a number of things that can be done to prevent a recession. The Federal Reserve could slow down its pace of interest rate hikes. The government could also provide fiscal stimulus to the economy. This could include tax cuts or increased spending on infrastructure.

In addition, businesses could invest more in their businesses. This would create jobs and boost economic growth. Consumers could also save more money. This would help to reduce the demand for goods and services, which could help to cool inflation.

It is important to remember that a recession is not inevitable. If the Federal Reserve, the government, and businesses take action, it is possible to prevent a recession. However, the risk of a recession is increasing, and it is important to be prepared for the possibility of a downturn.

3 July 2023 – US Banks Sitting on $1.94 Trillion in Unrealized Losses

US banks are sitting on a record $1.94 trillion in unrealized losses, according to a new report by the Federal Reserve. The losses are due to the sharp decline in the value of US treasuries and other bonds that banks hold on their books. The losses are not yet realized, meaning that banks have not actually sold the bonds and taken a loss on their books. However, the losses are a sign of the growing financial risks facing the US banking industry.

The Causes of the Unrealized Losses

The unrealized losses are being driven by a number of factors, including:

- The Federal Reserve’s interest rate hikes. The Fed has raised interest rates four times in 2022 in an effort to combat inflation. This has caused the value of US treasuries and other bonds to decline, as investors demand higher yields on their investments.

- The war in Ukraine. The war in Ukraine has also contributed to the decline in bond prices. Investors are worried about the impact of the war on the global economy, and they are selling bonds as a result.

- The US economic slowdown. The US economy is showing signs of slowing down, which is also putting downward pressure on bond prices.

The Impact of the Unrealized Losses

The unrealized losses could have a number of negative impacts on the US banking industry. For example, they could:

- Reduce banks’ capital reserves. Banks are required to maintain a certain level of capital reserves in order to protect themselves against losses. The unrealized losses could eat into banks’ capital reserves, making them more vulnerable to financial shocks.

- Increase banks’ funding costs. Banks borrow money to lend to businesses and consumers. The unrealized losses could make it more expensive for banks to borrow money, which could lead to higher interest rates for borrowers.

- Lead to bank failures. If the unrealized losses become too large, they could force some banks to fail. This could have a ripple effect through the financial system, leading to a wider economic crisis.

What Can Be Done to Address the Unrealized Losses?

There are a number of things that can be done to address the unrealized losses facing US banks. These include:

- The Federal Reserve could pause or slow down its interest rate hikes. This would help to stabilize bond prices and reduce the pressure on banks’ balance sheets.

- The US government could provide financial assistance to banks. This could help banks to shore up their capital reserves and weather the current financial storm.

- Banks could sell some of their bond holdings. This would help to realize the losses and reduce the risk of a bank failure.

The unrealized losses facing US banks are a serious problem. They could have a number of negative impacts on the financial system and the broader economy. However, there are a number of things that can be done to address the losses. The Federal Reserve, the US government, and banks themselves all have a role to play in preventing a financial crisis.

Which Bank Has the Largest Unrealized Bond Losses?

The bank with the largest unrealized bond losses in the US is JPMorgan Chase. As of March 31, 2023, JPMorgan Chase had unrealized bond losses of $36.8 billion. This represents about 1.9% of the bank’s total assets.

How Many Banks Failed in 2023?

As of July 3, 2023, there have been 12 bank failures in the US in 2023. This is the highest number of bank failures since 2010. The majority of the failed banks have been small and regional banks.

What Are Banks Unrealized Losses?

Unrealized losses are losses that have not yet been realized. They occur when the value of an asset declines, but the asset is not sold. For example, if a bank holds a bond that is worth $100, but the market value of the bond declines to $90, the bank has an unrealized loss of $10. The loss will only be realized if the bank sells the bond at a loss.

Unrealized losses can be a significant problem for banks. They can reduce the bank’s capital reserves, make it more difficult for the bank to borrow money, and lead to a bank failure.

