Work with others to protect and grow your business with less uncertainty

Registering for Failure To Manage Enterprise Risks Vs Failure Of Risk Managers Risk Management Toolbox Talk gives you free Basic Risk Manager Membership of BusinessRiskTV to facilitate access to future risk management toolbox talks. If you wish to sign up for 12 months Pro Risk Manager membership of BusinessRiskTV please click here.

Outline of risk management toolbox talk

In this context we do not just mean people with Risk Manager in their job title. We mean people who should take ownership of specific key enterprise risks as well as the people charged with monitoring or supervising risks including making sure risk management is embedded within the day to day activities of the business or enterprise.

Do you know if your business is making good or bad enterprise risk management decisions?

BusinessRiskTV

This enterprise risk management toolbox talk focuses on understanding business risks better and how to make better business decisions to build business resilience and boost business performance. Because your time is so valuable we will complete our introduction to better enterprise risk management in no more than 30 minutes.

Title: Introduction To Better Business Risk Management :Failure To Manage Enterprise Risks Vs Failure Of Risk Managers

Date: Subscribe for free alerts to next one

Time: xx:xx

Speaker: Keith Lewis, BusinessRiskTV

In this enterprise risk management toolbox talk we will cover:

- Taking personal ownership of enterprise risks.

- Understanding the true level of risk facing your business.

- Identifying risk management action to protect your business better and grow it faster.

Save the date for introduction on how to improve your management of business risks to boost your business resilience and performance. Put enterprise risk management principles into practice for your business.

There is still no cure for cancer. Doctors are not miracle workers. Neither are risk managers. Risk Managers must work as part of a team to mitigate some catastrophic risk events they cannot stop and risk accumulation.

Just as the world is running out of effective antibiotics to combat infections and disease, risk managers must work on new risk management solutions to existing business problems and keep an eye on enterprise problems on the horizon.

People tend to either not want or except risk assessment warnings and as a result we are overexposed to unnecessary risks. What you don’t know can harm you and crossing your fingers is less effective at controlling business risks than acting on sound enterprise-wide risk assessment findings.

BusinessRiskTV

The UK, like many countries and businesses in those countries, do not act proactively to manage risks well. We normally have to learn the hard way. We have to suffer, before protecting ourselves better. Many of our critical health problems have been under our noses for years, like the antibiotic issue.

The financial services industry has for years had a highly damaging virus spreading through its veins. From pension scandals to endowment scandals to mortgage scandals to market rigging scandals. Just about every financial product has been mis-sold to greater or lessor extend in UK and around the world. Cue to financial crisis of 2008. Many people do not realise how close the world came to systemic societal collapse due to systemic financial system meltdown. At the heart of most financial wrongdoing has been financial services industry institutional and practitioner ethical failure, ignored or perhaps even promoted by governments around the world. In short – greed! From Switzerland to UK to America to Russia to China historically poor ethical behaviour has been at the heart of the problem.

Several big dominoes during the 2008 financial crisis were stopped from falling in the UK including Royal Bank of Scotland (now Natwest group) and HBOS (now part of Lloyds bank). Other massive to big to fail lenders and insurers in other countries were similarly saved like mortgage companies and AIG in USA. If they had not been held up by their respective governments anarchy on the streets would have prevailed never mind major financial loss. The 2008 financial crisis was actually the best example so far of the failure of risk managers, not a failure to manage risks.

