How can business leaders inform their business decision-making

Want all the latest business risk management news and enterprise risk analysis for your country and industry? Sign up to our BusinessRiskTV newsletter, Business Risk Alerts and Business and Economic Risk Reports email editor@businessrisktv.com or follow us on your favourite social media account.

BusinessRiskTV business live streaming. ERMtv business live news online and ondemand business live video stream. Executives business experts and influencers join BusinessRiskTV business live video online to discuss the key threats and opportunities in the world of business. Live business news opinions debates interviews analysis and reviews online. Business management online workshops and webinars to develop risk knowledge and develop new skills sets. Use practical tools and techniques to protect and grow your business.

Will the Philips Curve bring inflation under control in US EU and UK with unrelenting interest rate increases doing their job?

The Phillips curve is a theoretical relationship between inflation and unemployment. It suggests that there is an inverse relationship between the two, meaning that lower unemployment is associated with higher inflation and vice versa. However, the Phillips curve has been called into question in recent years, as the relationship between inflation and unemployment has become more complex.

In the United States, the European Union, and the United Kingdom, central banks are raising interest rates in an effort to bring inflation under control. These interest rate hikes are expected to lead to higher unemployment, as they will make it more expensive for businesses to borrow money and invest. This could put downward pressure on inflation, as businesses will be less likely to raise prices if they are facing higher costs.

However, it is not clear whether the Phillips curve will be enough to bring inflation under control in these countries. The relationship between inflation and unemployment has become more complex in recent years, and there are other factors that could also contribute to inflation, such as supply chain disruptions and rising energy prices.

It is also possible that the central banks in these countries will need to raise interest rates even higher than they currently plan to in order to bring inflation under control. This could lead to even higher unemployment, which could have a negative impact on economic growth.

Overall, it is too early to say whether the Phillips curve will be enough to bring inflation under control in the United States, the European Union, and the United Kingdom. The relationship between inflation and unemployment is complex, and there are other factors that could also contribute to inflation. It is possible that the central banks in these countries will need to take more aggressive measures to bring inflation under control.

More archives articles:

What happens if inflation is high according to Phillips curve?

What is the Phillips curve for inflation control?

What does the Phillips curve predict?

Does Phillips curve decrease in inflation?

Lessons From The Last Depression

Banks using depositors money in 1929 to invest in stock market caused banks to call in their loans to businesses which resulted in lack of money in economy causing mass in employment and Great Depression of 1930s

The Great Depression, which began in 1929 and lasted for over a decade, was one of the most significant economic crises of the 20th century. Many factors contributed to the severity of the Depression, but one major factor was the way banks were using depositors’ money to invest in the stock market.

In the 1920s, the stock market was booming, and many Americans were eager to invest in the market. However, most Americans did not have the money to invest directly in stocks. Instead, they deposited their money in banks, which then used the deposits to invest in the stock market on behalf of their customers.

This practice, known as “speculative investment,” was profitable for banks and their customers as long as the stock market continued to rise. However, in 1929, the stock market crashed, and the value of many stocks plummeted. Banks and their customers who had invested heavily in the stock market suffered significant losses.

As banks realised the extent of their losses, they became hesitant to lend money to businesses, fearing that they would not be repaid. This lack of lending meant that many businesses could not borrow the money they needed to operate, leading to a slowdown in economic activity.

To make matters worse, banks began calling in their loans to businesses that had already borrowed money, hoping to recoup some of their losses. As businesses were unable to repay their loans, many were forced to shut down, leading to widespread unemployment.

The lack of money in the economy also led to a decrease in consumer spending, further exacerbating the economic downturn. As more and more people lost their jobs and businesses closed their doors, the Great Depression deepened, and the effects were felt around the world.

In response to the crisis, the U.S. government implemented a number of policies designed to stabilise the economy and prevent a similar crisis from occurring in the future. The most significant of these policies was the creation of the Federal Deposit Insurance Corporation (FDIC), which insured bank deposits up to a certain amount and gave depositors more confidence in the safety of their money.

The Great Depression was a devastating economic crisis that had far-reaching effects on the United States and the world. While many factors contributed to the severity of the Depression, the practice of banks using depositors’ money to invest in the stock market played a significant role in the economic collapse. The lessons learned from this crisis continue to inform economic policy and financial regulation to this day.

The Federal Deposit Insurance Corporation (FDIC) is vastly underfunded. If your insurance does not have enough funds to payout when it needs to what will you do?