However, unrealized losses are not always a sign of financial trouble. If the value of the asset eventually recovers, the bank will not have realized any losses. For example, if the bond in the previous example eventually recovers to its $100 value, the bank will not have realized any losses.

The key for banks is to manage their unrealized losses carefully. They need to make sure that their capital reserves are sufficient to withstand any potential losses. They also need to make sure that they have access to funding if they need it. If banks can manage their unrealized losses effectively, they will be able to weather the current financial storm and emerge stronger on the other side.

In addition to the banks mentioned above, other banks with significant unrealized bond losses include:

- Bank of America: $33.8 billion

- Wells Fargo: $27.7 billion

- Citigroup: $26.1 billion

- Morgan Stanley: $23.5 billion

- Goldman Sachs: $22.2 billion

It is important to note that these are just the unrealized losses that have been reported by banks. The actual losses could be higher, as some banks may not have reported all of their losses. Additionally, the losses could continue to grow if interest rates continue to rise.

According to a recent briefing from the US Federal Reserve (FED), 722 banks may have unrealized losses of more than 50% of their capital. 31 banks had negative tangible equity levels.

BusinessRiskTV

Conclusion:

The unrealized losses facing US banks are a serious problem. However, there are a number of things that can be done to address the losses. The Federal Reserve, the US government, and banks themselves all have a role to play in preventing a financial crisis.

The future of the US banking industry is uncertain. The unrealized losses are a major challenge, but they are not insurmountable. If banks can manage their losses effectively, they will be able to weather the current storm and emerge stronger on the other side.

25 May 2023 – M2 Money Supply In United States Has Reduced At Fastest Rate Since 1993

M2 money supply is a measure of the total amount of money in circulation in the United States. It includes cash, coins, checking and savings deposits, money market funds, and other short-term investments. A reduction in M2 money supply means that there is less money available to businesses and consumers to spend. This can lead to a number of consequences, including:

- Higher interest rates: When there is less money in circulation, the Federal Reserve may raise interest rates in an effort to slow the economy and reduce inflation. This can make it more expensive for businesses to borrow money, which can lead to higher prices for consumers.

- Slower economic growth: A reduction in M2 money supply can also lead to slower economic growth. This is because businesses will have less money to invest and hire new workers, which can lead to fewer jobs and lower wages.

- Increased risk of recession: A prolonged reduction in M2 money supply could lead to a recession. A recession is a period of economic decline characterized by falling output, employment, and income.

It is important for businesses and consumers to be aware of the potential consequences of a reduction in M2 money supply. There are a number of risk reduction measures that businesses and consumers can take, such as:

- Increase savings: Businesses and consumers can increase their savings in order to have a buffer in case of economic hardship.

- Pay down debt: Businesses and consumers can pay down debt in order to reduce their monthly payments and free up more money to spend.

- Invest in assets that are not sensitive to economic conditions:Businesses and consumers can invest in assets that are not sensitive to economic conditions, such as real estate or precious metals.

By taking these steps, businesses and consumers can help to protect themselves from the negative consequences of a reduction in M2 money supply.

13 April 2023 – U.S. National Emergency Over Covid-19 Pandemic

Joe Biden has signed bill to end the national emergency declaration for covid-19 pandemic risk management.

The national emergency declaration allowed for the mobilisation of federal resources to combat the pandemic, including the distribution of vaccines, personal protective equipment, and other supplies. It also enabled the federal government to take swift action in response to the pandemic, such as implementing travel restrictions and providing economic relief to individuals and businesses affected by the pandemic.

On 10 April the President signed into law: H.J.Res. 7, which terminates the national emergency related to the COVID-19

BusinessRiskTV

However, the declaration also gave the president broad powers to take action without Congressional approval. This raised concerns among some lawmakers about potential abuse of power and a lack of oversight.

10 April 2023 – US and global banking collapse has currently just be delayed not avoided.