BusinessRiskTV

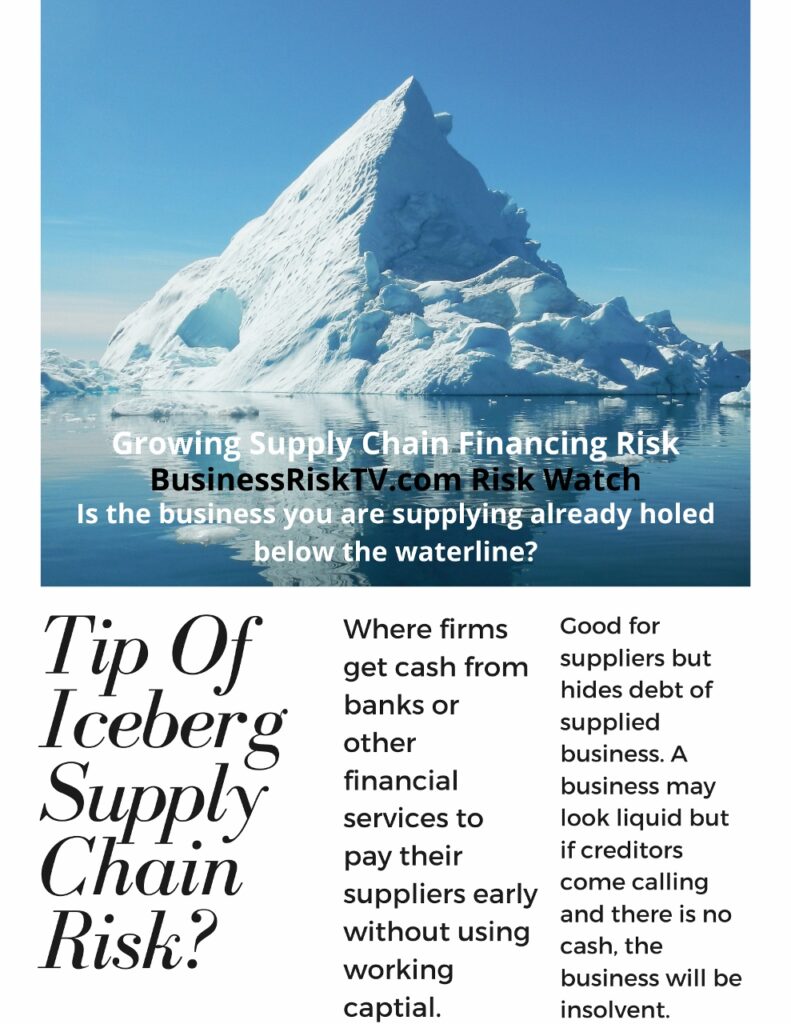

Following the financial crisis of 2008 caused by the financial services industry leaders and governments around the world, there has been a change for the better but yet more financial risk management is on the horizon. Sadly this has also necessitated capital unnecessarily being stockpiled because the financial services have demonstrated once too often it cannot be trusted to manage risks well. Trillions of dollars is being stockpiled or held in reserve to tackle the next financial disaster caused by the financial services industry.

In the next few years there will be another financial disaster. We may not be prepared for it if the mood music about financial services liberalisation turns into a reduction in sound enterprise risk management practices adopted following financial crisis of 2008.

People say the pain of childbirth is quickly forgotten? Similarly the pain from the absence of good financial services risk management is all too quickly forgotten. The world may not survive the next birth of financial crisis without maintaining existing good ethical risk management standards!

BusinessRiskTV

When we need to find solutions to business problems invariably we do

Just because something is new does not always mean it is better. Enterprise risk management can help pick the winners to support them and avoid more losers before they are costly divergences from the core objectives of a business.

BusinessRiskTV

Risk management leadership is crucial for any real benefit to come out of the investment of time and money in enterprise risk management principles and practices.

Unfortunately we have to make do with the decisions of our political masters – blue, red, yellow or green! As business leaders we have to take control of the controllables. Focusing on controlling what we can control is more liberating than whinging about what we cannot change. Regardless of which political party is in power, business leaders can make the difference between success and failure with the same business assets or resources available. To avoid business leader failure, an enterprise risk management approach to business decision making can help to manage enterprise risks better.

We have wasted so much time and money. We are where we are, so now is the time to stop trying to change the unchangeables and set a business risk management strategy for a better life in business, in the business environment we have not the environment we wished we had.

BusinessRiskTV

Are you ready to build a better business? It is within your grasp. Reach out and grab it with both hands today!

The main reason risk managers fail is that they are setup to fail from the get-go. Risk managers are often setup to fail. Why – lots of different reasons from the the board only wanting to pay lip-service to risk management systems and processes to desire to manage risks better without investing properly in a holistic risk management approach to strategic, operational and project risks.