How does printing money affect the economy of the world

Crippling debt from incessant money printing will mean inflation will not hit central banks for many decades – if ever. Central governments are addicted to borrowing money. Central banks are happy to print unlimited new money that devalues currencies and adds fuel to the fire of inflation. As central banks belatedly responded to rising inflation with higher interest rates they arrived with water pistols to put out high-rised inflation tower blocks! Meanwhile, many key governments in developed world including USA, UK and Eurozone responded to central bank deflationary policies that included Quantitative Tightening QT with hundreds of billions – in USA case trillions – of borrowing that will feed through to higher inflation. Unhinged global indebtedness by governments, businesses and individuals means we now have an insurmountable mountain of borrowing that will push inflation higher and instigate a very deep and long recession. In other words a depression. The Federal Reserve in USA will pivot its policy on interest rates at beginning of November 2022. The Bank of England and the European Central Bank ECB will have no choice but to blast their interest rates higher, in part to reduce inflation caused by strength of the dollar, boosting their own currencies whilst the US dollar pauses then falls in value from recent highs. This next interest rate increase by Bank of England and ECB maybe the last, as the UK EU and USA slip deeper and deeper into stagflation and drawn-out depression drowned in over-printing of money. An already deep and prolonged depression does not even require new lockdowns from health risks, escalating war in Ukraine or new war based on Taiwan, or the real threat of collapse of major financial institution. The current fragile business marketplace has not been this vulnerable since early 1930s.

The solution for business leaders is to assess the key risks to business objectives and pick the best risk management plan to navigate the depression which can still include growth but at least survival until 2025 when things should be better.

Is the US dollar just your problem?

The US dollar is killing most if not all currencies including Canada Australia EU UK and Japan. Are they really so much weaker? Or is the US dollar just so much

stronger.

- Why is US dollar so much stronger?

- When will it come off it’s high?

- Who will benefit from weaker dollar?

- What could cause the dollar to collapse?

- How can you use currency fluctuations to boost your business sales and profit?

Global recession canary in the coal mine early warning system

Do you want world business news risk insight analysis and review

What is happening in the world of business risk management with BusinessRiskTV

Risk Management Online Webcasts

For expert business and economy risk analysis and risk insight on the biggest risks on the horizon or here now watch our webcast to find out BusinessRiskTV Webcast.

Virtual risk conference webinars workshops training and online discussions

Learn innovate and grow your business faster with less uncertainty impacting on your business objectives. Network and join online discussions with business leaders and business risk management professionals locally and globally online. Discover better ways to protect and grow your business.

Boost business performance build business resilience increase knowledge and new skills sets

Risk In Business Management Live Online

Explore risk management problems and solutions. Do you work in risk management, or need more growth with less uncertainty? Are you interested in enterprise-wide business solutions for your business problems, or looking to save money and time on business risk management? Do you want to connect with enterprise risk management experts or other buyers of enterprise risk management services? Subscribe for free to BusinessRiskTV now email editor@businessrisktv.com now or follow us on your favourite social media account now.

Business Economy Live Digital Programming enter code #ERMtv

Subscribe to BusinessRiskTV Business Live risk streaming for free alerts to upcoming business live video online broadcasts and bulletin reviews for ondemand viewing at your leisure

Look into the future of risk management with BusinessRiskTV. Discover good changes you can make to your business. Use practical tools and techniques to grow your business faster. Develop your risk knowledge and skill sets. Explore common business problems and identify solutions that may work for your business.

Live Streaming Consultancy Services

Driving Business Growth With Less Uncertainty With BusinessRiskTV

Business Live News Online

9 May 2023 – Great Depression 2023

There is no consensus among economists about whether or not there will be a Great Depression in 2023. Some economists believe that the current economic conditions are not as severe as they were during the Great Depression, and that a recession is more likely than a depression. Others believe that the current economic conditions are more similar to those of the Great Depression, and that a depression is a real possibility.

There are a number of factors that could contribute to a Great Depression in 2023. These include:

- A prolonged period of high unemployment

- A sharp decline in asset prices, such as stocks and real estate

- A loss of confidence in the financial system

- A decline in consumer spending

- A rise in protectionism and trade wars

If any of these factors were to occur, it could lead to a Great Depression. However, it is important to note that a Great Depression is not inevitable. There are a number of things that can be done to prevent a depression, such as:

- Monetary policy: The Central Banks can use monetary policy to stimulate the economy and prevent a recession.

- Fiscal policy: Governments can use fiscal policy to stimulate the economy by increasing spending or cutting taxes.

- Financial regulation: Governments can regulate the financial system to prevent another financial crisis.

- International cooperation: Governments can work with other countries to prevent a global depression.

It is important to stay informed about the current economic conditions and to take steps to protect yourself from a recession or depression. If you are worried about the economy, you can talk to a financial advisor or other financial professional.

11th May 2022 – Morgan Stanley forecasts this year’s global economic growth to be less than half of 2021 due to risks from the Russia-Ukraine conflict and COVID-19 surge in China even as central banks tighten monetary policy to control record high inflation.

The brokerage expects global growth to be at 2.9 percent, compared with the 6.2 percent growth in 2021, on a year-on-year basis.

30th April 2022 – Global Risk Review Summary: Global Growth Shrinking. Weaker demand. Supply chain shortages continue. Higher global inflation. Global optimism falling. World trade falling. Commodity prices rising. OECD says global growth fall more than 1 percent in 2022 to 4.5 percent due to war in Ukraine. Global consumer price inflation jump in 2022.

27th April 2022 – According to newest United Nations UN report by 2030 the world will experience 560 major disasters per year. Global Assessment Report (GAR2022), released by the UN Office for Disaster Risk Reduction (UNDRR), says the world suffers from 350 to 500 medium- or large-scale disasters every year—and this has been the case for the past two decades.