Taking personal ownership of enterprise risks

Reduce harm to your business and engage all employees more by setting a clear enterprise risk management framework with clearly allocated and accepted risk management responsibilities. A strong enterprise risk management framework with stiffen your business resilience.

Develop a better risk management culture at all levels of the organisation – taking personal responsibility for actions, or inaction. When the proverbial hits the fan it is clear that part of the reason it hit the fan is due to no one taking true ownership of key business risks. Everyone needs to be clear who is responsible for what. It must also be clear who will be held accountable for failure to manage risks they are responsible for – clear job descriptions with financial and criminal consequences for actions or inaction.

Clear personal individual responsibility for key risks will improve your business standards and overall enterprise risk management culture. It will focus all staff minds on what matters most in your business, drive up standards of risk management across the business and make your business easier to run and supervise.

If there is failure to manage risks it should be clear who is accountable, especially senior managers and executives who must have defined written ownership of business risks. All individuals in your business should be held up to the risk management standards expected of them. Adopting enterprise risk management philosophy in your strategic, operational and project management decision-making will help:

- Clarify responsibilities at all levels of your organisation

- Improve how you do things in business and demonstrate clear accountability in all key business decision-making

- Ensure responsibility for failure is clear and people are less able to hide behind the collective failure of the Board, teams or business functions

- Identify who are key risk owners and risk management supervisors charged with making risk management work well in practice

- Give the business, external regulators and the courts more ability to act against individuals if risk management failure does occur. Nothing focuses the mind more on the quality of business risk management than having your neck on the block come judgement time! Too often in the past individuals laugh at risk management ideas cause they know they are unlikely to personally suffer for risk management failure. No blame post-loss analysis to remedy future failure may work to prevent recurrence, but it is not as preventative as personal accountability.

- More personal accountability at senior management level also helps improve the standards of recruitment and risk management training to improve standards of service. If your neck is on the block for key risk ownership you will want to make sure those below you who report to you and who supervise risk management standards are good at what they do cause if they fail the business they will put you personally at risk for corporate failure. Training will not seem as expensive when it could protect the individual with clear key corporate responsibilities!

- Create a holistic picture of the enterprise-wide risks to ensure that there are no gaps where key risks are not fully allocated to a senior manager in the business to own. It will also help to focus limited business resources on the key issues that matter to your business resilience and business growth, with less uncertainty impacting on corporate objectives.

- It should be the responsibility of the business owners, CEO or managing director or someone else with overall responsibility for leading the business to ensure that all key business risks are allocated to just one senior manager to take ownership of and responsibility for all key business risks (perhaps with deputy). To aid this process it maybe worthwhile creating an enterprise risk management roadmap that among other things identifys who has overall responsibility for risk management action plan, and which manager is responsible for which risks, together with named risk management supervisors who assist risk owners to ensure risks are managed in accordance with risk management process outcomes.

- All employees including the non-risk owners or risk supervisors, must know and be clear about the business risk management goals, systems and risk assessment processes, as well as what the business is doing to manage key risks. All employees job performance reviews should be linked to the management of risk within their business to focus their minds on what they must do to manage business risks.

- To be fair to the people at the top where the buck stops, probably 100 percent of CEOs, managing directors, managing partners, business owners and business leaders do happily take on the personal responsibility. What is less clear is that they truly know what the key business risks are, or if they do, that they care about the impact on other key stakeholders enough to dictate an effective risk management plan for the business they manage.

- With clear, very specific and accepted risk management responsibilities from top-down organisational structure, you have an effective enterprise risk management framework. An ineffective enterprise risk management framework is doomed to failure. The only reason failure has not occurred is due to luck! Your lack of serious business failure is not a vindication of the strength of your enterprise risk management framework.

- Many businesses point to their enterprise risk management framework as a source of pride and resilience. However, the framework is often no more than window-dressing. It is a facade that can easily crumble when put under pressure internally, or externally. It is often built to satisfy external regulators or third party organisations, not the needs of the business. As a result the framework is highly vulnerable to real life risk events, and could collapse when put under pressure.