Between 1970 to 2000, only about 90 or 100 disasters of this size were reported each year.

According to UN disaster report writers, the reason incidents become disasters is due to policymakers poorly assessing the risks of disasters, on account of their “optimism, underestimation, and invincibility”.

The world needs to do more to incorporate disaster risk in how we live, build and invest, which is setting humanity on a spiral of self-destruction

Amina J. Mohammed, Deputy Secretary-General of the United Nations, who presented the report at the UN headquarters in New York

Only 40 percent of disaster-related losses since 1980 were insured, with that number falling to 0 percent in some developing countries, according to the report.

What really needs to happen, according to Mami Mizutori, chief of the UN Office of Disaster Risk Reduction, is rethinking disaster preparation and funding allocation.

“Disasters can be prevented, but only if countries invest the time and resources to understand and reduce their risks,” Mizutori said in the UN release. “By deliberately ignoring risk and failing to integrate it in decision making, the world is effectively bankrolling its own destruction. Critical sectors, from government to development and financial services, must urgently rethink how they perceive and address disaster risk.”

One example that the report outlines is talking about how likely something is to occur in the next 25 years, versus giving an annual probability.

“The good news is that human decisions are the largest contributors to disaster risk,” Mizutori said, “so we have the power to substantially reduce the threats posed to humanity, and especially the most vulnerable among us.”

Book Sales Jump In UK During Coronavirus Pandemic

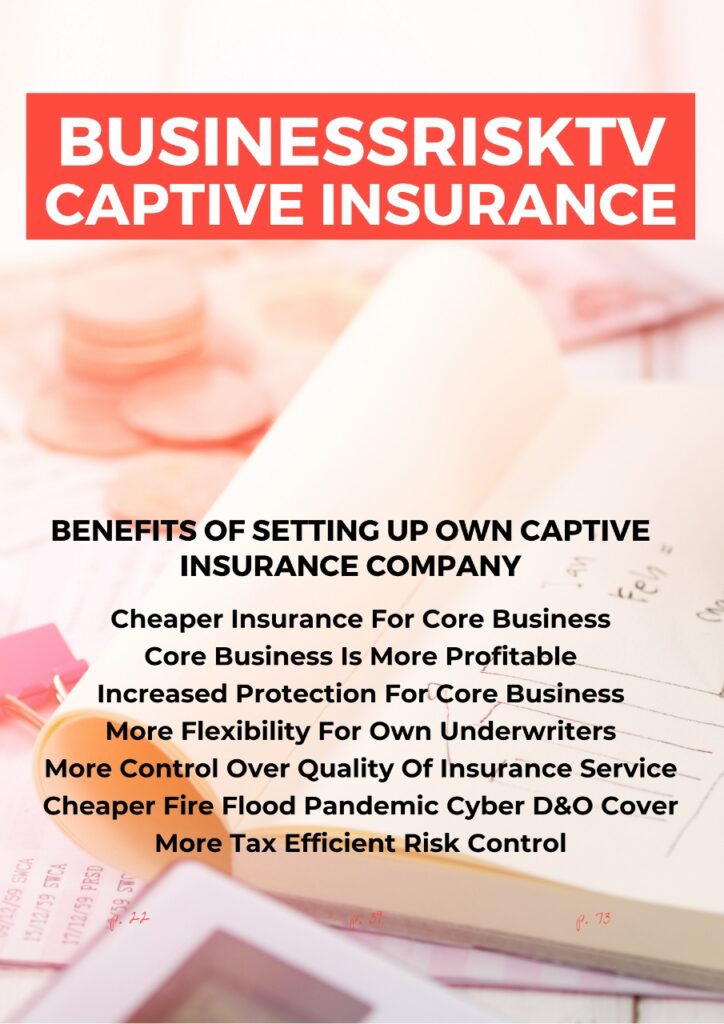

Benefits of setting up own captive insurance company as part of risk management strategy

Business Live Streaming Online Business Coach

Business Coaching Services

Promote and market your business on BusinessRiskTV for 12 months

Find out how to promote your business locally and globally. CLICK HERE or email editor@businessrisktv.com for more information entering code #BusinessRiskLive

Put your products or services in front of new customers already interested n your type of business offering before your competitors do.

Link into your existing online sales process direct from BusinessRiskTV or use our eCommerce solutions to increase sales cash flow and profit

Increase the sources of your revenue streams more sustainably. Grow your business faster with BusinessRiskTV.

Recommended business articles discussions videos and webcasts trending on BusinessRiskTV business live and ondemand streaming

Scan QR Code Business Risk Management Live To Keep Up To Date With Business Risk Management News Risk Analysis and Risk Reviews

#BusinessRiskTV #BusinessLiveStreaming #BusinessLiveNewsOnline #BusinessLiveVideo #BusinessNewsLive #BusinessRiskTVlive #BusinessRiskLive #BusinessLive #BusinessNews #BusinessReview #BusinessReports #BusinessAnalysis #BusinessOnline #BusinessMagazine #BusinessMarketplace #RiskManagement #EnterpriseRiskManagement #ERMtv

Business Risk Management Live Streaming Online BusinessRiskTV

Business Risk Management Club