- The way we learn from both mistakes and successes in managing business risks is improving. We are even learning to do new things better before we even make mistakes which is perhaps a first! However, an old friend GIGO Garbage In Garbage Out still applys to artificial intelligence AI. For example, what if you programme AI to give you the decision, or outcome, you want rather than the right answer, or outcome, whatever the right answer, or outcome is? If Adolf Hitler had AI tech he could have done things faster! Artificial Intelligence AI does and will increasingly present business leaders with the ability to crunch almost limitless amounts of raw data to understand threats and opportunities better. It is supporting more rapid business decision making. This speed is in itself a threat and an opportunity. AI should not be making decisions for business leaders. It should support business leader decision making. AI can lead to poor decisions being made faster as well as good decisions being made faster.

- If your actions shut down profitable businesses and loses jobs forever, for the sake of the environment when other parts of the world spew out environmental damage, are you acting responsibly or irresponsibly? It was not always clear, but is now, that environmental or green action can be economically beneficial to countries and businesses. Is protecting the world with less coal-fired power stations and retained trees in the Amazon fair to the people in poverty in China or Brazil? If people in the UK are not prepared to pay an environmental tax on personal income to be given to China or Brazil do we really take environmental responsibility? Being socially responsible is not about wearing T-shirts and bunking-off school. It is, or should be, about paying the price for improving the world. One key part of this would be increased vegetarianism including manufacturing fake meat cheaply for all, but are you really acting responsibly to save the planet, or do you just like to be woke about saving the planet, as a business or an individual?

- A companion of responsibility is accountability. Without accountability there is no real responsibility. Corporate history is littered with important people in business and government but little accountability. As a result poor risk management and risk management failure is perpetuated at the highest level of society and business. Invariably, legislation follows serious risk management failure. Business leaders cannot be trusted to be preventative and proactive, so a stick is used to make sure they are – legal obligations. Trouble is, often the statutory uplift of responsibilities is inadequate, watered-down or mealy-mouthed! If business leaders were more personally responsible it would marginally impact on innovation, but very quickly entrepreneurs would adapt to make better business plans with better risk management strategies for increased business resilience and stronger long term growth. Business leaders who are more likely to end up in jail for risk management failure are more likely not to fail. This does not stop entrepreneurism. It just makes it more likely for the business to have legs.

How does your corporate risk culture affect your corporate risk management behaviour? Do you promote ethical, socially responsible and good corporate governance risk and compliance principles and practices to create good outcomes for your business and business stakeholders? If you do not, how could this impact on your business objectives? If you do, are you doing enough to protect and grow your business faster?

Setting good corporate risk management principles and suitable working practices creates good risk management standards all business stakeholders should comply with. If they do not there should be remedial action including remedial action for business stakeholders such as disciplinary action for employees, as well as system changes or changes to risk assessment.

Business leaders direct business planning and business strategy including risk management outcomes expected in terms of governance risk and compliance. Senior management, executives and business owners must lead be example including demonstrating a positive attitude to risk management. Business leaders must design a risk management strategy that allows middle management to monitor and supervise effectiveness of risk management controls. The business risk management strategy sets the direction and the business priorities of the business.

Leaders set the tone and standards of the organisation. Are leaders doing what they say they want done? Are they walking the talk? This drives the risk management behaviour of all staff and the quality of risk management decision-making at all levels. If business leaders are not doing it, why should anyone else? Risk management leadership should permeate the whole business and be embedded in strategic, operational and project management.

BusinessRiskTV

Business policies procedures and practices must be challenged at all levels of the organisation to improve risk management decision-making. This can only be fulfilled if the risk management culture set by business leaders allows supports and encourages such challenges to risk management.

Management information needs to be available including performance against Key Performance Indicators KPIs and Key Control Indicators KCIs set to help achieve business objectives. Such management information helps to monitor overall business performance, ensure the business is going in right direction and check if business plan is working.

Business leaders need to recruit and retain staff with the right skills. These skills need to be maintained, improved and supported with good business intelligence and risk management information.

Employees including business leaders need to be rewarded based on performance reviews aligned to business KPIs and KCIs set to achieve business obectives. This should include salary, benefits and bonuses.

- A CEO once advised, he headed an organisation which cared for its customers, he was also keen to find new problems to solve to help his business perform better. However, he was not keen on finding too many problems! He was the only person in the room with me when he clearly tried to influence my risk management audit outcomes. He knew what he was doing and so did I. However his comments did not influence my end report. I believe my reports recommendations improved the outcomes for many key stakeholders in the business, though potentially made the CEO job harder. If he took the decision to punish my employer for my audit report he easily could. Sales people or top level executives in my organisation would not take kindly to loss of core business due to a risk management audit report upsetting a CEO. I am not alone as an auditor facing this type of risk audit dilemma.

- Risk auditing, or auditing in general, has been undermined in recent years in UK and internationally. After one of the biggest businesses in the world was praised by one of the biggest accountancy businesses in the world, both collapsed due to failure of the said big energy company. Enron was bankrupt and one of the then Big 5 accountancy firms in world Arthur Anderson partnership was dissolved under mainly pressure from mainly reputational damage. Arthur Anderson accountants thought Enron’s management systems were just peachy! Sadly, in the UK at least, the remaining Big 4 accountancy practices in the world have not shall we say performed well. Most if not all have suffered tens of thousands, or hundreds of thousands of pound penalties following the collapse of several high profile businesses following audits by Big 4 accountancy practices. In the UK the auditing by Big 4 accountants is undergoing major restructuring in an attempt to de-risk allegations of selling cheap audits in return for lucrative consultancy services. They are currently still under self-regulation as a profession, but only by the skin of their teeth! Many wanted professional accountancy businesses to have independent regulation of standards due to repeated failure to complete competent business audits. This is part of the dilemma for enterprise risk management. If your paymaster is going to be shot. If the messenger is going to be shot. Then poor management of risks will continue, businesses will continue to fail needlessly and risk managers will fail. Big 4 global accountants are splitting their businesses into two parts – management accounting fee generation and auditing fee income generation in an attempt to avoid independent regulation of their activities. Millions have been paid out in fines by Big 4 accountants and accountants in next tier down for poor auditing practices. It is now widely accepted that the poor audits are a result of accountants underplaying their audits to get access to more profitable management accountancy fee income streams. Or in other words feathering their nest with management accountancy fee income whilst not doing what they should have been doing during the auditing process. Accountants who say this is not true need to explain the significant rise in fines for poor accountants audits and the acceptance of the biggest accountants in the world splitting off their auditing business from their management accountancy business. Not a business change they would do willingly unless they absolutely had no choice.

- Accountants are not the only ones to face the risk management auditing dilemma. Most if not all auditors face this critical problem. Many executives only want auditors to find the problems they already know about, and are trying to manage. The fear of the threat to their personal standing, reputation and future employ-ability from “surprise risks” overrides the enterprise resilience and ability to grow. The more flexibility in the risk auditing process the more likely the risk management audit will fail, businesses will fail and indeed risk managers will fail. Risk managers need the risk assessment process to alert them to risk management failings before risk management fails.

- If you are only allowed to report acceptably bad risk management practices to senior management team then risk managers will continue to fail to protect businesses from perhaps easily avoidable risk events.

- Often people further down the organisational structure know how to stop risk events occurring, or can identify imminent risk events to mitigate them before they occur. However, as not all employees are engaged in the enterprise risk management process, the business intelligence and risk knowledge of the business suffers failure, and the risk event happens. In UK, a low level universal credit civil servant identified more than a billion pounds was being paid into one bank account and stopped it happening by his or her alertness. It is likely that, this weakness was not known at high level. Systems including IT systems are vulnerable to attack and misuse and should never be seen as the panacea to enterprise problems even in the age of the Fourth Industrial Revolution 4IR.

- Risk Management cultural issues will continue to be at the core of failure to manage risks, and failure of risk managers. Risk managers would fail less if they were permitted to manage risks proportionate to level of risk exposure, appetite for risk of enterprise leaders and risk tolerance of the entity.

Understanding the true level of risk facing your business

Business leaders who understand the risks facing their organisation and how they manage their risks, will better control the future of their business than business leaders who do not understand their risks. Those business leaders who fail to embrace corporate risks and enterprise risk management methodology may well fail to protect and grow their business resiliently and productively.

- What is a possible threat may not be what you should focus on. What is possible to do does not mean you should do it. The opportunity cost from not doing what is best for your business may greatly surpass the benefit from doing something that is simply possible.

- What seems impossible maybe within reach for your business. Alternatively, what you think is an impossibility maybe something you should prepare to mitigate against on basis that if it did, your business would never ever recover.

- Enterprise risk management is about getting the best out of your business, not simply making your business a success. It is certainly not just about stopping, or mitigating, bad things from happening to your business.

- Is your perception, or your team members perception, inappropriately impacting on you management of enterprise risks? Are you taking too much or too little risk to achieve your enterprise objectives?

Who are the key persons in the business attitude to risk taking and opinions on current level of business risk exposure? What is current capacity for business loss? What is attitude to taking risks in future and what is their opinion about risks in future business activity, on the horizon? What to key business decision makers in the business aspire to achieve in future? Are they more interested in protecting what they already have, or do they want to see a change in future, and if so a change to achieve what? A SWOT risk analysis may be useful to identify and clarify current strengths weaknesses opportunities and threats of the business. Is the business where it currently is by chance, or because it has been striving to be in this place very deliberately as part of a particular business strategy? Why is the business where it currently is in its own business plan, in the current market and not doing something else?

Is the business expecting any great changes up or down from where it is? To what extent are all business stakeholders happy with where the business is now? What level of risk are business leaders prepared to take to improve its current situation? What prompted business leaders to put in place current levels of business protection? What made business leaders think they could potentially make changes to improve business? Restructuring the business risk management plan is not just about facts. It should address the emotions and perceptions of business leaders.

Business leaders need to be clear about what they fear most for the business. This will be a clear driver for change in the business. It could be a fear that the business will fail to reach full potential or it could be that there is an imminent threat of reputational damage. If changes to the business float around but do not address the greatest causes of concern, then the key decision makers of the business will fail to be fully engaged in business changes, and changing the business will fail.

Changing the business must be closely aligned to the changes key business decision makers want. If you cannot change the perceptions of risks of the key decision makers then you need to change the business to reflect their perception of risks, otherwise there will be a constant perpetual perception of under-performance or perception of business failure. The failure of a business can be in the eye of the beholder, not necessarily objective measurement of failure. For example, if a business doubles its market share, profit and dividends to shareholders within 12 months period whilst its suppliers employees work 17 hour days in poverty including young children, and the end product when it reaches the end of its life damages the environment – is this success or failure? What are, or need to be, the priorities of business leaders for business resilience and growth?

- Understanding the true level of risk facing your business is not about sitting round the table with your peers assessing enterprise risks. It is about engaging all your stakeholders in your enterprise in the assessment of your enterprise risks. A board of directors talking about enterprise risks as some uses, but is unlikely to get the true level of risk. Employees on the shop floor talking about your enterprise risks is unlikely to to cover the true level of risk adequately. Together, the engagement of all levels of an organisation, will uncover the true level of risk, and more importantly know how to manage enterprise risks better to boost enterprise performance.

- If you have made an error in the assessment to risk due to the wrong perception of real risks or by poor understanding of the real risks, you may be more exposed to risks or overprotected from risks. This can lead to poor decisions by risk managers.

Identifying risk management action to protect your business better and grow it faster

Bad things are and will continue to happen in business.

If a risk management audit finds worrying problems does this mean risk management is working or not working?

BusinessRiskTV

Depends on when the audit was completed. A risk management audit that picks up issues before a risk event occurs is an example of risk management working well. An audit report findings on issues picked up post-risk event is an example of risk management not working.

Picking up risk management improvement actions from a risk management audit prior to risk event is a case of risk managers doing their jobs well not an example of failure of risk managers.

Post risk event risk managers can also be seen to be working well. Businesses that recover quickly post risk event can be held up as businesses that are well managed.

Risk managers may be putting a lot of effort, time and money into managing risks, but if the risk management culture of the business is poor then the risks will still be managed badly. Paying lip-service to enterprise risk management is so wasteful of limited business resources. Far better to turn good risk management rhetoric into good risk management practices.

There is something to admire and benefit from by being honest and saying we do not care rather than saying we do care massively about our customers, employees and owners when in fact you only care about yourself!

BusinessRiskTV

The hard part about embedding enterprise risk management in a business is that everyone is so “woke” now! As a result it is harder to know when enterprise risk management is failing company stakeholders such as customers, employees, shareholders and others affected by the business activities. Business risk managers are now more than ever keen to tell you they love everybody without exception and the environment, yet there is still evidence of race and sex inequality, the environment is burning or drowning and shareholder value has repeatedly been destroyed.

Put away your mission statements and corporate values. Forget for a moment your policies and procedures. Stop tweeting your support for the unfortunate! Start:

- Engaging your business stakeholders in holistic enterprise risk management

- Communicate consistently and honestly internally and externally

- Measure the whole business performance against Key Performance Indicators KPIs that really matter

Your business is as good as what it gets out of enterprise risk management NOT what it puts into risk management.

- What is it that matters to your business stakeholders?

- How does what they want influence how you manage your business?

- How good is your business right now at managing business risks that really matter?

- Evaluate where your stakeholders in your business expect you to be on key issues that matter and where you actually are now. This will clearly point you to your gap in effective risk management and shows you how much you need to improve your management of risk.

- You then need to understand the level of business resources (time, money, experience and authority) you currently have at your disposal.

- Decide how to use your limited current resources to best effect in achieving risk management improvement of key business risks.

- Implement identified best key risk improvements and monitor progress.

- Communicate well with key stakeholders about how the business is doing on key business risks.

- Periodically check your risk management programme of action is working as you planned.

- Tell everybody about how your business has improved as a consequence of your approach to enterprise risk management decision making!

Shout from the rooftops how good you are doing at improving your brand through holistic risk management approach to business decision making to build more stakeholder trust. Grow your business faster with less uncertainty impacting on your business. Then there may well be fewer examples in future of failure to manage risk.

Most businesses are not run by bad people intent on doing bad things. However good people can make bad decisions, especially when under pressure, or when allowed to deliver less than the risk management standard expected of them. Making bad business decisions is possible for most business leaders. However expecting to make better business decisions without changing how you make those business decisions is a sign of madness, as well as bad business management.

All stakeholders in a business should be clear on what is demanded of them from the business. What does the business need from its stakeholders and activities to achieve key business objectives?

- What key performance indicators KPIs must be hit to achieve or exceed business objectives?

- What key control indicators KCIs must be hit to protect the business assets and its business objectives?

- What must be done by all business stakeholders, as a minimum, to achieve business objectives?

To be more preventative and proactive to protect and grow your enterprise faster with less uncertainty impacting on your enterprise objectives, adopt enterprise risk management methodology to drive your risk management action.

Your business risk tolerance is key to appropriate sustainable enterprise risk taking to achieve realistic business goals. Your business risk tolerance will depend on your specific enterprise risk profile and enterprise goals.

- What is your business risk capacity? How able is your business to take risks? How strong is your business financially? What are your business goals? Generally speaking, a business with a higher level of financial strength and ability to organically produce revenue relative to business liabilities and costs, has the business capacity to take higher risks so has higher business risk capacity? You need to complete a business risk audit to truly understand your business risk capacity. Evaluate your financial strength including revenue generation power and total costs of business risks.

- What is your business risk culture? What is the attitude to risk of your business owner, senior managers or executives? How willing are your business decision makers to take risks to achieve business goals? Attitude to risk has more to do with personal psychology, experience and perception of risks than the facts of real risks in business. Some business leaders will find the prospect of business environment volatility and risk of loss distressing to contemplate. Others will be more relaxed about risk taking. Often hindsight is the only real determinant of who is right or wrong, but business leaders cannot run a business based on hindsight.

- Increasing risk foresight, business intelligence and risk knowledge will assist business leaders in making the best possible preventative and proactive business decisions to achieve business goals within sustainable business capacity.

Our enterprise risk management capability audits and risk tolerance reviews help to give you an idea of your business risk management resilience and develop a better risk management plan. Once you understand where you are now it is is easier to see which business strategy options are more suitable for you business.

More comprehensive enterprise risk management training with BusinessRiskTV will provide a fuller explanation of the underlying enterprise risk management methodology used in business risk profiling to support more informed business decision-making.

- How well do you understand the strategic, operational and project risks for your business?

- How prepared and capable is your workforce to manage your key business risks?

- How resilient is your business to large unexpected costs?

- How good is your business at identifying, prioritising and maxmising the benefits from business growth opportunities?

The lack of engagement of the whole workforce in managing business risks opens the business to failure to manage business risks. This is a failure of business risk owners. Risk management failure in itself is not always failure to manage business risks. No business is perfect after all. The risk management failure should not however result in the significant disruption of the business if business risk management is applied well. Your business risk management framework should engage the whole workforce in the identification and control of key risks at an early stage. Most unwelcome business surprises can be eliminated, mitigated or deflected if all business stakeholders are on the same journey and destination.

It can be hard to measure good corporate governance and effective enterprise risk management. Business leaders seeking to manage out failures to manage risks should adopt KPIs based on specific welcome or unwelcome outcomes, or poor and good business risk management behaviours. Measuring such business risk management KPIs will help risk managers evaluate the success or otherwise of strategic, operational and project risk management. They will help evaluate business risk management capability.

How do you know if your approach to managing business risks is working?

Risk Management Think Tank

Instead of bring you problems without solutions we aim to provide solutions to common business problems wherever you are in the world, and whatever industry you work. in. BusinessRiskTV Pro Risk Manager members are automatically full members of our Risk Management Think Tank.

Our enterprise risk management expert panel online events enables business leaders to find new solutions to common business problems. This includes BusinessRiskTV members and non-members, though non- Pro Risk Manager members may have to pay a fee.

Risk management experts can help you more quickly solve your business problems, often more inexpensively.

To finance the operation of BusinessRiskTV we need to look to sponsors, advertisers and BusinessRiskTV membership fees to sustain our onlin erisk management services.

Because your time is valuable, we only planned to use a maximum of 30 minutes this time around. If you like the idea of working closer together to help overcome business problems we will run more risk management toolbox talks to assist your business development and business protection. Make sure you hear about upcoming toolbox talks to help you make better business decisions.

Risk Management Toolbox Rules Culture and Etiquette

During Zoom risk management toolbox talk you may have chance to use Zoom Raise Hand feature via “More” tab at top or bottom of your screen during the video conference. Should you wish to speak, or ask a question, click on Raise Hand Zoom feature to attract the host attention. He or she may give you the chance to speak for benefit of all participants, though this is at the discretion of the Zoom risk management toolbox talk host. We ask that you only use the Raise Hand Zoom feature to give yourself a chance of speaking, or to ask a question, as this will aid the smooth running of risk management toolbox talk and make it more productive for all participants. Abuse of the Zoom Chat feature may risk the barring or ejection from talk by the host at his or her discretion and without refund or liability whatsoever, where relevant. We do encourage participants to get involved, but abuse of the video conferencing process detracts from the quality of the experience by other participants who do comply with risk management toolbox talk etiquette. Your observance of rules will be much appreciated. We want to create an equal and fair platform that produces practical business improvement with less uncertainty for all participants and shared business experience to improve business intelligence and risk knowledge.

| Marketplaces | Exhibitions |

| Cost Reductions | Risk Magazine |

Further Risk Management Reading News Opinions Reviews and Videos

#BusinessRiskTV #RiskManagementFailure #ToolboxTalks #RiskExpertsHub #RiskManagementFailure #RiskManagement #RiskManager #RiskAnalysis #RiskAcademy #RiskAssessment #RiskMitigation #Risks #RiskSolutions #RiskCulture #RiskIntelligence #RiskGovernance #RiskAdvisory #RiskManagementConsulting #Risk

Failure To Manage Enterprise Risks Risk Management Toolbox Talk

Business risk management club